Fixed deposits (FDs) and Mutual Funds (MFs) are the most popular financial instruments to grow your savings. An FD is a savings instrument offered by NBFCs and banks to their customers to help them grow their savings. Here, you set aside a fixed amount of your savings at a predetermined fixed deposit interest rate for a fixed tenor, ranging from 7 days to 10 years.

On the other hand, a mutual fund is a professionally managed investment option in which a group of investors pool a certain amount of their money with a common aim of increasing their savings. The losses, gains, expenses, and incomes generated by this fund are distributed proportionately among the owners of that mutual fund.

Both the tools deliver decent returns by helping the customers build a corpus of wealth and have amazing benefits to offer. Hence, choosing between the two can be a difficult task. Having a clear understanding of how these instruments differ can help you make an informed decision for the growth of your savings. Let’s dive a little deep into the entire FD vs mutual funds debate.

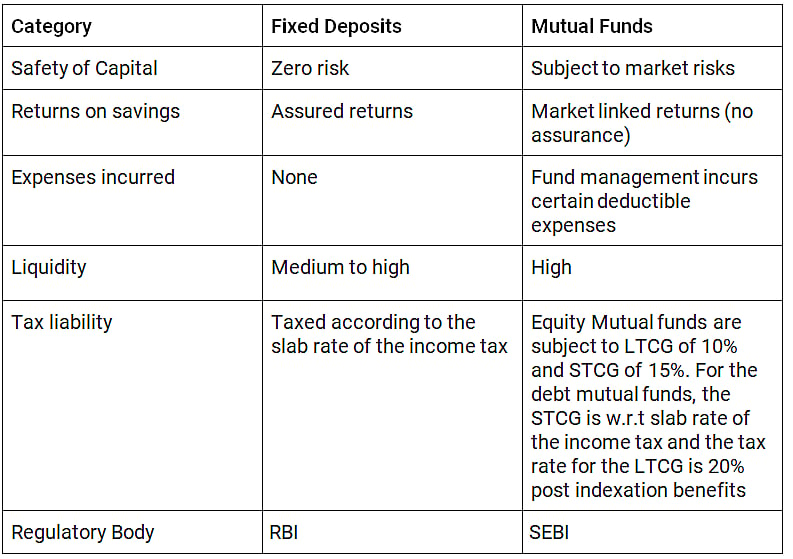

Fixed Deposits v/s Mutual Funds

FDs provide guaranteed returns whereas mutual funds provide returns that depend on market fluctuations. Let’s find out how these two instruments differ from each other:

● Safety of Capital

Fixed deposits are quite safe because they are independent of the market fluctuations. On the other hand, mutual funds are subject to market risks as they are market-linked instruments.

● Return on Savings

Fixed deposits are offered at predetermined fixed deposit interest rates and offer fixed assured returns. On the other hand, mutual funds offer variable return on investments, depending on the various market conditions.

● Expenses Incurred

There are no expenses involved in maintenance of fixed deposits. However, in case of mutual funds, the management of these funds attract certain expenses or charges, which are auto-deducted from the invested amount.

● Liquidity

You can easily liquidate your fixed deposit before its maturity by paying a very minimal and affordable penalty amount. On the other hand, you can get your mutual fund amount earlier than its maturity without having to pay any penalty. However, a tax penalty of early withdrawal can occur but that’s rare.

● Tax Liability

FD is a better option for you if your income lies in the taxable income slab. FD interest rates are taxed according to the slab rate of the income tax. They are subject to the TDS of 10% on the interest amount earned above ₹40,000 in a financial year.

On the other hand, equity mutual funds are subject to long-term capital gains of 10% and short term capital gains of 15%. This is applicable if the interest gains exceed ₹1 Lakhs/financial year. For debt mutual funds, the short term capital gain is according to the slab rate of the income tax and the tax rate for the long term capital gain is 20% post indexation benefits.

● Regulatory Body

Fixed deposits are regulated by the Reserve Bank of India (RBI) while mutual funds are regulated by Securities and Exchange Board of India (SEBI).

To enhance your understanding, here’s a visual representation of FD vs mutual funds:

Conclusion

Both, fixed deposits and mutual funds, are popular savings instruments. They have their own set of benefits and can suit different individuals. Before making any decision to grow your hard-earned savings, it is advisable to grasp a clear understanding of all the benefits, features, liquidity, limitations, your financial ambitions, and other factors.

Hence, it is best to gain knowledge about the market risks, conditions, and check if they align with your personal requirements, priorities, or financial capacity. Always remember to make an informed decision for your savings as per your risk appetite and financial goals.