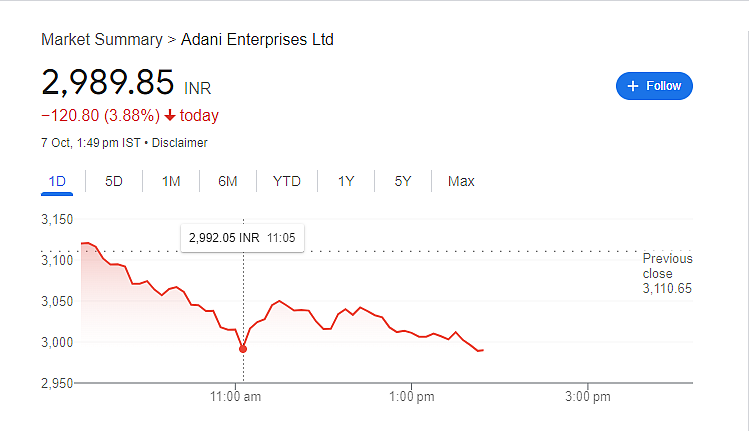

The shares of Adani Enterprises plummeted down more than 4 per cent on the National Stock Exchange amid German materials company's Indian cement arm, Heidalberg Cement, and Adani Enterprises, The stock saw a declining opening at Rs 3110.65 per share on the NSE.

The stock went on touch the day low level of Rs 2980.45 per share on the stock exchanges, losing about 3.88 per cent on the bourses, amounting to a Rs 120.80 per share drop in share price on the Indian Stock Exchanges.

A representative claims that negotiations are underway for the Adani Group to purchase Heidelberg Materials' Indian cement business for a potential USD 1.2 billion.

The billionaire Gautam Adani's Adani Group joined the Indian cement market in 2022 when it acquired Holcim's local operations. Since then, it has acquired a number of companies to gain market share against leading cement manufacturer UltraTech Cement.

Another report states that the Adani Group would withdraw from the competition if it turned into a full-sale process involving other competitors.

In the running for HeidelbergCement India, a media report from last year mentioned UltraTech and JSW Cement, which was about to go public.

Heidalberg cement

According to their website, Heidelberg Materials entered the Indian market in 2006 through a series of domestic acquisitions. As of right now, they have four plants with a combined yearly capacity of 12.6 million metric tonnes.

With the announcement of India Cements' acquisition in July, UltraTech Cement strengthened its position in the southern market.

The company announced through its exchange filing that the proposal to purchase the promoters' 32.72 per cent stake in India Cements at Rs 390 per share has been approved by the board of the Aditya Birla Group firm. The Rs 3,954 crore deal size.