For every parent, providing their child with the best education is of paramount importance, especially as education plays a major role in shaping the child’s career. However, with education costs rising rapidly, parents must ensure that they have the necessary corpus to facilitate your child’s education. This can be made possible by investing in the right instrument.

In light of Children’s Day, take a look at how you must invest for your child’s future. While there are several investment options like fixed deposits, mutual funds, government schemes for children, and more, it is important to remember some simple rules of investing to maximise the returns. Read along to know how to invest, without having to make any compromises.

Invest as early as you can

Ideally, you must start investing for your child as soon as you plan to have one. This is to say that when it comes to investing for children’s education, there’s no such thing as it being too early. Investing for a long period allows you to benefit from the power of compounding interest, giving you a better chance at accumulating a substantial amount. Moreover, doing so ensures that you don’t have to dip into your savings or your retirement fund to finance an educational course.

Determine the amount you will require

If you are investing while your child is extremely young, you may wonder how you should determine the amount that you need. This is fairly simple. As most parents prefer enrolling their children in private schools, find out the annual cost today, and then determine the future value by taking into account the rate of inflation. Currently, education inflation amounts to around 7% in India.

Do the same for higher education courses to determine the total amount you need. If you’re unsure of what your child would like to study, err on the side of caution. You can benchmark the amount you will need, against the most expensive courses, so you don’t end up facing any shortage. Also take into account costs for transport, extra-curricular activities and hobbies. Once you know how much you need for primary education and higher education, allot these goals timelines so you know by when you need to accumulate the amount.

Choose your investment instruments smartly

The instruments that you should invest in will depend on how much time you have to achieve your goals. Short-term funds, for instance, are ideal if you have only a handful of years to invest. On the other hand, if you’re investing early, you can rely on safer instruments to grow the amount steadily over time. While Systematic Investment Plans are a good option for the long-term, another one is a fixed deposit.

This is a safer alternative as its returns are guaranteed, and not linked to the market. By choosing a reputed FD you can be sure of receiving the amount you need on time. For instance, Bajaj Finance Fixed Deposit carries the highest ratings from ICRA and CRISIL as well as S&P Global’s -BBB rating. This means that you will get the amount due to you, on time and in full.

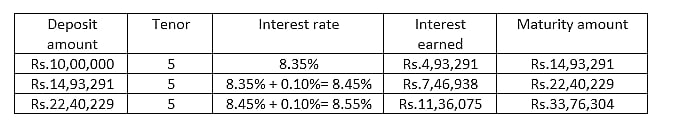

Moreover, investing in an FD doesn’t mean compromising on returns. Bajaj Finance offers competitive FD interest rates of up to 8.35% to regular customers and 8.70% to senior citizens when you take an FD for at least 3 years, with interest payable at maturity. By opting for this payout option, you can accumulate the amount you need comfortably. Here’s how: Assume that you invest Rs.10,00,000 for 3 consecutive terms of 5 years each. Each time you reinvest, you get an extra 0.10% interest.

By staying invested for a long tenor, you can multiply your wealth for your child’s education substantially. In fact, you can use a fixed deposit calculator to determine your returns before you invest.

Apart from the auto-renewal facility that you can opt for at the time of booking an FD, you can also make use of the multi-deposit facility. Here, you can open several FDs of varying amounts, tenors and payout frequencies via a single cheque and invest for other aspects of your child’s future just as easily. Best of all, you can invest as little as Rs.25,000 and even avail a loan against your FD amounting to Rs.4 lakh if you ever need funds for an emergency. With a book size of over Rs.16,000 crore and a customer base of 2.5 lakh customers, Bajaj Finance’s FD is truly one of the best in the market.

What’s more, you can start investing for your child right away, courtesy of the Bajaj Finance Online FD booking process. Simply fill a short online form to authorise an executive to call and guide you with the investment steps.

Please note: This is partnered content.