Indore (Madhya Pradesh)

The Input Tax Credit (ITC) can be blocked only if the authority has strong proof and legal reason that the input credit availed by the concerned taxpayer in his credit ledger is related to tax evasion or as per the rules, is ineligible, so in such cases, the tax payers or its consultant can get the proof and reason from the concerned officer. It is the right of the taxpayer.

The action of blocking the ITC can be carried out only by the GST authorities, commissioner or any assistant commissioner level officer authorised by the commissioner. Tax payers must keep this point in mind.

Tax experts said this in a workshop organised jointly by Commercial Tax Practitioners Association (CTPA) and MP Tax Law Bar Association. The subject of the workshop was ‘ITC blocked by Department: Ways and Means’.

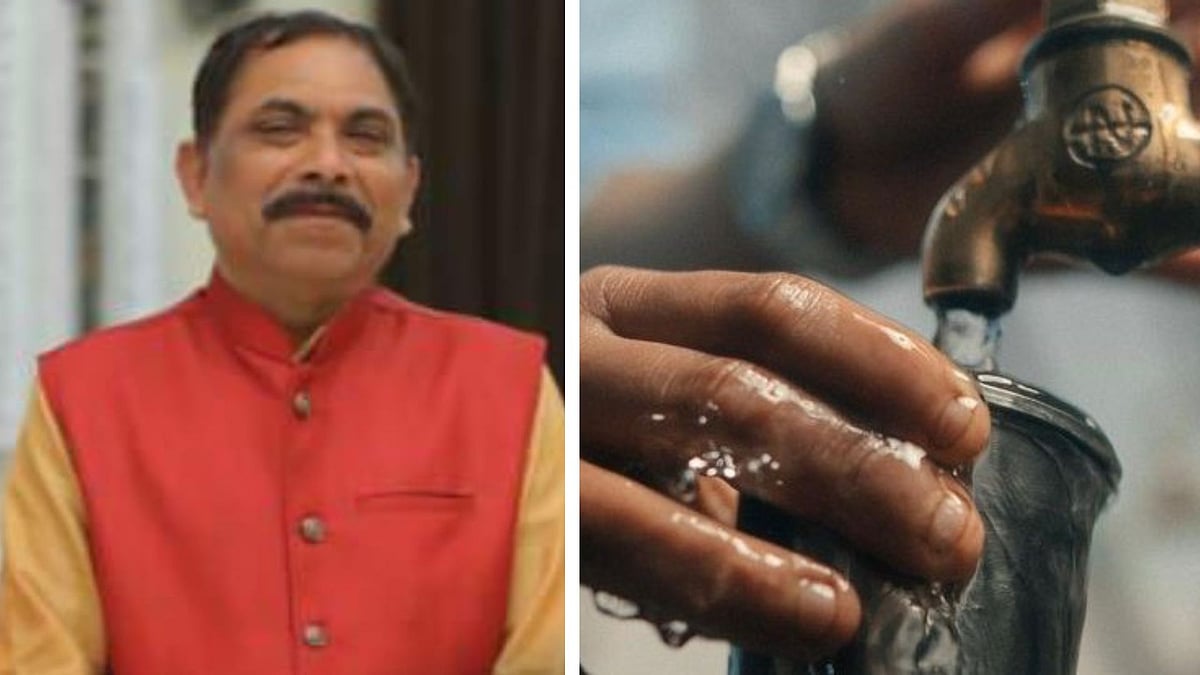

State GST Commissioner Lokesh Kumar Jatav was the guest of the honour and director of State GST NS Maravi was special guest.

The key note speakers were tax consultant Amit Dave and CA Sunil P. Jain. Tax

consultants Kedar Heda, president of MPTLBA Ashwin Lokhotia and former

president of CTPA Yashwant Lobhane welcomed the guests.

Key note speaker of the session and senior tax consultant Amit Dave threw light on the various aspects of the ‘ITC Blocking’. He made it clear that under the provision mentioned in rule 86A, when, why, how

and to what extent the action can be taken to block ITC by the department.

Tax payers are partners of Govt in development

Lokesh Kumar Jatav, State GST Commissioner, while praising the working and objectives of both the tax-organisations said that there is a link between all tax advisors, CAs and advocates, businessmen and departments, without whom the target of revenue collection is impossible. He described the taxpayers as the government's partners, who are making an important contribution towards the strong economic development of the nation and the state.

.jpeg)