India’s economic boom has created a rapidly expanding affluent base. According to a 2025 Wealth Report, millionaire households have nearly doubled in just four years, reaching 8,71,700. This surge has been driven by strong stock markets, robust urban growth, and a wave of entrepreneurship.

A striking trend is the youth of this new wealth class. Many Indian billionaires today are under 40, and their relationship with money is markedly different from previous generations. “Earlier, affluence came in your late 50s or 60s, after decades of building a business,” says Ronak Sheth, Chief Marketing Officer at 360 ONE Group. “Today, founders in their 20s are building multi-million-dollar empires.”

For this generation, wealth is not the destination — it is a means to a larger purpose. “Seventeen years ago, when I started my career, clients wanted safe returns and legacy continuity. Today, they ask very different questions,” Sheth observes. “How can I invest in global innovation? How can I be part of the startup changing the way business is done? How can I make my capital more purposeful?”

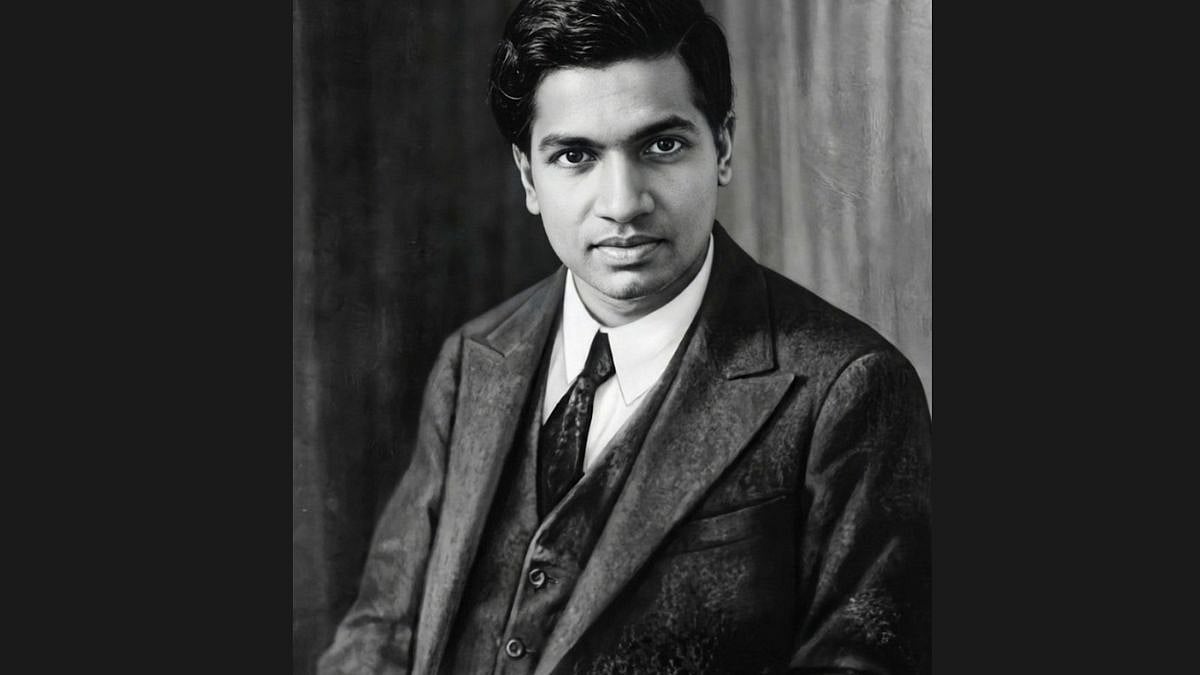

Meet The Affluent Investor

The purpose-driven shift is perhaps the most defining change in wealth management today. Clients are no longer satisfied with simply preserving or growing their assets. They want their wealth to have meaning.

“As affluence grows, purpose becomes the new alpha,” Sheth notes. “It’s not only about inheritance anymore — it’s about values, knowledge, and impact. Clients want to ensure their children inherit the right worldview, not just the money.”

This purpose often manifests as philanthropy, ESG investing, or passion projects. But Sheth points out that many clients struggle with how to channel this intent effectively. "Today, we have pioneered a more catalytic approach to giving through returnable grants and outcome-based finance. We would love to reach a stage where we not only manage clients' portfolios but also help institutionalise giving, creating structured ways for clients to give back."

A New Identity

When 360 ONE Group rebranded from IIFL Wealth in 2022, the move was not just cosmetic. The firm, which had built a legacy over 17 years under the IIFL name, was no longer only about wealth management. It had evolved into a multi-business, multi-product financial ecosystem managing over USD 50 billion in assets under management.

“IIFL was a strong legacy brand, but by then we were much more than a wealth management company. We had asset management, lending solutions, estate and trust planning. Our ambitions had outgrown the old name,” says Ronak Sheth, Chief Marketing Officer, 360 ONE Group.

The new identity signified a 360-degree holistic view of the one person who matters most to the company: the client. “We wanted to build a brand that was modern, contemporary, subtle, yet brought with it the gravitas of India’s leading wealth manager.”

For 360 ONE, marketing has always been led through experiences and human connections, Sheth explains. “In today’s world of constant digital interactions, people are lonelier than ever. We believe in bringing them together — in events, in communities — where ideas are exchanged and relationships deepen.”

This approach translates into unique client initiatives. For instance, their DIVE program brings together clients’ children aged 20–30 for two days of immersive learning with global speakers. The Young Leaders Program (YLP) offers undergrad children of clients a three-week internship designed to prepare them for future leadership.

For others, the “plus” in 360 ONE’s ‘Performance Plus’ philosophy translates to money-can’t-buy experiences, such as attending the Wimbledon final or intimate knowledge-sharing sessions with industry pioneers like Morgan Housel or Henry Kravis.

“Performance is about how we manage a client’s portfolio,” says Sheth. “But the plus varies for every individual. For some it’s access, for others it’s learning, for some it’s family engagement. That personalisation is what strengthens the bond.”

The true test of any wealth manager lies in retention — and by Sheth’s account, 360 ONE has the highest client retention rate in the industry. “Clients stay with us because they trust us to do the right thing for them,” he says. “That trust is earned by living up to expectations consistently, year after year.”

As the firm expands its portfolio further — through asset management, lending, estate planning, and acquisitions such as B&K Capital and ET Money — it is positioning itself as a full-fledged financial ecosystem for India’s growing affluent class.

Ultimately, what sets 360 ONE apart is its ability to see wealth as beyond just numbers; intertwined with meaning, values, and human connection. “Our clients are asking deeper questions,” Sheth reflects. “They want to know how their wealth can fuel innovation, how it can give back to society, how it can prepare the next generation. That’s what we’re here to help them answer.”