Key Highlights:

- Net profit jumps 67 percent YoY to Rs 91 crore in Q1 FY26

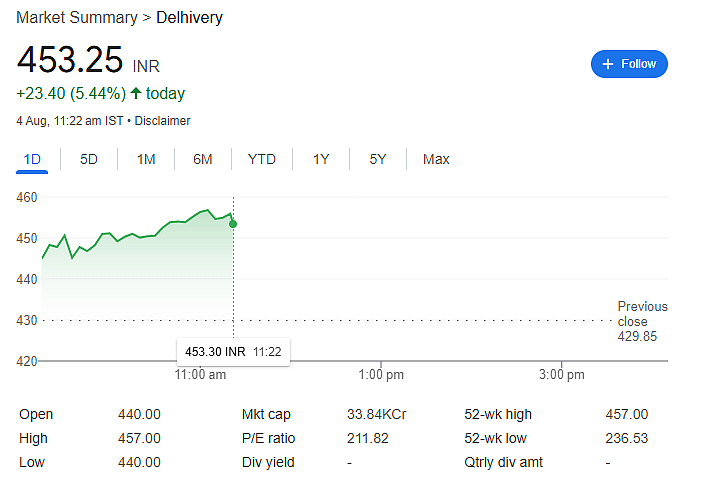

- Delhivery stock hits 52-week high, up 6 percent on NSE

- Ecom Express acquisition completed for Rs 1,407 crore

New Delhi: Shares of Delhivery jumped over 6 percent on Monday to hit a 52-week high after the company posted strong financial results for the June quarter. Investors reacted positively to the rise in profit and news of a major acquisition.

On the NSE, the stock climbed 6.03 percent to touch Rs 455.80 per share. On the BSE, it rose 5.97 percent to hit Rs 455.50 per share.

June Quarter Profit Jumps 67 percent

In a filing made last Friday, Delhivery said it reported a 67 percent year-on-year (YoY) jump in net profit, reaching Rs 91 crore for the April–June quarter (Q1 FY26). This is up from Rs 54 crore earned during the same quarter last year (Q1 FY25).

The company’s revenue from contracts also increased by 6 percent YoY, rising from Rs 2,172 crore to Rs 2,294 crore in Q1 FY26.

Shipment Volumes See 14 percent Growth

Delhivery’s total shipment volumes in the quarter stood at 20.8 crore, which is a 14 percent increase from 18.3 crore shipments handled in the same period last year. This growth indicates rising demand for the company’s logistics services.

Ecom Express Acquisition Completed

Along with strong financials, Delhivery also announced that it has completed the acquisition of rival company Ecom Express. The deal is valued at up to Rs 1,407 crore. This strategic move is expected to boost Delhivery’s market share and strengthen its position in the logistics and delivery sector.

Market Reaction

The broader market also opened on a positive note on Monday. The BSE Sensex rose 207.43 points or 0.26 percent to 80,807.34, while the NSE Nifty gained 74.35 points or 0.30 percent to reach 24,639.70.

Delhivery’s strong Q1 results, growing shipment numbers, and acquisition news have added to investor confidence, leading to the sharp rise in the company’s stock.

(With PTI Inputs)