New Delhi: French energy giant Total SA as well as oil-to-telecom conglomerate Reliance Industries are unlikely to bid for acquiring India's second biggest oil refining and marketing company BPCL, while UK's BP plc said it wants to see what is on offer before deciding to bid.

The government is looking at selling its 53.29% stake in BPCL to a strategic investor in the biggest privatisation bid in the history of India. BPCL has a market capitalisation of Rs 1.05 lakh crore and its acquisition together with the mandatory open offer to minority shareholders would cost upwards of Rs 82,000 crore.

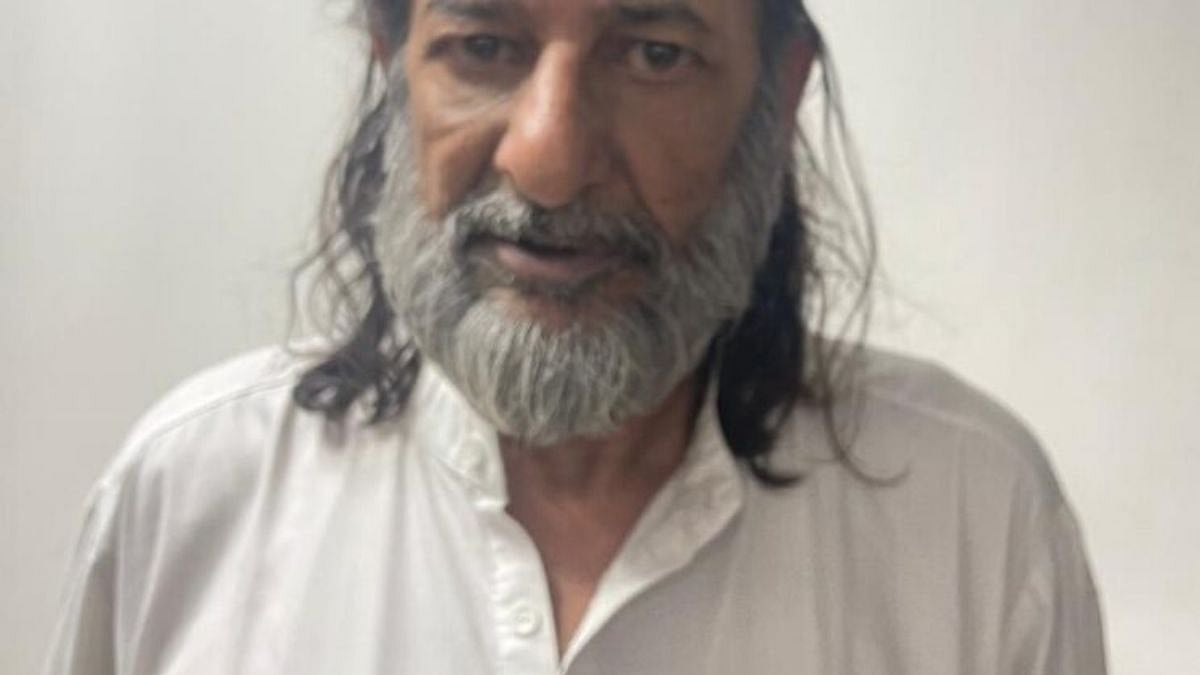

On a visit here to attend an industry conference, Total Chairman and CEO Patrick Pouyanne said the company was interested in investing in downstream petrochemicals and retailing market in India but was "not interested in Indian refineries".

The French giant announced buying 37.4% stake in Adani Gas - which retails CNG to automobiles and piped cooking gas to households besides developing import terminals and a national chain of petrol stations.

Reliance, which operates the world's biggest refinery complex at single site, too is unlikely to bid as it is already in talks to sell out a fifth of its oil-to-chemicals business to Saudi Aramco to cut down high debt it had taken for its foray in telecom business, sources said.

It is unclear if Saudi Aramco, which is keen to enter the world's fastest growing energy market, will bid alone or with some other partner such as Abu Dhabi National Oil Co (Adnoc).