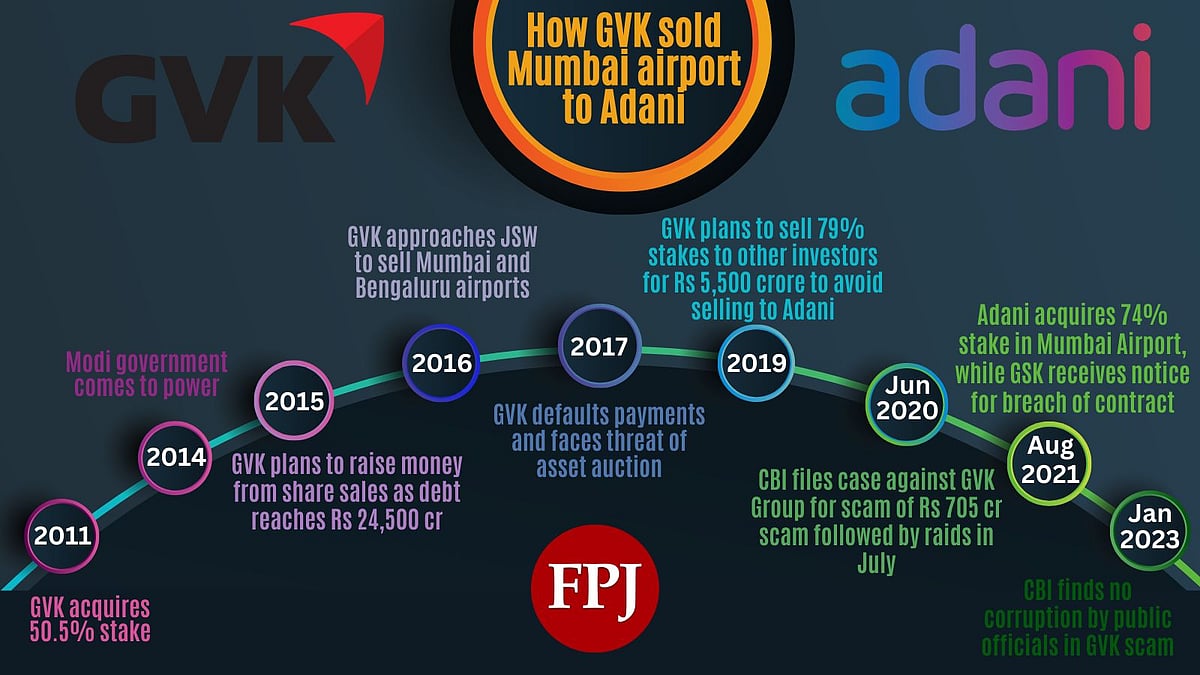

After the Adani storm struck the parliament, state-owned firms such as LIC and banks including the State Bank of India, along with institutions such as SEBI have been dragged into the debate. Rahul Gandhi brought up the decision to handover the Mumbai airport to the Adani Group, alleging that CBI and ED were used to pressure the previous owner GVK. But the Vice Chairman of the GVK Group dismissed his claims, and reiterated that the deal was purely driven by their need to repay lenders, while they faced financial stress.

GVK claims that it was already in talks with investors before the covid lockdown hit operations and revenue at airports, prompting it to accept Adani’s offer of going sealing the deal in a month. Here’s a complete timeline of how the saga has unfolded, from the UPA era to the Modi regime.

2006: GVK became the first to secure private ownership of an airport in India after emerging as the biggest bidder for Mumbai airport, during the UPA-1 government.

The selection process was marred by controversy as Anil Ambani’s Reliance Airport Developers approached the Supreme Court, alleging that standards were lowered to favour GMR for Delhi. It also argued that even with lower standards, Reliance was better than GVK, and a fresh bidding could’ve been conducted for Mumbai airport.

Explained: How GVK had to sell Mumbai airport to Adani after initial resistance |

2011: GVK purchased an additional 13.5 per cent stake in Mumbai airport, making it the majority shareholder with a 50.5 per cent stake.

2014: After heavy borrowing, both Adani and GVK as well as other firms in infrastructure sector hoped to raise as much as $5 billion to pay debts after Modi regime took over.

2015: With a debt of more than Rs 24,500 crore, GVK planned to raise money from share sales by listing its airports.

2016: To pay off dues, GVK approached JSW for sale of Mumbai and Bengaluru airports, while it offered to sell its road projects.

2017: After defaulting on repayment of loans, GVK faced a threat of its assets being auctioned, as banks tightened screws on overdue debt.

2019: In a bid to avoid selling Mumbai airport to Adani, GVK planned to sell 79 per cent stake to Abu Dhabi’s investment authority, Canada’s PSP and the National Investment and Infrastructure Fund, for paying back Rs 5,500 crore of its debt.

June 2020: CBI registers a case against GVK Group for criminal conspiracy and fraud, over a Rs 705 crore scam, followed by raids on its premises by the enforcement directorate in July.

August 2021: Adani acquires a 74 per cent stake to take control of Mumbai airport. GVK’s investors send notice, calling the stake sale to Adani a breach of contract.

January 2023: CBI court finds no corruption by public officials in GVK scam, case transferred to magistrate court.

The entire saga has its roots in the UPA regime, when the now bankrupt Anil Ambani alleged that rules were changed to favour GVK and GMR. The twist came when fortunes of debt laden Adani and GVK took a turn in opposite directions, leaving the latter with no choice but to sell Mumbai airport.

Facing a massive debt, the GVK group was further hit by covid, and found a quick deal from Adani as a way out. But at the same time, it was also facing action from CBI and ED over financial irregularities.