Money brings a lot of emotions with it, as even though it cannot practically buy happiness, it definitely can bask you in it. Since childhood, our parents have taught us money to be the rarest asset and therefore should be used very wisely. This imbibed fact becomes clearer as we start earning and know that it is definitely not a piece of cake. Given by this thought we incur many unwanted thoughts with regards to money and knowingly or unknowingly make irrational decisions. Making decisions based emotions could be disastrous and thus decision-making must be evaluated and then pursued. Let us checkout six such strong fears and certain ways to conquer them.

Fear of losing all the money: This fear is common among individuals with limited financial knowledge. Money remains a precious gem in our lives and the mere thought of empty pockets and bank accounts can make the most peaceful individual to have sleepless nights. Therefore, thoughts such as sudden huge medical bill or stock market crash or other such unforeseen event makes us uncomfortable for days. How to conquer it? Simple, don’t try to control things that you cannot, rather target tasks that have zero to minimum impact of such event. Medical insurance, emergency fund or investing in hybrid funds in case of stock market fears are some of the solutions.

The pink slip fear: If you ask an employee what is his/her worst nightmare, without second thought s/he will answer layoffs. With corporates always striving to reduce cost and on top of that regressive financial trends such as recession, it is easy for any employees to be uncomfortable. How to conquer it? Belief within yourself is the first and foremost thing. Second, keep learning and updating with new knowledge or qualifications in order to be ahead of time. Last, build up an emergency fund and a second income resource.

Doom in retirement: An overthinker’s favourite, but a nightmare at the end. Retirement, as each one of us dreams, is the most comfortable part of our life. However, inadequate money in retirement practically displays the famous Rajesh Khanna movie Anand in our dreams and thereafter we wake up gasping. Technically, it is difficult to comprehend our future. However, it is futile to lose our sleep for things that are yet to occur. How to conquer? For starter, start retirement planning. Understanding your current lifestyle and predicting how much money shall be sufficient for your retirement could help you. Thereafter, set aside a certain sum of money and invest the same in such instruments that can easily make you achieve that level.

Play safe and stick to cash: Common fear amongst individuals who simply cannot take losses well or fear of any such comprehension. These individuals prefer keeping their salary or income in bank account rather than investing it. Everyday the only way to achieve peace of mind is by looking at their passbook or bank statement. It is not that they do not know the impact of inflation or the opportunities that are being given up by them. The thought of mismanaging the money is what’s stopping them for doing anything. How to conquer? By understanding the biggest truth of life that every investment including money in the bank possesses risk. It is also okay to ask for help or guidance. Moreover, the quantum of losing by keeping money in bank is much more than missing out on the compounding magic.

Being debt free is a luxury which I cannot afford: From credit card to personal loans, debt does not take too long to make you uncomfortable. Many salaried individuals live on credit card. How to conquer? Setting up a budget and reducing your dependency on credit card. Apply the ‘save first buy later’ strategy rather than ‘buy first pay later’. Another important aspect in reducing debt is not to borrow to minimise debt.

No money talks: Financial talks between spouses or family members is thought of encroachment of private space. How to conquer? Life is full of learnings and there are teachers galore. Advices always open new doors or ideas that may simplify your living. Hence take the first step and begin.

Too much fear is unhealthy for any lifestyle and it certainly does not help when it comes to financial planning. It is wise to be watchful but overthinking is sheer foolishness.

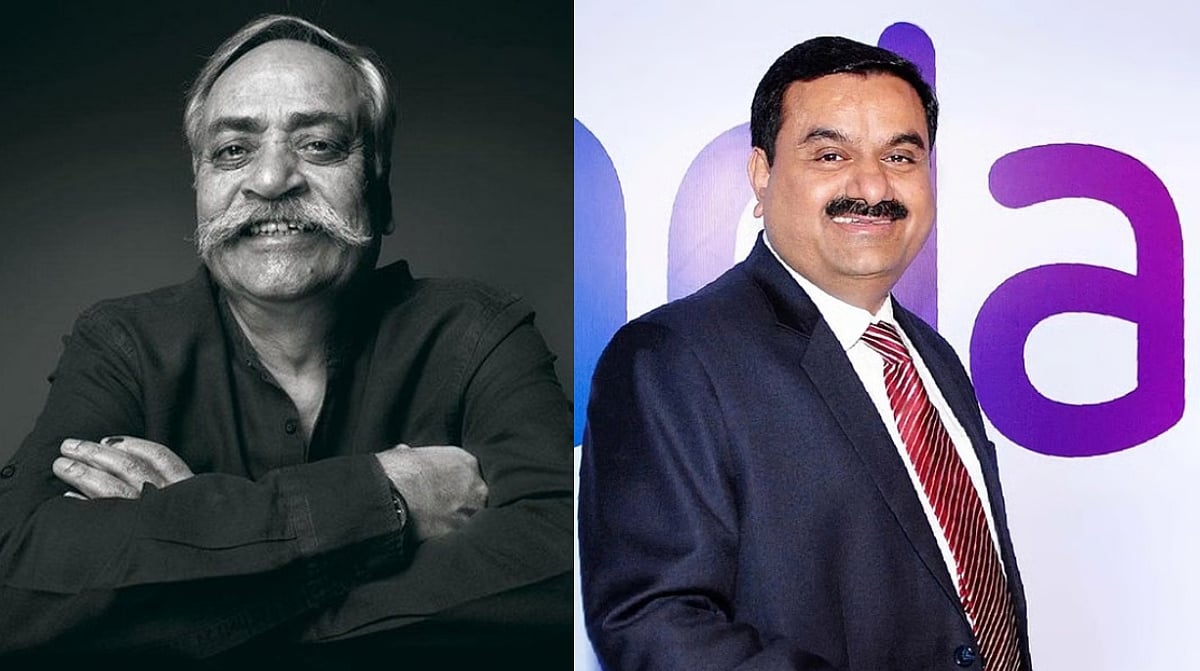

(Viral Bhatt is the Founder of Money Mantra — a personal finance solutions firm)