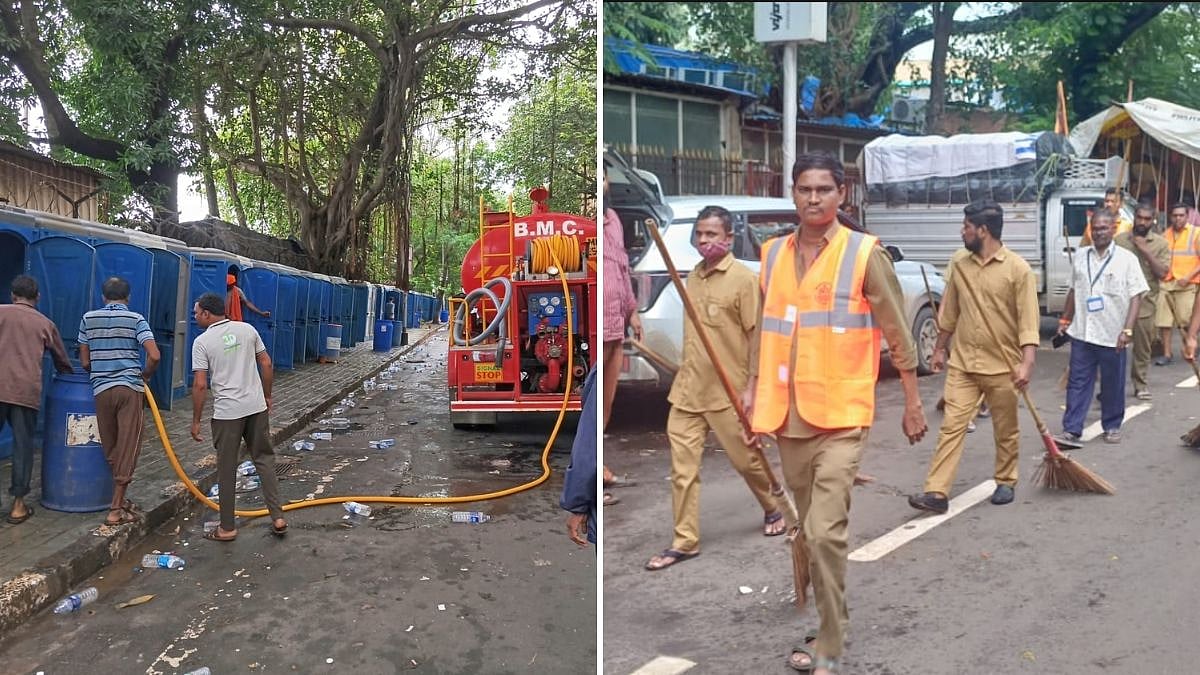

The BMC has achieved a record-breaking property tax collection of Rs. 6,388 crores against Rs. 6,200 crores for the financial year 2024-25, the highest since 2010. The civic body has achieved the target despite there being no property tax increase in the past decade and the ongoing exemption for properties up to 500 sq ft.

The civic body had initially set a property tax collection target of Rs. 4,950 crore, which was later revised to Rs. 6,200 crore. In the previous financial year (2023-24), the total property tax collection amounted to just Rs. 3,195 crore by March 31, 2024. However, the BMC’s Assessment and Collection (A&C) department’s focused actions against major defaulters played a crucial role in boosting revenue this year. Additionally, the civic body collected Rs. 178 crore from taxpayers who delayed their payments, incurring a 2% interest charge per month.

The highest revenue has been collected from G South (Worli, Prabhadevi areas) Rs. 624.50 crores, K East (Jogheshwari and Andheri East) - Rs. 568.56 crores, H East (Khar, Santacruz) - Rs. 526.64 crores, K West (Andheri West) - Rs. 505 crores. The municipal corporation’s property tax collection has faced challenges in recent years. The decline in collection was largely due to exemptions for residential properties up to 500 sq ft and the lack of a tax revision since 2015-16. Legal complexities associated with new methods of property tax calculation further hindered revenue collection for the BMC in the 2023-24 financial year.

The BMC currently imposes a 2% late fee on delayed property tax payments each month, which adds up to an annual penalty of 24%. Given that this amount can be burdensome for taxpayers, the civic body has submitted a proposal to the state government requesting a reduction in the late fee by 1%.