Nifty has been consolidating this week and looks mildly bullish for the next few weeks. Bank Nifty still looks bearish.

We recommend investors to wait on both these indices before seriously allocating capital. The correction can deepen further over the course of the next few weeks.

Nifty 50 |

Bank Nifty |

Nifty FMCG

The FMCG index has consolidated over the past week and seems to have found a medium term bottom. We could see this index forming a fresh base before heading up again. Investors could consider building longs slowly in this sector.

Nifty FMCG |

Nifty IT

The Nifty IT index looks like it has taken support from the 34400 levels and has bounced from there. In the medium term this sector will consolidate and may test its resistance near the 37500 levels. We would recommend investors to wait for a while for clarity to emerge before investing in this sector.

Nifty IT |

Derivative Outlook

Nifty current month future closed with a premium of 40 points to its spot. Next month's future is trading at a premium of around 90 points.

We saw open interest reduction of nearly 2.93 percent in Nifty.

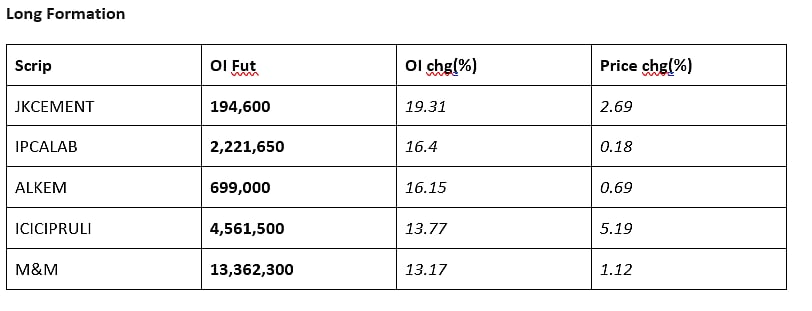

Long Formation |

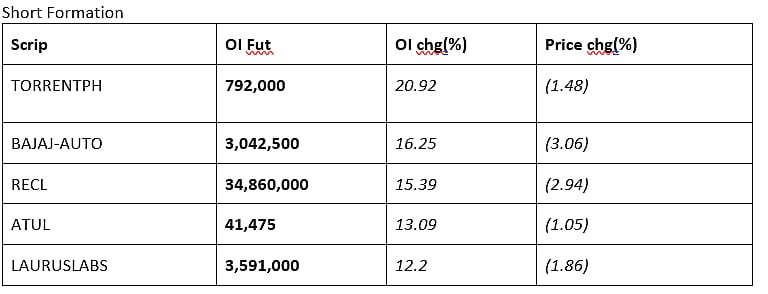

Short Formation |

Top five recommendations

BOSCH LTD

BOSCH LTD is trading in the strong uptrend. It had taken the support of the previous resistance level also RSI indicator shows bullish signal. Above 18950 level will be a good opportunity to go long.

Buy BOSCHLTD above 18950 CMP 18565.75

Target 1 - 19560

Target 2 - 20185

Stop loss: 17715

CIPLA

CIPLA is trading in the tight range of 930 and 885 level. It is consolidating at the support level which indicates higher chances of upside breakout. Any sustainable move above 930 level will be a good buying opportunity.

Buy CIPLA above 930 CMP 915.95

Target 1 - 950

Target 2 - 970

Stop loss: 890

TATA MOTOR

TATAMOTOR is in consolidation zone since past four weeks. Any sustainable breakout above 530 level will drag the stock to the new high. Above 530 level will bring some good upside momentum in the stock.

Buy TATAMOTOR above 530 CMP 507.05

Target 1 - 555

Target 2 - 580

Stop loss: 480

ULTRACEMCO

ULTRACEMCO is trading at its important support level. It is trading at support of previous resistance level. Above 8150 level good opportunity to go long.

Buy ULTRACEMCO above 8150 CMP 8080.75

Target 1 - 8275

Target 2 - 8400

Stop loss: 7900

HDFC AMC

HDFCAMC is trading near its previous support level. It is resisting at the previous support level indicating bearishness in the stock. Below 2600 level good opportunity for shorting.

Short HDFCAMC below 2600 CMP 2627.35

Target 1 - 2567

Target 2 - 2535

Target 3 - 2502

Stop loss: 2665

(Gaurav Udani is Founder & CEO of Thincredblu Securities. He tweets @Udanii)

.jpg)