As the fiscal year 2023-24 draws to a close on Sunday, March 31, 2024, many individuals may wonder whether banks will remain open during the weekend to facilitate financial transactions.

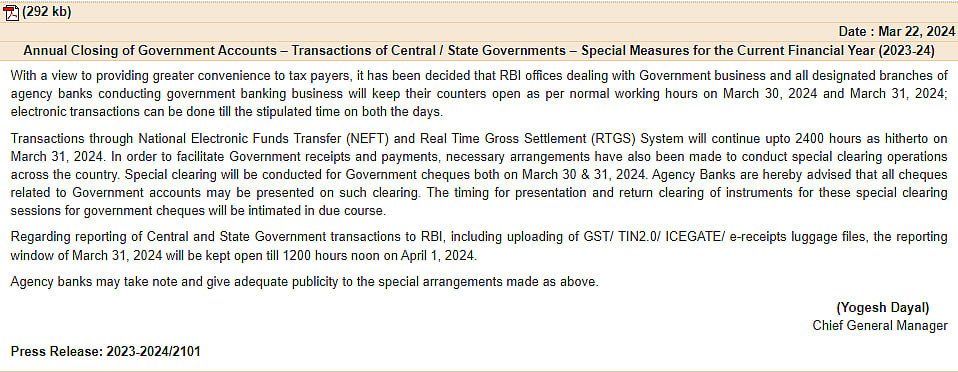

In response to this query, the Reserve Bank of India (RBI) has issued a directive to all agency banks, mandating their operational presence on both Saturday, March 30, and Sunday, March 31, 2024. This move aims to ensure the smooth processing of government receipts and payments as the financial year concludes.

RBI's Directive Ensures Continuity of Services

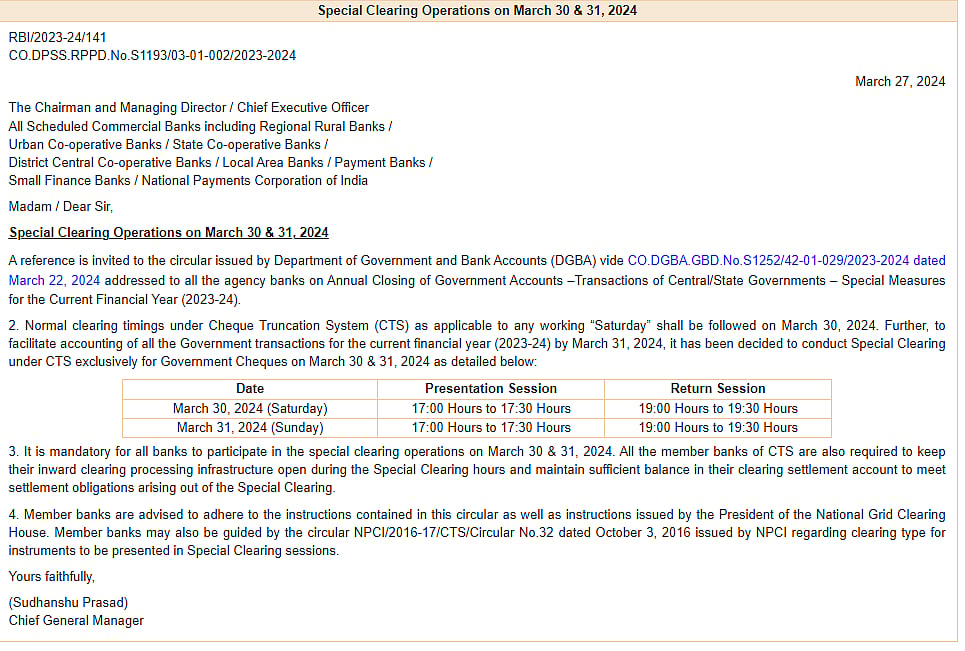

Under the recent circular dated March 27, 2024, the RBI has advised all branches of banks handling government transactions to maintain regular working hours on this weekend.

This includes conducting transactions related to government receipts and payments, thereby extending their operational support beyond typical weekdays.

Agency Banks

Agency banks, comprising 12 public sector banks, 20 private sector banks, and one foreign bank, serve as designated institutions authorised by the RBI to carry out specific government-related financial activities. These banks play a crucial role in ensuring the efficiency and effectiveness of government transactions, particularly during critical periods such as the end of a fiscal year.

List of Agency Banks

The following banks are designated as agency banks by the RBI: Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, Indian Bank, Indian Overseas Bank, Punjab and Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, Union Bank of India, Axis Bank Ltd., City Union Bank Ltd., DCB Bank Ltd., Federal Bank Ltd., HDFC Bank Ltd., ICICI Bank Ltd., IDBI Bank Ltd., IDFC FIRST Bank Ltd., IndusInd Bank Ltd., Jammu and Kashmir Bank Ltd., Karnataka Bank Ltd., Karur Vysya Bank Ltd., Kotak Mahindra Bank Ltd., RBL Bank Ltd., South Indian Bank Ltd., Yes Bank Ltd., Dhanlaxmi Bank Ltd., Bandhan Bank Ltd., CSB Bank Ltd., Tamilnad Mercantile Bank Ltd., and DBS Bank India Limited.

Services Available During the Weekend

During the extended operational hours on March 30 and 31, customers will have access to various banking services. Transactions through the National Electronic Funds Transfer (NEFT) and Real Time Gross Settlement (RTGS) System will be facilitated until 2400 hours on March 31, 2024.

RBI

Additionally, special cheque clearing sessions will be conducted to process government cheques, providing a seamless experience for stakeholders.

RBI

Tax Payments and Other Transactions

Individuals seeking to make tax payments or engage in other financial transactions with the government can do so by visiting the branches of agency banks during the weekend.