Whether following the COVID-19 guidelines or not, tens of thousands of people fall prey to the deadly pandemic. With surging COVID-19 cases across the country, COVID insurance is the need of the hour. It is high time that every citizen knows the importance of having COVID insurance.

COVID-19 insurance covers the hospitalisation and treatment costs once a person tests positive for the infection. The cover can be availed in several forms, i.e. by way of a separate insurance policy or as a rider attached to your existing health insurance policy. Such insurance may also cover the other comorbidities of the policyholder. In addition, there are COVID policies that reimburse the lost income due to hospitalisation.

How to apply

Since it is not safe to step out to purchase COVID-19 insurance, we recommend that you buy the insurance cover online. Just visit the official website of the preferred insurer and read through the terms and conditions associated with COVID insurance. Choose the tenure for the insurance from the options—3 months, 6 months, and 9 months.

Click on the ‘Buy Now’ button and enter your details. You will receive an OTP to validate your mobile number. Enter it on the screen and make the premium payment. Your application will be processed, and the coverage will be initiated based on the applicable cooling period.

Making cashless claim

If a policyholder has tested positive for COVID-19 from any authorised COVID-19 test centre, the person qualifies for insurance coverage for the treatment.

Find a convenient network hospital from the list,

Inform the insurer about hospitalisation within 24 hours in the case of an emergency hospitalisation or before 48 hours of planned admission through their toll-free number or email address,

Request for cashless hospitalisation at the insurance help desk of the hospital. Carry the cashless hospitalisation card, identity card, and policy number to complete documentation,

The hospital will forward your claim request to the insurer. Upon review, the insurer informs the hospital regarding the approval of your claim request,

If approved, the insurer will settle the expenses directly with the hospital. If rejected, the policyholder must bear the hospital expenses.

Filling reimbursement claim

During emergencies, beds may not be available in the network hospitals. In such situations, the policyholder can get treated at a hospital other than the network hospitals if need be. The claim reimbursement procedure is given below.

Inform the insurer about the hospitalisation within 24 hours of getting admitted (in emergency cases) or before 48 hours of getting admitted to the hospital,

Get receipts for every expense you incur at the hospital. Make a copy or two of these receipts and keep them safe. You need to submit them to the insurer to get the reimbursement,

Get the Claims Form from your insurer’s official website and fill it up with relevant details. Attach document proofs as mentioned in the form and submit it directly to the insurer’s office or send it via the courier service. Alternatively, you can upload the bills online,

Pay the hospital bills from my pocket at that moment. Upon getting approval on your claims request, the insurer will reimburse the money within 30 days.

The procedure to apply, make a cashless claim, and make a reimbursement claim may vary from insurer to insurer.

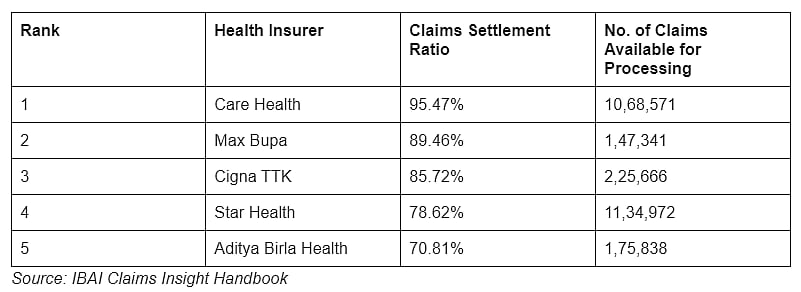

Claim settlement ratio of top insurers for FY 2019-20

The Claim Settlement Ratio is the number of claims settled during the year/total number of claims available for processing. This ratio can be a deciding factor while purchasing a health insurance policy.

Health insurers with the highest claims settlement ratio for FY 2019-20 are listed below.

Health insurers with the highest claims settlement ratio for FY 2019-20 |

Insurers nitpick claims

Since the COVID-19 cases are rising exponentially, the insurers are nitpicking on the claim requests to find reasons to reject them.

To ensure the insurance companies accept the claim requests, one should abide by the following:

Make sure that the COVID positive report is issued by an authorised test centre that follows the guidelines set by AIIMS, the government, WHO, and ICMR,

If the concerned doctor suggests getting treated at your home, do follow it. If such a patient gets hospitalised against the doctor's advice when there is no need, the insurer may reject the claim request,

Inform the insurer about the hospitalisation within 24 hours in the case of emergency admissions and before 48 hours in the case of planned admissions,

Check if the insurance has well-passed the waiting period. Any COVID positive reports generated during the waiting period will not be eligible for claims.

The first two reasons are mostly to avoid the misuse of hospital beds by not-so-critical patients and provide them for the needy, and to discourage cases that could be false claim.

(The writer is founder and CEO, ClearTax-a fintech SaaS company for e-filing and GST compliance)