Mumbai, Jan 31: Reliance Communications Ltd (RCOM) had informed stock exchanges in March 2025 that its suspended director Punit Garg, who was recently arrested by the Enforcement Directorate (ED) in the Rs 40,000-crore alleged bank loan fraud case, had permitted the sale of its subsidiary company’s assets in an unauthorised manner. Corporate filings show the company had approached the National Company Law Tribunal (NCLT), Mumbai, over a potentially fraudulent overseas transaction during Garg’s tenure.

The ED on Thursday arrested Garg in connection with the alleged Rs 40,000 crore bank loan fraud and money-laundering case involving RCOM’s group entities. The case, being investigated under the Prevention of Money Laundering Act (PMLA), is separate from the ongoing insolvency proceedings before the NCLT, officials said.

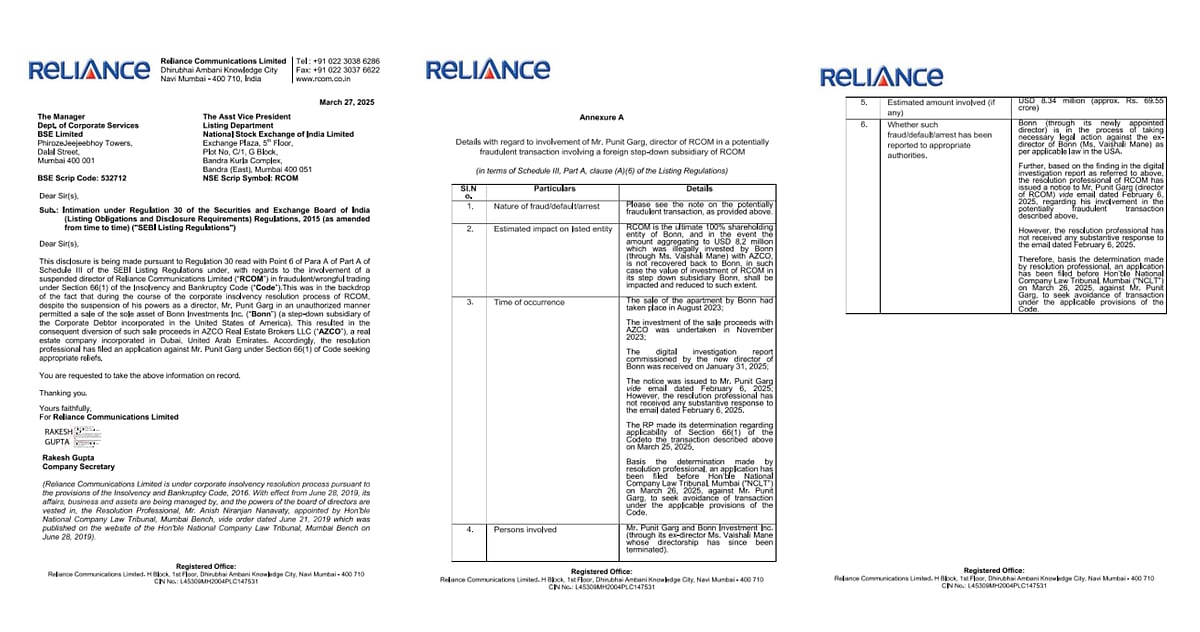

In its SEBI disclosure dated March 27, 2025, RCOM said its resolution professional filed an application under Section 66(1) of the Insolvency and Bankruptcy Code (IBC) concerning a transaction involving Bonn Investments Inc, a US-based step-down subsidiary. The filing alleged that Garg, despite being a suspended director during the insolvency process, authorised the sale of Bonn’s sole asset in August 2023. RCOM is the 100% shareholder of Bonn Investments.

The proceeds from the sale were subsequently invested in Dubai-based AZCO Real Estate Brokers LLC in November 2023 without company approval. The resolution professional has sought NCLT intervention to reverse the transaction and grant appropriate reliefs under the IBC. The alleged diversion involves an estimated USD 8.34 million (around Rs 69.55 crore), and the company said the transaction, if not reversed, could directly impact its investment in the overseas subsidiary.

Garg held several key positions in RCOM over nearly two decades. He served as a president handling the company’s Global Enterprise Business between 2006 and 2013, and later as President of Regulatory Affairs from 2014 to 2017. In October 2017, he was appointed Executive Director of RCOM, and subsequently served as a non-Executive Director from April 2019 until April 2025.

The matter involving Garg surfaced after a digital investigation report, commissioned by Bonn’s newly appointed director, was submitted on January 31, 2025. Based on the findings, the resolution professional of R-COM issued a notice to Garg on February 6, 2025, seeking an explanation for his alleged role in the transaction.

RCOM said no substantive response was received. “Based on the determination made by the resolution professional on March 25, 2025, an application has been filed before the Hon’ble NCLT, Mumbai, on March 26, 2025, seeking avoidance of the transaction and appropriate reliefs under the applicable provisions of the Code,” the filing stated.

RCOM added that Bonn, through its newly appointed director, is also in the process of initiating legal action in the US against its former director Vaishali Mane, whose directorship has since been terminated and who is alleged to have been involved in executing the investment of the sale proceeds.

Reliance Communications has been under corporate insolvency resolution since June 28, 2019, following an NCLT order, with management vested in the resolution professional and the powers of the board of directors remaining suspended.

Also Watch:

In the Rs 40,000-crore bank loan fraud case, the ED has alleged that Garg was a key accused, involved in the acquisition, concealment, layering, and diversion of “proceeds of crime” generated through the alleged bank fraud.

To get details on exclusive and budget-friendly property deals in Mumbai & surrounding regions, do visit: https://budgetproperties.in/