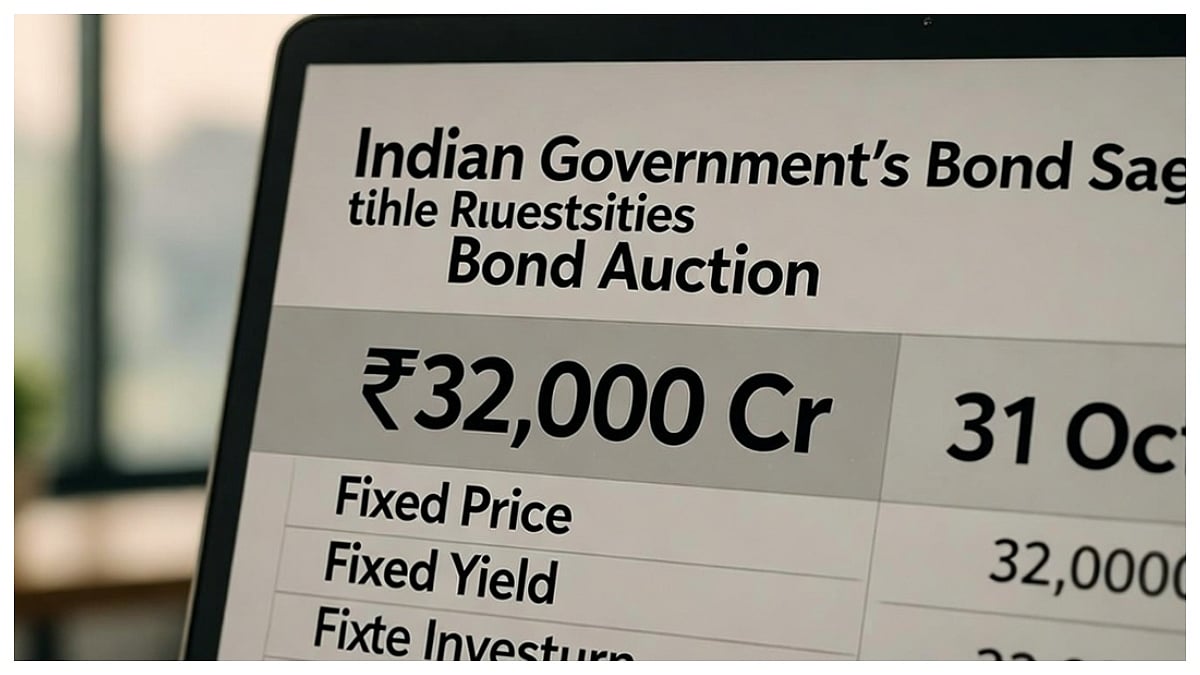

Mumbai: The Reserve Bank of India (RBI) is set to auction four government securities (G-Secs) worth a total of Rs 32,000 crore on October 31 (Friday). The settlement for these securities will take place on November 3 (Monday). Through this auction, the government aims to raise funds for public spending and developmental projects such as infrastructure, education, and healthcare.

Government securities are sovereign-backed debt instruments, making them one of the safest investment options in India. Investors earn a fixed rate of interest periodically and receive their principal amount upon maturity, providing a steady income stream with minimal risk.

Extra Subscription Reserve and Bidding Process Explained

To accommodate higher market demand, the government has set aside an additional subscription reserve of Rs 2,000 crore, which allows the overall issuance size to be expanded if necessary.

The auction will be conducted at the RBI’s Mumbai office through the multiple price method, under which successful bidders are allotted securities at the yield or price they bid for. Primary dealers can submit bids for Additional Competitive Underwriting (ACU) between 9:00 AM and 9:30 AM on the day of the auction.

The RBI has also stated that these securities will be available for “When Issued” trading between October 28 and October 31, 2025, enabling investors to trade them even before the official issuance to gauge potential pricing.

Competitive vs Non-Competitive Bids

All bids will be submitted electronically through RBI’s e-Kuber system. In competitive bidding, large financial institutions specify the yield or price they are willing to pay, and allocation depends on the cut-off yield determined during the auction.

In non-competitive bidding, retail investors and smaller institutions can participate without quoting a yield. They receive securities at the weighted average price decided in the auction, making participation easier for individuals.

How Retail Investors Benefit

The funds raised will support public infrastructure projects such as roads, schools, and hospitals, stimulating employment and economic growth. For small investors, G-Secs offer a safe, government-backed avenue to earn fixed interest income. Through non-competitive bids submitted via banks, post offices, or the e-Kuber platform, they can invest securely and often earn slightly better returns than fixed deposits (FDs).