Bharti Airtel, one of the leading telecommunication company, Monday (August 5) announced its audited financial results of the Company for the first quarter (Q1) ended June 30, 2024, the company announced through an exchange filing.

Key Highlights

In Q1FY25, the telecome giant reported a total revenue of Rs 38,506 crore, a remarkable surge of 2.8 per cent year-on-year (YoY) and a 2.4 per cent increase quarter-on-quarter (QoQ).

In the Indian segment, the company posted a revenue of Rs 29,046, a rise of 10.1 per cent YoY growth.

Financial Highlights - Q1FY25

In Q1FY25, the consolidated EBITDA of the company stood at Rs 19,944 crore with a margin of 51.8 per cent and EBIT at Rs 9,355 crore with a margin of 24.3 per cent.

The company invested Rs 8,007 crore in Q1 FY25. Out of the total, Rs 6,781 crore was invested in the Indian segment. | pixabay

The Net Income of the company befor exceptional items was at Rs 2,925 crore, up 0.8 per cent YoY.

After exceptional items, the telecom giant posted an increase to Rs 4,160 crore, a 158.0 per cent YoY increase.

Furthermore, the company invested Rs 8,007 crore in Q1 FY25. Out of the total, Rs 6,781 crore was invested in the Indian segment.

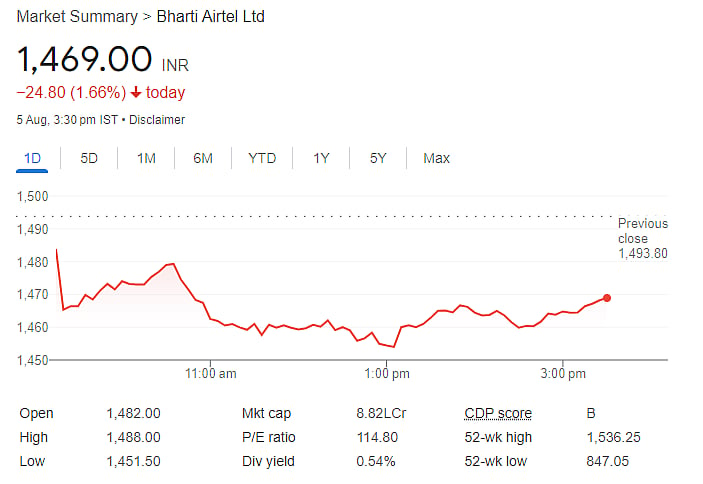

Share Performance

The shares of the company on Monday at 3:30 PM IST closed on a red note at Rs 1,469.00 apiece, down by 1.66 per cent.

Share Performance |

Segment-wise Performance

Mobile Services India

In this segment, the revenue of the company had an increase by by 10.5 per cent YoY.

The company also had a surge in their overall mobile customer base, which stood by 29.7 million YoY and 6.7 million QoQ, a 73 per cent surge | Representative Image

As per the regulatory filing, some of the factors driven to this growth included the company's strong 4D/5G custimer addition, improved customer mix and an increase in the Average Revenue Per User (ARPU).

Airtel Business

In Q1FY25, the company posted a revenue growth by 8.3 per cent YoY.

Homes Business

This segment reported a growth by 17.6 per cent YoY in revenue.

Digital TV

The revenue of the company increased by 5.0 per cent YoY.

The company also had a surge in their overall mobile customer base, which stood by 29.7 million YoY and 6.7 million QoQ, a 73 per cent surge.

The mobile ARPU of the telecom giant surged to Rs 211 in Q1 FY25 from Rs 200 in Q1 FY24.