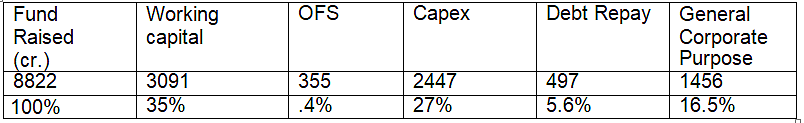

The Indian stock market has seen a remarkable surge in Small and Medium Enterprise (SME) IPOs, with 242 companies raising an impressive ₹8822 crore in the past year. While this growth appears encouraging, a closer look reveals that 35% of these funds (₹3091 crore) were raised specifically for working capital, prompting concerns about transparency and fund utilization.

All Values in Cr.

Source: Finavenue Analysis with DRHP reports sourced from SME and BSE Exchange

The Basics of Working Capital

Working capital refers to a company’s short-term liquidity, calculated as the difference between current assets (such as cash, receivables, and inventory) and current liabilities (like payables and short-term debt). Efficient working capital management ensures smooth business operations, but excessive allocation toward working capital may indicate inefficiencies or mismanagement.

Potential Red Flags: Misuse of Working Capital

While working capital is essential, it is also one of the most manipulated financial metrics. Some questionable practices include:

Overstating Receivables: Companies might show inflated sales figures or delayed payments from customers to project a higher need for working capital.

Undisclosed Diversions: Funds earmarked for working capital may be diverted towards personal gains, speculative activities, or non-core business ventures.

Inventory Mismanagement: Companies might overstate inventory levels or delay inventory write-offs to justify excessive working capital requirements.

Such practices undermine investor confidence and can lead to financial instability or defaults.

Key Indicators of Strong Financial Management

Investors should conduct thorough due diligence to identify companies with sound financial practices. Here’s what to look for:

Scrutinize Financial Statements: Look for consistency in reported numbers across income statements, balance sheets, and cash flow statements. Discrepancies or sudden spikes in working capital requirements should raise red flags.

Assess Working Capital Ratios: Metrics like the current ratio, quick ratio, and working capital turnover provide insights into how efficiently a company manages its short-term assets and liabilities.

Check Auditor Notes: Pay close attention to the auditor’s report for any qualifications, concerns, or irregularities flagged in the financials.

Industry Comparisons: Compare the company’s working capital requirements with industry peers. An unusually high percentage allocated to working capital might indicate inefficiencies or potential manipulation.

Management Transparency: Companies that openly discuss their financial practices and provide detailed breakdowns of fund utilization often inspire greater confidence.

When Does Working Capital Funding Make Sense?

While excessive working capital requirements can be a red flag, there are valid scenarios where additional funding is justified:

Seasonal Businesses: Companies operating in industries with seasonal demand (e.g., agriculture or retail) may require additional working capital to manage inventory and operations during peak seasons.

Unutilized Capacity: Working capital funding is justified when a company has unutilized capacity, and additional working capital can activate operating leverage. By examining fixed asset turnover and comparing it with peer benchmarks, investors can gauge whether the working capital usage is fair and aligned with the company's operational potential.

Rapid Growth Phases: Businesses experiencing exponential growth often need extra liquidity to scale operations, manage supply chains, and meet heightened demand.

Economic Downturns: In challenging economic conditions, additional working capital can help companies maintain stability and protect against unforeseen disruptions.

Conclusion: Invest Wisely, Stay Vigilant

The recent SME IPO boom highlights both opportunities and risks for investors. The ₹3091 crore allocated to working capital in recent IPOs underscores the need for careful scrutiny. Investors must look beyond the surface numbers, assess financial health rigorously, and remain cautious about potential red flags.

India's SME sector holds immense promise, but responsible investing requires vigilance. By prioritizing thorough research and sound financial assessment, investors can protect their wealth while contributing to sustainable economic growth.

Mr. Abhishek Jaiswal,

Fund Manager, Finavenue