The share of Zee Entertainment Enterprises zoomed almost 10 per cent on NSE (National Stock Exchange) after Punit Goenka resigned from the post of MD (Managing Director) of Zee Entertainment Enterprises.

The shares of Zee Entertainment Enterprises rocketed up almost 10 per cent touching the day-high level of Rs 126.19, after hitting the opening bell at Rs 119.75 per share. The stock opened with a surge of 3.76 per cent Rs 4.35 per share on the bourse.

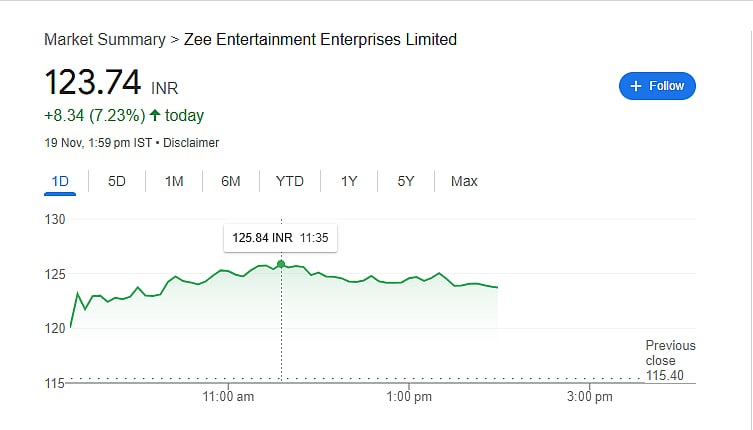

The stock was currently trading around Rs 123.74 per share on the NSE (National Stock Exchange), surging about 7.23 per cent amounting to Rs 8.34 per share on the Indian Bourses.

Company's Exchange Filling

Punit Goenka will remain the CEO and devote all of his attention to the operational duties that the board of the company has delegated to him.

The board has 'accepted the resignation of Punit Goenka as Managing Director of the Company and appointed him as CEO,' according to a regulatory filing from Zee Entertainment.

The terms of Goenka's appointment state that he will receive the variable portion of his salary upon reaching a specific milestone.

Zee exchange filling

Zee Entertainment Enterprises Q2 FY25

Following cost reductions, Zee Entertainment Enterprises (ZEEL) reported a net profit of Rs 209.4 crore on Friday for the second quarter of the fiscal year (Q2 FY25), up 70.2 per cent year over year (Y-o-Y).

Compared to Rs 2,437.8 crore in the same quarter last year, the Mumbai-based company's revenue fell by nearly 18 per cent to Rs 2,000.7 crore.

Zee Entertainment Enterprises EBITDA Q2 FY25

Entertainment giant's earnings before interest, taxes, depreciation, and amortisation were Rs 109.1 crore, a 16.8 per cent year-over-year decrease. It claimed that lower programming and technology expenses were the main causes of the drop in operating costs.

ZEEL's other revenue fell 53 per cent year over year to Rs 33.7 crore. Other income climbed by 77.4 per cent on a sequential basis.