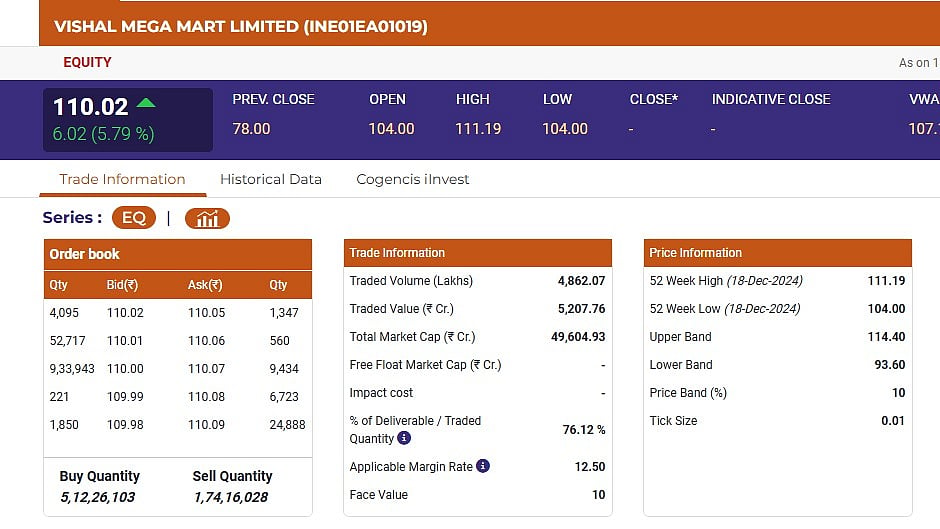

Retail hypermarket chain Vishal Megamart debuted on exchanges today, December 18 , when its shares were listed on the NSE at Rs 104 each, representing a 33.33 per cent premium over the issue price of Rs 78. The stock went on to touch the day high level of Rs 111.19 per share.

Listing gains on per lot

The strong listing was advantageous to investors who purchased IPO shares as well. Retail IPO investors had to bid at least 190 shares. Investors in the Vishal Megamart issue who were given at least one lot at the NSE listing price would have received Rs 4,940 for each lot.

The single lot was valued at Rs 14,820 (190 x Rs 78) at the issue price and Rs 19,760 (Rs 104 x 190) at the listing price.

Share performance

The Vishal Megamart shares were trading at Rs 110.02 per share on the NSE (National Stock Exchange) with a surge of 5.78 per cent amounting to a Rs 6.02 per share on the Indian exchanges, at the time of writing.

Vishal Megamart IPO Details

Subscription across all categories

Bids were made for nearly 87.4 crore shares, booking the retail limit 2.31 times, compared to the 37.83 crore shares set aside for the category.

The Non-Institutional Investors (NIIs) applied for nearly 231 crore shares out of the 16.21 crore shares reserved for them. The NIIs section had 14.25 reservations.

1,745.85 crore of the 21.62 crore shares that were allocated to Qualified Institutional Buyers (QIBs) were put up for auction. Eighty-seven times the QIB quota was booked.

IPO size and structure

The Vishal Mega Mart IPO comes with the entire offer-for-sale (OFS) of 102.56 crore shares. There is no fresh issue component included in the issue.

For the category of Qualified Institutional Buyers, Vishal Mega Mart has reserved 50 per cent of the net offer amount. Individual retail investors have received up to 35per cent of the net issue from the company, with 15 per cent going to the Non Institutional Investor (NII) category.

Price band and minimum bid

In Vishal Mega Mart's initial public offering (IPO), shares are priced between Rs 74 and Rs 78.

Retail investors needed to apply for the offer with a minimum lot size of 190 shares, amounting a total investment of Rs 14,820. For a total investment of Rs 2,07,480, Small Non Institutional Investors (sNII) were required to bid on a minimum of 14 lots, comprising of 2,660 shares. For Rs 10,07,760, Big Non Institutional Investors (bNIIs) needed to apply for 68 lots, comprising of 12,920 shares.