Mumbai: Shares of stockbroking companies continued to fall on Monday after the Union Budget 2026 announced a sharp increase in the Securities Transaction Tax (STT) on Futures and Options (F&O) trading. The move has raised concerns about lower trading activity and profitability for brokerage firms.

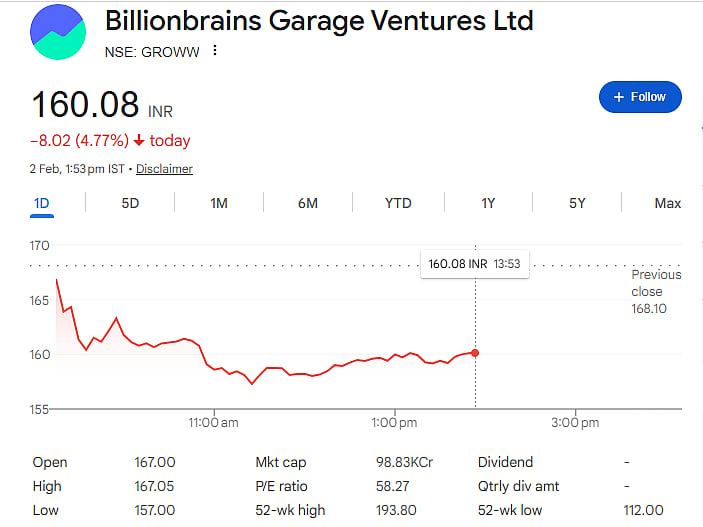

On the BSE, Billionbrains Garage Ventures, the parent company of Groww, saw its stock drop 5.86 percent, making it the biggest loser among brokerage stocks. Geojit Financial Services fell 2.98 percent, Anand Rathi Share and Stock Brokers declined 2.30 percent, Angel One slipped 2.26 percent, while 5paisa Capital dropped 2 percent.

These stocks had already faced strong selling pressure in the previous trading session after the Budget announcement.

What caused the fall?

The main reason behind the decline is the government’s decision to increase STT on derivatives trading. Finance Minister Nirmala Sitharaman said the move aims to discourage small investors from taking high risks in speculative trading.

Higher STT directly increases trading costs for investors and traders. This reduces overall trading volumes, which hurts brokerage firms that depend on high volumes for revenue.

New STT rates announced

In her Budget speech for 2026–27, Sitharaman announced that the STT on futures contracts will increase to 0.05 percent from 0.02 percent.

For options, STT on premium will rise to 0.15 percent from 0.1 percent, and STT on exercise of options will increase to 0.15 percent from 0.125 percent.

These hikes are considered steep and are expected to make derivatives trading significantly more expensive.

Expert views on impact

Ajay Menon, MD and CEO of Wealth Management at Motilal Oswal Financial Services, said higher STT reduces trading profitability for active traders and raises concerns about future liquidity and growth in the derivatives segment.

Shripal Shah, MD and CEO of Kotak Securities, said the sharp increase in STT will raise impact costs for traders, hedgers and arbitrage players. He added that the government’s aim seems to be controlling volumes rather than increasing tax revenue.

Long-term shift expected

A Balasubramanian, MD and CEO of Aditya Birla Sun Life AMC, said the move may hurt trading activity in the short term. However, he believes it could encourage investors to shift towards the cash market and long-term investing instead of frequent speculative trading.

Overall, the STT hike has created near-term pressure on brokerage stocks, with investors worried about slower business growth in the derivatives segment.