It has now been more than a month that the Reserve Bank of India (RBI) suspended operations of the Punjab and Maharashtra Co-operative (PMC) Bank and appointed an administrator. All of a sudden, all the bank’s operations were suspended.

The depositors could withdraw a mere Rs1,000 every six months, as per an initial RBI notice. The limit was raised to Rs10,000 and then to Rs25,000, later. Now, the RBI has capped the withdrawal limit at Rs40,000 once every six months.

What has emerged is the PMC Bank CEO/MD committed a fraud and opened 21,000 bogus accounts to disburse loans to HDIL to an extent of Rs6,500 crore.

They violated the maximum exposure limit to a single party and gave 73 per cent of their total deposits to one single party HDIL, which blackmailed the management into giving it all these funds or going public and making the bank collapse. The board of directors, chairman and five others were in the know of these loans.

The bank’s latest balance-sheet has been audited by a Ghost CA firm, Lakdawala & Co, and the auditor gave ‘A’ classification (highest classification for good conduct). Obviously, it looks like it is a fake audit.

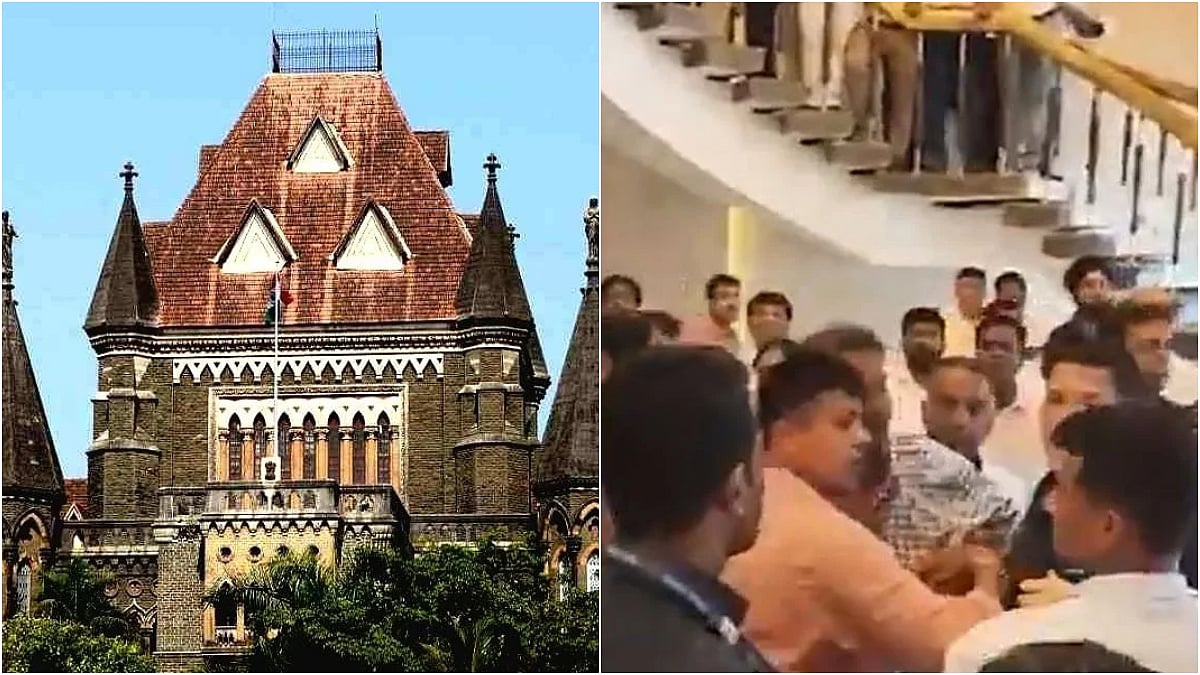

The borrowers, Suresh Wadhawan and his son, Sarang were arrested by EOW, Mumbai Police. Later some bank directors, including chairman Waryam Singh, were also arrested.

ED has seized the assets of HDIL and not the assets of the PMC Bank. Net result is this that for no fault of theirs the depositors of 137 branches in multiple states, numbering 17,00,000 have been left high and dry.

Finance minister Nirmala Sitharaman first shrugged off all responsibility, but as it is an election season in Maharashtra and this issue has become a hot potato, she later assured action.

The RBI has done nothing much, not even named the auditors responsible for missing the fraud. The PM has, too, not spoken a word about it, probably because Mukesh Ambani, Gautam Adani and Anil Ambani are not involved.

Now, the depositors are in panic when they came to know Rs1,00,000 of their deposited amount is insured. And, the biggest problem is it could happen to any bank with RBI, government, finance ministry and PM reacting in the same manner.

Because the real estate sector is under stress. So, any bank that has exposure to the real estate sector can collapse. And, some of the major banks, such as SBI, ICICI and HDFC, have big exposure to the sector... because the economy is in doldrums... because the government is broke. And, it has no clue, not knowing what to do.

So, instead of raising the deposit guarantee insurance to Rs1 crore, the government reacts by sending a message that over Rs1,00,000 in the bank is at risk.

And then, they want the banks to somehow survive this stabbing in the back. What kind of government do we have? It is presiding over the death of genuine depositors who don’t have access to their own funds.

All because the regulators of RBI and other auditors failed to detect and stop a scam in the PMC Bank. Today it is PMC, tomorrow it may just be any other bank, private, cooperative or nationalised.

Is the government trying to wriggle out of a situation where if any bank collapses, it can take shelter in this clause of just Rs1,00,000 as the guaranteed amount to be refunded to depositors?

Is this then not the same as bail-in provision implemented through an indirect route rather than through FRDI Bill? Will someone own up? Or will depositors keep dying? Time you got very worried as a depositor in any bank. Sadly, the PMC Bank account holders who are protesting their locked-in deposits have their social media accounts reported and blocked.

They are being threatened by BJP/RSS/Shiv Sena people not to write about their problems as this is causing bad name for BJP/RSS/Shiv Sena and would affect the election prospects of the political party’s.

This is what the democracy has been reduced to in our country. First, you get sucked of your legitimate cash, then you can’t even protest.

—The writer is convener ,Indians for Actualisation of Democracy