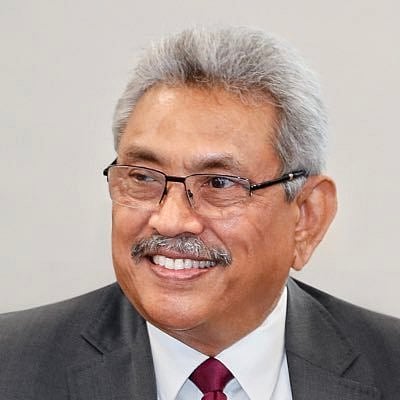

Battered by "worst-ever" financial crisis since independence, Sri Lanka's President Gotabaya Rajapaksa has talked to the international financial institutions including the International Monetary Fund (IMF) and other countries on loan repayment.

In a special address to the nation on Wednesday night, President Rajapaksa said that talks have been started with IMF to find a way to pay off annual loan instalments and sovereign bonds.

"Subsequent to my discussions with the IMF, I have decided to work with them after examining the advantages and disadvantages," the President said in the address which was telecast on all television stations in the country. Going to the IMF was a complete reversal from his government's earlier stance.

In his speech President Rajapaksa vowed to take "tough" decisions to solve the inconveniences faced by people and said that a National Economic Council and an Advisory Committee have been appointed find ways to overcome the financial crisis.

South Asian island-nation's debt ridden economy suffers with a severe food, fuel, power, transportation and medicine shortages with long queues at fuel stations, gas stations and hours of daily power cuts.

Started with the Easter Sunday bombing in 2019 followed by the Covid-19 pandemic, Sri Lanka is currently facing a sever foreign exchange crisis with foreign reserves fell to $ 2.36 billion as of January.

To save foreign currencies, the government last week blocked the importation of over 360 non-essential imports including milk products, fruits, fish footwear and wine. This was in addition to the ban imposed on motor vehicles which India is a major stakeholder and other items such as mobile phones, ceramic items since March 2021.

In 2022 the country has to pay $6.9 billion in loan instalments and sovereign bonds.

President Rajapaksa addressed the nation on the day when his brother and Finance Minister, Basil Rajapaka is on a visit to India met India's Prime Minister Narenda Modi with plans to obtain $1 billion emergency financial assistance to get essentials such as food, medicines and fuel. Basil Rajapaksa also met with India's Foreign Secretary, Harsh Vardhan Shringla in New Delhi.

Since the crisis, India has helped Sri Lanka with a $400 million RBI currency swap, $500 million loan deferment and another $500 million Line of Credit for fuel imports.

(With IANS inputs)