There are quite a few seemingly cynical banking jokes that nevertheless hit the nail on the head. You borrow in lakhs, you are in trouble with the bank but you borrow in crores, the bank is in trouble with you — perhaps says it all. You come on your bicycle to borrow but ride your Mercedes to tell the bank you have gone bust and therefore cannot repay is the icing on the caustic cake. The common man especially the home loan borrower often wonders with pardonable self-righteousness that why the hell she should agonise over her next EMI when Nirav Modis and Vijay Mallyas of the world sneer at the Indian banks and government from London which incidentally has over the years become the preferred hideout for such wilful defaulters.

On June 8 the RBI came out with a circular that has muddied the waters more and fortified the impression that it is at its wits’ end reining in the defaulters. Incidentally, the government’s chest-thumping and self-congratulation on making bank balance sheets squeaky clean and convert the splotches of red into black hides the shocking fact that such image makeover or kayakalp has been made possible by brushing dollops of NPA under the carpet by repeated recapitalisation after write-offs bankrolled by the taxpayer. At the end of the day, it is the taxpayer who is grinning and bearing stoically.

The recent circular has stirred up a hornet’s nest and raised a storm. It allows banks to not only negotiate a one-time settlement when a specified default threshold is reached but more shockingly allows them to give additional loans after a cooling off period of twelve months in a manner of throwing good money after bad with an inane condition that the criminal prosecution and other legal steps relating to earlier defaults would go on untrammeled. Touché! This is evergreening of bad debts hitherto done furtively by banks by playing footsie with the wilful defaulters. Now it would be no-holds-barred! It would be orchestrated and overseen by bank boards themselves.

The RBI and the government are not as hapless and helpless as they sound. While behest lending might have stopped, the bank loan framework has to change drastically. Roots and branches reforms are called for. Islamic banking has got some lessons for our policy wonks. Under Islamic banking which the likes of the pedigreed Barclays have adopted in Islamic nations willy-nilly, the bank doesn’t extend loans but instead buys the assets needed by the wannabe borrower. This is akin to a beggar being bought food lest he spends the alms in boozing. Loans credited into the borrower’s account tantalises him into diversion which in this day and age is possible through a few clicks of the mouse into distant clandestine banks where the Indian government’s writ doesn’t run.

Na rahega baas na bajegi baansuri is old hat. Banish the temptation from the scene is the subliminal message. To be sure a few banks are already practicing project financing but asset-based financing must become the inviolable norm. Of course, for working capital financing this model would come a cropper. The solution lies in tightening the promoter guarantee regime. Personal guarantees of promoters must be invoked at the first hint of default and should not be the measure of lost resort which amounts to shutting the door after horses have bolted! Indeed, the guarantee regime must be tightened so that it is foolproof and not conducive to being rendered farcical which happens when properties offered as collateral for guarantees are sooner or later held in the names of near and dear ones or benamis.

More ideally, listed companies and other big-ticket borrowers must be made ineligible for PSB loans. If every Tom. Dick and Harry including loss-making companies can go public by making IPOs, there is no reason why they should not seek loans through issuance of bonds tradeable in the bourses. Market is a martinet of disciplinarian. Bonds defaulting on their interest and repayment obligations are sooner than later reduced to a junk status thus heightening the yield for the latest holder of such bonds and exposing the issuer for who he is. Banks on the other hand are loath to name and shame the defaulters with the RBI citing fiduciary relationship for not exposing their shenanigans.

PSB loans must be reserved for the small man who has a better track record of repayment and who has no means of decamping with the loot. The apologists for the recent circular indulging wilful defaulters aver that the present regime of NCLT proceedings under the Insolvency and bankruptcy Code (IBC) is time-consuming and costly both in terms of legal expenses and haircuts banks inevitably and invariably have to take. It is naively believed that negotiation and compromise with wilful defaulter would entail lesser haircuts.But the other defenses of the apologists — with passage of time the mortgaged assets lose value and belated recovery entails erosion in the value of realisations given the time value of money — have a ring of truth.But that doesn’t mean we must jump from the fire to the frying pan. Lending to the wilful defaulter after a cooling off period of one year is laughable and amounts to throwing good money after bad. IBC indeed hasn’t improved the lot of our banks except giving them the cold comfort that the wilful defaulters have been dethroned and a new promoter has been installed.

Negotiated settlement even at the board level bristles with moral issues — wink-wink nudge-nudge. You scratch my back and I’ll scratch yours. It is of a piece with the SEBI’s compounding mechanism behind closed ornate doors. It is not only secretive but discriminatory too. Are home loan takers shown similar latitude and accommodation? Many greater NOIDA wannabe homeowners are paying EMI for homes that are yet to be constructed thanks to the shenanigans of the builders who incidentally account for a sizeable share of wilful bank defaults.

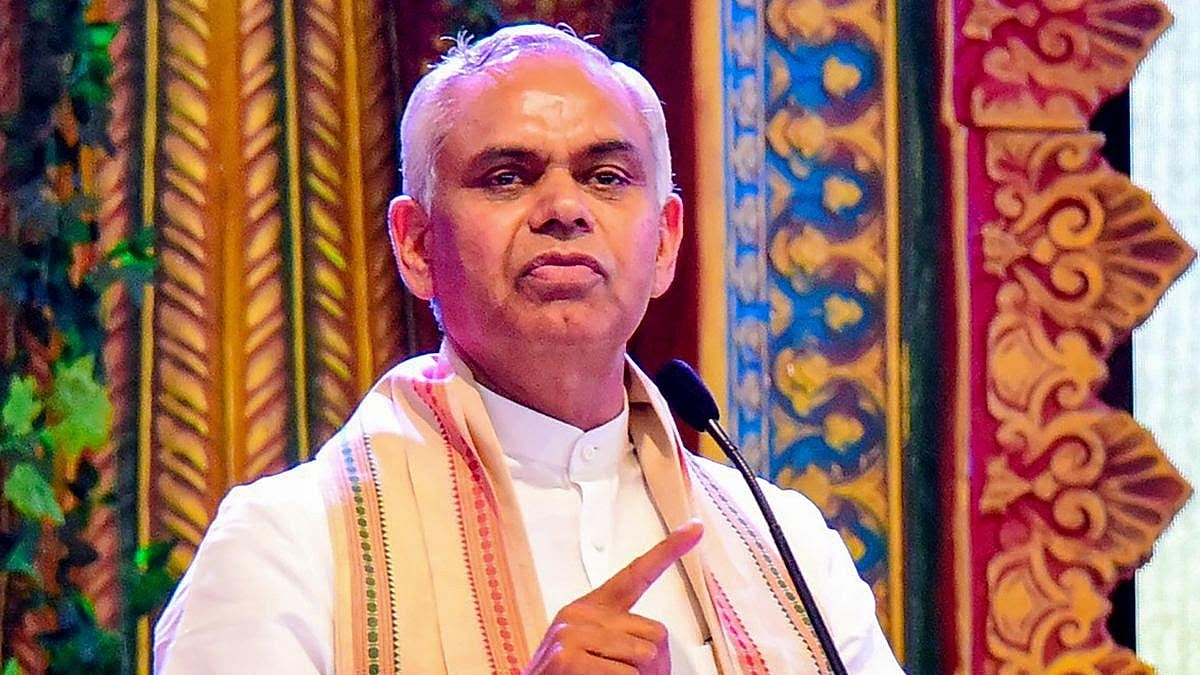

S Murlidharan is a freelance columnist and writes on economics, business, legal, and taxation issues

.webp)