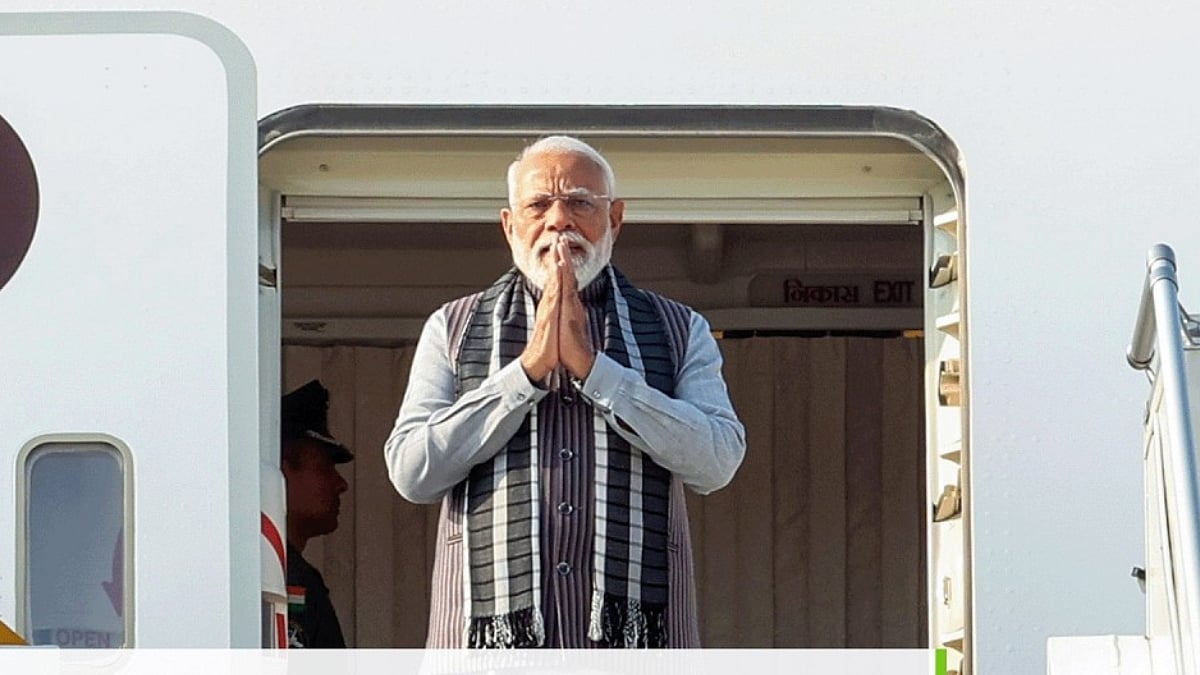

The very first paragraph of Union Finance Minister Nirmala Sitharaman’s relatively short speech presenting the Budget for 2023-24 made it amply clear that this was her last full-fledged budget before the next general elections. She talked of envisioning a “prosperous and inclusive India, in which the fruits of development reach all regions and citizens”, especially the youth, women, farmers and those belonging to the other backward classes (OBCs), Scheduled Castes (Scs), and Scheduled Tribes (SCs). The attempt clearly was to counter the criticism that these are the very sections of the population that have suffered the most over the last eight-and-a-half years of the Narendra Modi government.

Reality check of tax slab

The Finance Minister received the loudest applause when she announced her proposal to change the personal income tax regime—by increasing the rebate limit on annual taxable income from Rs5 lakh to Rs7 lakh and reducing the number of income slabs from six to five—thus incurring a revenue loss of around Rs37,000 crore. The least that a middle-class taxpayer would gain is Rs10,000. With tax planning, the gain would be higher. It should be recalled that five years ago, in the Budget for 2017-18, before the 2019 Lok Sabha elections, the government had modified the personal income tax regime. Sounds familiar, doesn’t it?

Sitharaman has increased the outlay on the Prime Minister Awas Yojana, a housing scheme for the poor, by 66 per cent to more than Rs79,000 crore and, as is typical of this government, announced schemes with catchy acronyms like PM-PRANAM (PM Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth), PM VIKAS (PM Vishwakarma KAushal Samman) and MISHTI (Mangrove Initiative for Shoreline Habitats and Tangible Incomes). Millets such as bajra, jowar and ragi have been renamed Shree Anna.

MSMEs gain in Budget 2023

A positive aspect of the Budget is the higher outlays for the Ministries of Health & Family Welfare and Education, which had stagnated or declined in the past. Loan guarantee schemes for micro, small and medium enterprises (MSMEs) have been expanded. Total capital expenditure (capex) is also proposed to be increased by a third to over Rs1 lakh crore. One hopes, but one is not sure, that the bulk of the higher capex will not be hogged by conglomerates headed by a few oligarchs.

State governments have been allowed a fiscal deficit as a proportion of their gross state domestic product (GSDP) of 3.5 per cent, of which 0.5 per will be “tied to power sector reforms”—a euphemism for bailing out financially strapped electricity distribution companies.

Budget 2023 and the underprivileged

There is, however, much in the Budget that is positively deleterious or harmful for the economy, especially for the underprivileged. The PM Poshan or mid-day meal scheme’s budget estimate (BE) for 2023-24 is Rs11,600 crore against the Rs12,800 crore revised estimate (RE) for the current fiscal year that ends on 31 March. The BE for the programme under the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) has been proposed at Rs60,000 crore against the RE of Rs89,400 crore for 2022-23.

Largest expenditure items and the Budget 2023

The single largest item of expenditure of the central government after interest payment is expenditure on providing subsidies for food, fertilizers, and petroleum products. In all the three instances, if the RE for 2022-23 is compared with the BE for 2023-24, the total decline is 28 per cent. Food subsidies are down by nearly one third (from Rs2.87 lakh crore to Rs1.97 lakh crore), fertilizer subsidies have been reduced by around 22 per cent (from Rs2.25 lakh crore to Rs1.75 lakh crore), while subsidies on petroleum products have been slashed by three fourths (from Rs9,171 crore to Rs2,257 crore). The government can argue that it can increase outlays through supplementary demands for grants, as it has in the past. However, the low outlays do not make for good optics.

Benefits for Gujarat

The Prime Minister’s favourite international financial services centre at Ahmedabad, the Gujarat International Fin-Tech (GIFT) City, has been granted a slew of benefits, as it was in the past few Budgets of the Union government.

No mention of “unemployment” and “inflation”

Overall, the Budget aims to please all sections of Indian society. That it may end up spreading the happiness rather thinly is another story. However, then the Modi government must show that it is for the poor, even if several of its actions have helped the rich while expenditures on social security, child nutrition, and pregnant mothers have stagnated or hardly gone up in terms of their proportion to the country’s gross domestic product (GDP).

Even if the job-creating potential of certain schemes have been mentioned, two words are conspicuous by their absence in the Finance Minister’s Budget speech, and these are “unemployment” and “inflation” , lthough the “massive slowdown” across the world due to Covid-19 and “a war” has been referred to.

In conclusion, an unusual sidelight of the Budget was how certain stocks performed. As share market indices went up and down during the day and ended on a positive note, the stock prices of companies belonging to a particular conglomerate bucked the trend.

The writer is an independent journalist and economic analyst based in Gurugram, Haryana.