Nifty, Bank Nifty Outlook

Nifty 50 closed at its lifetime high level on Friday (August 28). It closed at 16,990 up by 55 points after making a high of 16,722. Volumes in Nifty were lesser than its average volumes which brings in a possibility of a correction. Nifty has strong support in 16,550-16,580 range. The trend in Nifty remains bullish and any correction can be used to buy with strict stop loss.

Nifty50 |

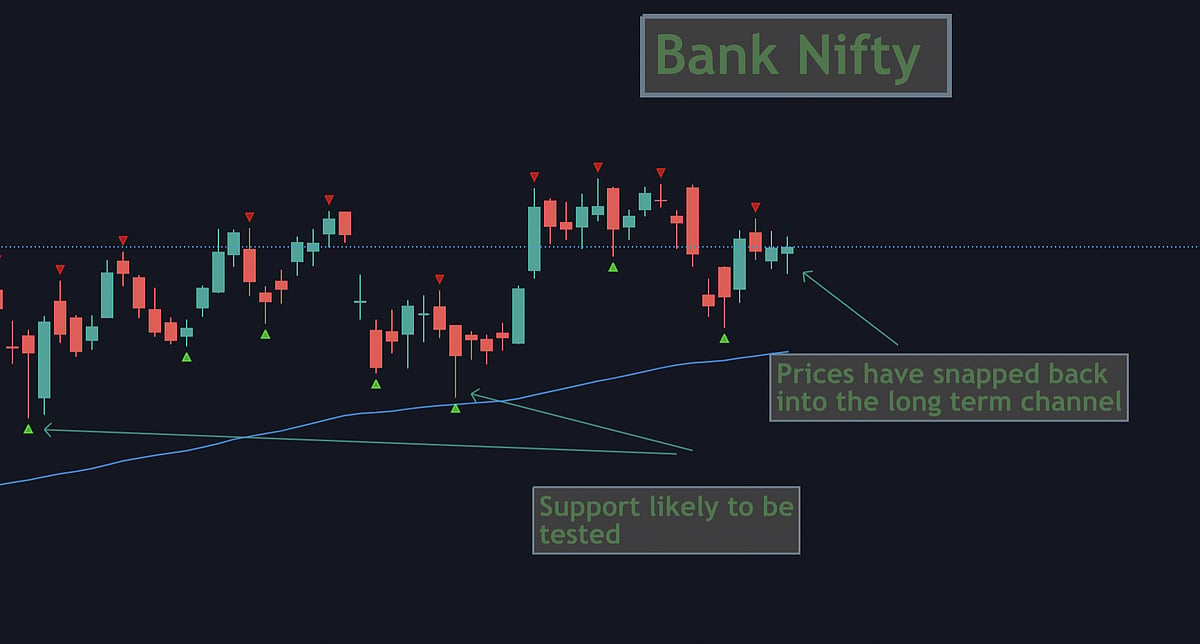

Bank Nifty has snapped back into its long term consolidating range and the sentiment is sluggish and we expect it to be slightly bearish, it would find good support near the 34,100 level which provide some downside cushion.

Bank Nifty |

Nifty FMCG

The FMCG sector has been going from strength to strength over the past 2-3 weeks now, it shows how investors are flocking to this sector in times of stretched valuations and so much uncertainty. Most companies in this sector have done very well and moreover are grounded in great fundamentals, we expect the bullish trend to continue in this sector.

Nifty FMCG |

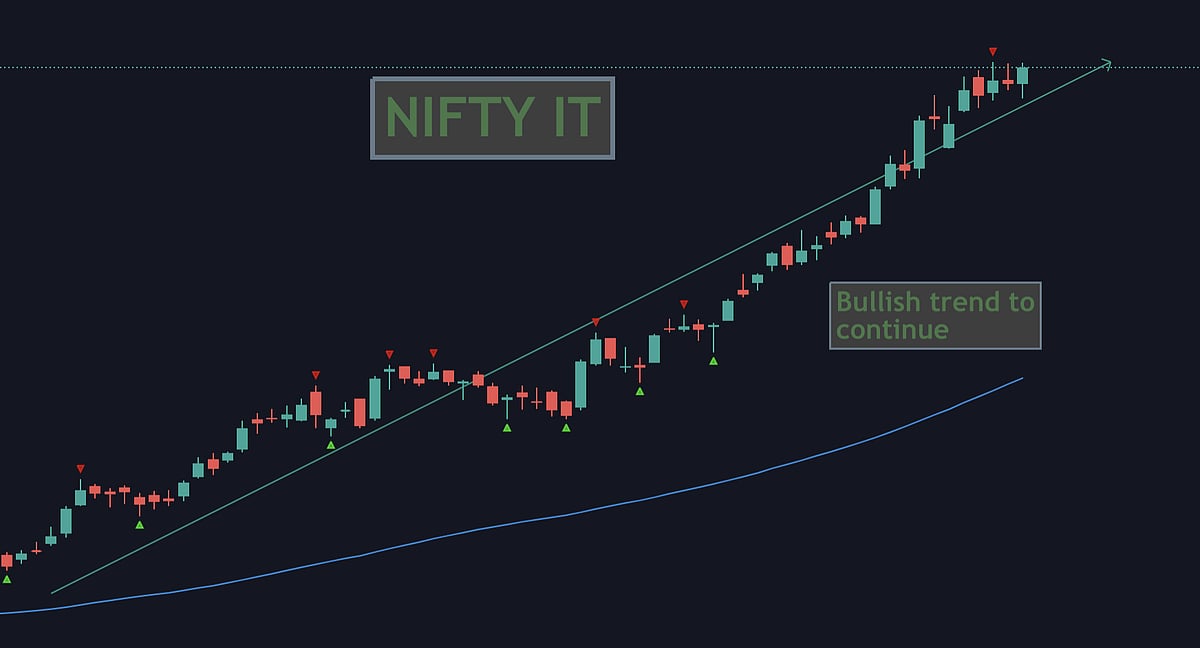

Nifty IT

Just like the FMCG sector, IT too has benefited greatly from the ongoing pandemic and has proven to be a safe haven of sorts for investors, on the bed of great fundamentals and clear guided growth trajectories of companies, this sector is poised to do really well over the coming weeks.

Nifty IT |

Nifty Pharma, Nifty Auto

Just like last week, we maintain a mildly bearish stance on both these indices as the charts look weak.

Derivative Outlook

Nifty current month future closed with a premium of 9 points to its spot. Next month's future is trading at a premium of 32 points.

We saw open interest addition of nearly 9.9 percent in Nifty and considering the price action it clearly hints strong buying during the week.

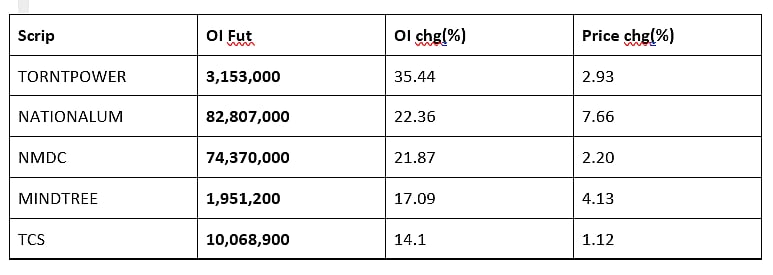

Long Formation:

The following stocks saw OI build up with a corresponding increase in price, suggesting a bullish sentiment.

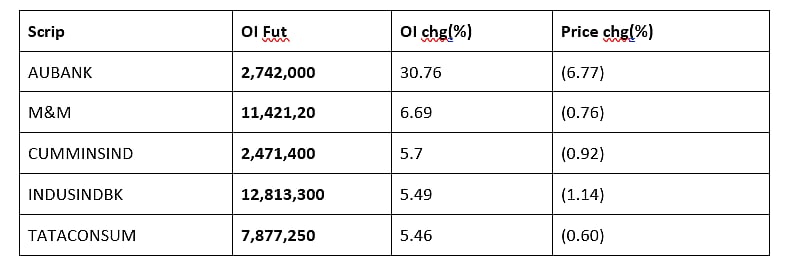

Short Formation

The following stocks saw OI build up with a corresponding decrease in price, suggesting a bearish sentiment.

(Gaurav Udani is Founder & CEO of Thincredblu Securities. He tweets @Udanii)