Ravi Varanasi, head of business development at NSE talks to Free Press Journal's Jescilia Karayamparambil and R N Bhaskar about the way forward.

Edited Excerpts:

What are the challenges faced while dealing with SMEs?

The initial reluctance from most of these SMEs is a challenge. For them, the idea of raising capital from equity market is like a cultural shock. They weren’t even aware quite often that they could raise capital from the market and get listed. Initially, we had to convince them that such a platform existed.

On the one hand, we were persuading entrepreneurs. On the other hand, we started working with merchant bankers, as most large merchant bankers were reluctant.

These merchants bankers did not see opportunity in doing much business with SMEs and their cost structure is such that they did not think they could make money out of this market.

So, we created a new set of merchant bankers by approaching all merchant bankers recognised by SEBI. In the past, we managed to get around two-three merchant bankers who were willing to look at SMEs. But now we have 24 merchant bankers with most of them working exclusively with SMEs.

The balance sheets of most of these SMEs needed to be worked on – as many promoters treat their personal and company finances as common resources.

They keep running the show as a family business. It took time for us to convince them to bifurcate the two. We put them across to a merchant banker or chartered accountant who could help them clean up their balance sheets.

There is a lot of hand holding that takes place in such cases. We actually introduce three-four merchant bankers to the entrepreneur and we ask them to choose, whoever they want to work with. Once that is done, SMEs learn to sit with their merchant bankers to get their paperwork right.

Initially, NSE emerge did face some difficulty with merchant bankers too, but now there are enough who are willing to work with SMEs.

Did NSE work towards creating a merchant banking segment for the SMEs?

Yes, we had to work towards achieving it. First, we worked with the entrepreneurs, then with the merchant bankers and the last leg of this chain, which is far more complicated, is to woo investors to this platform. In the case of investors, we are still struggling to get them on board. They took some time to invest.

Initially, high-net-worth individuals (HNIs) and family offices, started showing some interest. We have seen interest from foreign portfolio investments (FPIs) and mutual funds as well. But again, people are developing cold feet about investing in SMEs due to the prevailing market conditions.

By and large, the struggle still continues. But we have been able to get enough number of investors for our 200 listed companies. First three years, we had only handful of investors.

From 2015-2016 onwards, we have seen a significant offtake. However, there was a slowdown in investments post second half of 2018-2019. Even the main IPO market is not really doing very well.

Why do SMEs shy away from getting listed? Is that they do not need finance or is it that they do not want to dilute their shares?

In fact, SMEs need finance and they are starved of finance—debt and equity. They cannot raise any more funds maybe because they have hit the debt to equity ratio and whatever little they have is completely leveraged. If these SMEs want further debt, they will have to infuse equity which they may or may not be able to bring in.

Initially, there is some amount of reluctance over losing control as most of these companies are run by first generation or second generation entrepreneurs who lack understanding about markets. But once they realise the potential of the market to raise capital, these SMEs move pretty fast.

What impact do you expect on SMEs with the government’s proposed minimum public float of 35 per cent? There are talks of the proposed minimum public float being repealed.

On this issue, discussions are taking place with SEBI. There are some concerns that are being raised by the promoters and institutional investors.

At present, there are about 2.8 crore investors in the market. Over time, if this 2.8 crore figure goes up to 10 crore, you need to create investment avenues for these investors as well.

The one rationale behind this move by the government is that more and more investors like mutual funds, individual investors and FPIs are coming into the market.

This shows that demand side is picking up, so you need to increase the supply side as well. Other than this proposed regulation, it is important to list new companies as well.

This proposed regulation may not be repealed. It is just that it will take time to be implemented, as such things cannot take place overnight. At present, deliberations are underway.

Which is easier for promoters – access to public or private funds?

The core SME sector is not receiving equity funding from anywhere. The trouble is that Private Equity (PE) firms are not investing there. PEs are investing in some of the fashionable areas.

But the core SME sector —comprising units that are based in tier II and III cities or the manufacturing sector—is hardly getting any Venture Capital (VC) or PEs funding.

SMEs are able to raise funds through NSE Emerge and there is no other way they can raise funds. Most of the funding comes from raising debt. Unfortunately access to bank loans is also limited. There is a huge shortage of capital for SMEs, especially in the manufacturing sector. The manufacturing sector is facing difficulty.

During the awareness programmes (organised by NSE throughout the year), we meet many SMEs in clusters. Once they get over their initial fear, they are quite excited about the idea of raising capital from market.

How many new SMEs you plan to add to the platform?

We have around 80-90 SMEs in the pipeline. Right now, most of them are avoiding the markets due to market conditions. Once the market conditions start to improve, we think a lot of listing will start taking place.

How much have the listed SMEs raised?

They have raised around Rs 3,126 crore. At present the capitalisation is around Rs 12,000 crore. But it has dropped to Rs 9,000 crore because around 20 companies have migrated to the main platform.

There are some that are eligible for migration but they are not moving. We are of the opinion that unless they have a need for raising further capital they should not move. The NSE Emerge platform is created for SMEs and in the main market they might just get lost.

How are firms from manufacturing sector doing?

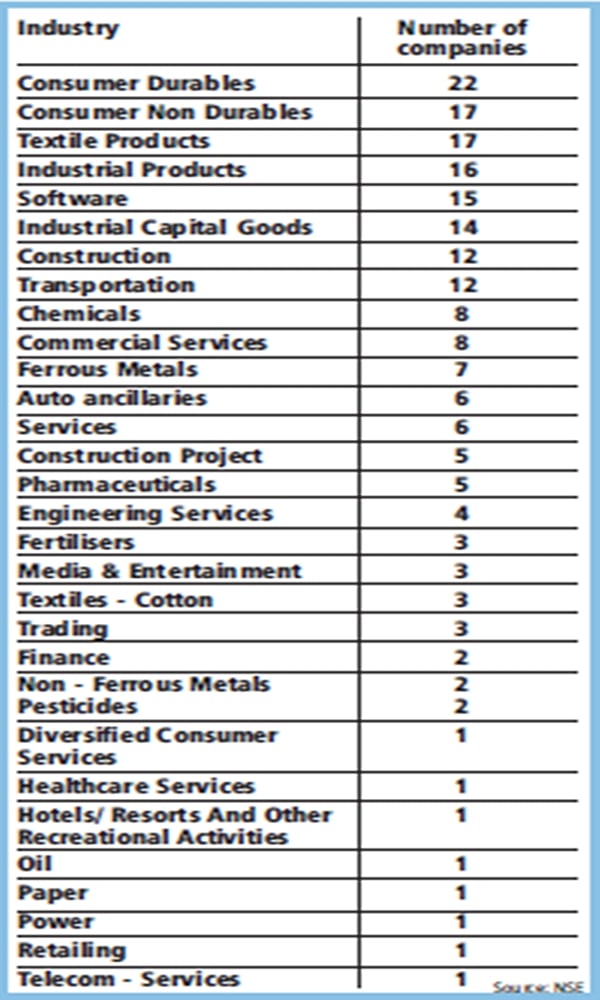

Initially, our focus had been the manufacturing sector. We wanted more manufacturing firms to come on board. Over a period, we relaxed this rule and allowed other sectors to come on board.

Have any SMEs delisted themselves?

No, we have not seen any de-listing. We have only seen migration to the main board.

Do you have a wishlist for the government?

Firstly, we request for tax breaks which will be useful for SMEs. For example, the government can waive the securities tax for SME-listed stocks.

That will get brokers interested. Another suggestion is to waive minimum tax on long-term capital gains as far as SME stocks are concerned. That will allow for a surge in investor’s appetite.

Secondly, on SME platform, the minimum application size is Rs 1 lakh. SEBI wanted to ensure that retail investors do not get into SME type of companies which is still in a growth phase.

It is essentially for larger investors, who are accredited and understand market risks involved. Such screening processes are good. But our suggestion to SEBI is to reduce the trading lot over a period. That helps in building the liquidity in the shares of the companies and will help many more companies.

NSE Emerge has signed MoUs with eight states. Is every MoU different or are all along similar lines?

We have reached out to a large number of states. But state governments sometimes move pretty fast, sometimes they take a lot of time. We have been approaching the state governments for creation of funds and reimbursement of a part of issue expenses.

While the latter is happening faster; the former, due to its complexity, is slow. Fund creation is far more complicated. Once the state government invests around 10 per cent of the issue, that will act as an endorsement. It gives confidence to other investors to invest.

Initially, we paid for the due diligence that was carried out by Crisil and Care Ratings on prospective SME companies that wanted to get listed on our platform. We never asked any SME to pay, because we knew that many would be reluctant to pay the money ratings agencies charge.

When we went to investors, they said they want due diligence done by large rating agencies. So we hired these agencies. Over and above the presence of merchant bankers, the due diligence done by top rating agencies helps build investors’ confidence.

Will such deals for investment not be possible with the union government?

The areas where we are looking for support lie within the state governments’ jurisdiction. However, the way we working with state governments, we will be happy to work with the union government too. We did meet SME ministry officials earlier, but there has been no discussion.

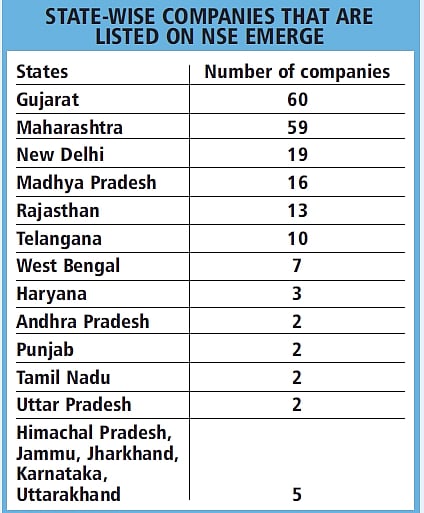

The state governments with whom we have signed MoUs have given grants to SMEs who have raised capital. A small portion of the issue expense have been reimbursed by the state governments. States like Gujarat, Rajasthan, Bihar and Punjab, have done this.

These states are reimbursing around 10-20 per cent of the issue expenses subject to a ceiling (it can be Rs 5 lakh or Rs 10 lakh). It is good for the entrepreneur.

Has NSE been able to monetise this platform?

The SME platform is nascent and we do not think we will start making money right away. However, as these SMEs grow over a period of time, they will migrate to the main board and there we can make money. At present, the idea is to make SMEs comfortable with the market.