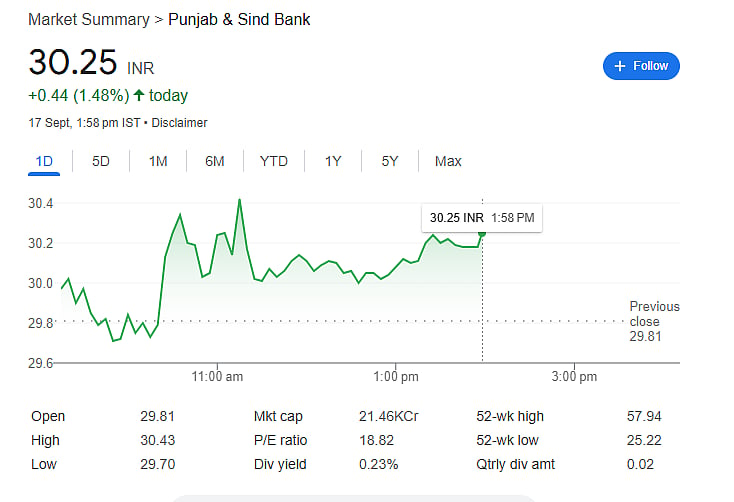

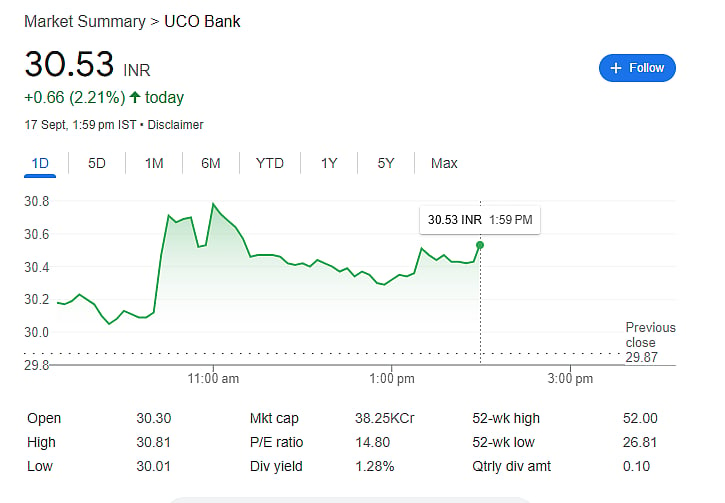

New Delhi: On September 17, shares of four public sector banks showed a slight rise. Stocks of Indian Overseas Bank (IOB), Punjab & Sind Bank, UCO Bank, and Central Bank of India went up by around 1 percent. This positive movement came after a key statement from M. Nagaraju, Secretary in the Department of Financial Services. He said that these banks are planning to raise capital this year.

Why Do These Banks Need to Raise Capital?

According to SEBI rules, every listed company must have at least 25 percent public shareholding. That means a minimum of one-fourth of the company’s shares should be held by general public investors. However, in these four PSU banks, the government holds much more than that. For example, it holds 94.61 percent in IOB, 93.85 percent in Punjab & Sind Bank, 90.95 percent in UCO Bank, and 89.27 percent in Central Bank of India. These levels are far above the allowed limit, so the banks must reduce government ownership by offering more shares to the public.

How Will the Capital Be Raised?

The banks can either issue new shares to the public or the government can sell a small part of its existing shareholding. This move will help the banks comply with SEBI rules, and also raise fresh capital to strengthen their financial health. With more capital, these banks can lend more, support economic growth, and improve their market value.

Investors Respond Positively to the News

After the news was made public, the stock prices of all four banks saw a small rise during early trading hours. Many investors believe that raising capital will improve the banks' overall performance and increase trust in the public sector banking system.

Why This Step is Important for the Banking Sector

If a company fails to meet SEBI’s 25 percent public shareholding rule, it can face penalties or restrictions. By following the rule, these banks are avoiding such action. Also, bringing in more public investors increases transparency and accountability. Most importantly, the new capital will make their balance sheets stronger and help them give out more loans, which supports the Indian economy.

The government has clearly stated that its shareholding will not fall below 51 percent, meaning it will still retain control of these banks. This decision helps maintain public trust in government-owned banks while also improving their financial strength.