The CBI has filed a case on Tuesday against Bandra-Kurla Complex (BKC) based IL&FS Transportation Network Ltd (ITNL) and its then directors and officials for allegedly defrauding 19 banks of Rs 6,524 crore between 2016 and 2018, agency officials informed on Friday.

According to the CBI, a written complaint dated 26.05.2023, addressed to Head of Branch, CBI, had been received from complainant Bhavendra Kumar, Chief General Manager, Canara Bank Circle Office, New Delhi, alleging therein that ITNL and its directors/CFO, entered into a criminal conspiracy to cheat 19 banks under multiple banking arrangements (MBA) (Canara Bank being the largest lender) and in pursuance of the said criminal conspiracy, the accused misappropriated the sanctioned credit facilities by cheating, diversion of funds, circular transactions between related/sister concerns, misrepresentation of books of income and expenditures etc. thereby caused wrongful loss of total Rs 6,524 crores (as on 31.10.2021) to the lending banks and corresponding wrongful gain to themselves.

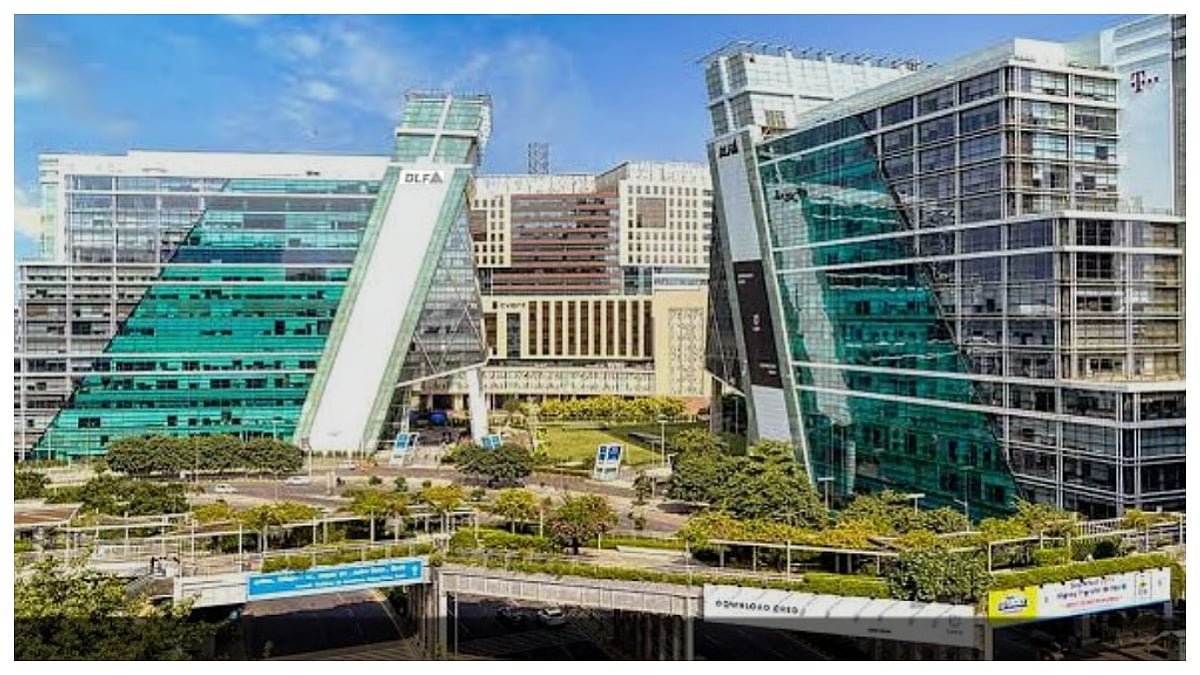

The borrower company, ITNL was incorporated in India on 29.11.2000 and is a subsidiary of M/s IL&FS Limited.

It is a developer, operator and facilitator of surface transportation infrastructure projects, from conceptualization through commissioning to operations and maintenance under Public Private Partnerships on Build-Operate-Transfer (BOT) based in India.

ITNL is the largest BOT road asset owner in India and a market leader in the transport infrastructure sector having its presence in Metro Rail, City Bus Service and Border Check Posts. For the said business, ITNL had availed various credit facilities under MBA. Canara Bank, being the largest lender, sanctioned a Term Loan of Rs 500 crore to the borrower company.

"ITNL has also availed credit facilities under MBA from 18 other banks/lenders with a total exposure of Rs 6831 crores. However, due to alleged irregularities in the credit facility, the account slipped to NPA on 30.12.2018 in Canara Bank. Forensic Audit conducted in the account disclosed fraudulent activities committed by the borrower company and hence fraud was declared on 23.09.2021 in Canara Bank. All other member banks under MBA also declared the account as fraud," the CBI claimed in its FIR.

.jpg)