Bajaj Auto Ltd. released its Q1 FY25 consolidated net profit, which increased 18 per cent year over year to Rs 1,941.79 crore. This increase was attributed to steady demand, strong 2-wheeler sales, and higher realisations.

The Pune-based automaker's revenue increased by 16 percent year over year to Rs 11,932 crore in the April-June quarter. This increase was facilitated by a better mix of products that favoured premium vehicles and better spares businesses, which raised the average selling price (ASP).

Total sales number

In comparison to the 10,27,407 vehicles sold in the same quarter last year, the Rajiv Bajaj-led company sold 11,02,056 vehicles in the June 2024 quarter, a 7 per cent increase.

EBITDA Margins

The company's EBITDA (earnings before interest, tax, depreciation, and amortization) increased by 24 per cent in Q1 FY24, from Rs 1,954 crore to Rs 2,415 crore. Additionally, the EBITDA margin increased by 130 basis points (bps), from 19 per cent YoY to 20.2 per cent.

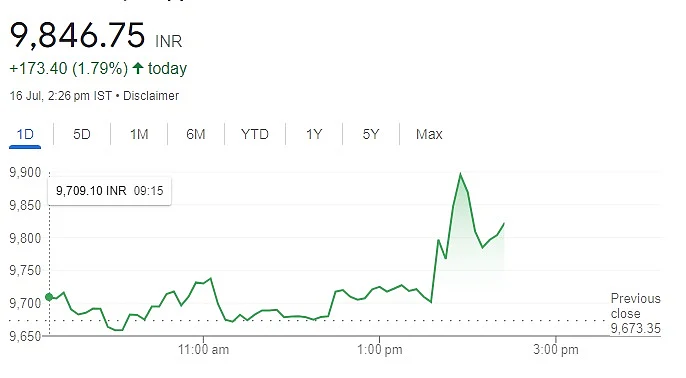

Bajaj Auto share price |

Strong car sales and record spares revenue helped Bajaj Auto's revenue from operations in Q1FY24 rise 15.7 per cent YoY to Rs 11,928 crore from Rs10,310 crore YoY.

The company's revenue increased by double digits year over year, and it experienced robust export growth. The company added that it continued to see double-digit growth in its domestic business for the ninth consecutive quarter.

The well-liked motorcycle Pulsar from Bajaj Auto continued to grow at a double-digit rate thanks to a push toward premiumization, the company said.

Bajaj auto q4

In the March quarter, the two- and three-wheeler major's net profit increased by 18 per cent to Rs 2,011.43 crore from Rs 1,704.74 crore in the same period last year.

For the January-March quarter, Bajaj Auto reported revenue of Rs 11,249.8 crore, up 30 per cent from Rs 8,660 crore in the same period the previous year.

In the December quarter before last fiscal year, the auto major's net profit crossed the Rs 2,000 crore mark for the first time. The company reported a 33 per cent increase in net profit to Rs 7,479 crore for the year that ended on March 31, 2024, from Rs 5,628 crore for the FY23 fiscal year.

Operating revenue increased from Rs 36,428 crore in the fiscal year 2022–2023 to an all-time high of Rs 44,685 crore in the fiscal year 2024.

Share Performance

At 2:25 pm on the NSE, Bajaj Auto shares continued to rise; the counter was trading around Rs 9856 per share on the bourses.