With India’s steady rise in FD rates, you should consider investing in a fixed deposit. 2022 market movements have been favourable for investors, and if you consider this instrument, now may be the right time to invest. Choosing the Bajaj Finance Fixed Deposit, one of the top instruments, can help you lock in a generous FD rate and earn handsomely all through the tenor. Based on the investor profile and other beneficial features, Bajaj Finance recently issued an FD rate hike and now offers interest rates up to 7.35% p.a.

Bajaj Finance Fixed Deposit offers exclusive special interest rates for all its customers on notable tenors like 15, 18,22,30,33 and 44 months. The additional rate applies to fresh deposits opened and renewed after 25th April 2022.

Due to the rising inflation and the increased cost of living, it is wise to inject stability into your portfolio and safeguard your hard-earned savings from erosion. You can do just that with this FD and also access special provisions. For instance, with digital tools like the online FD calculator, planning your investment becomes easier as you can accurately forecast your returns. Read on to understand better how the Bajaj Finance Fixed Deposit interest rate hike can help you work toward your financial goals.

Get a lucrative FD rate on your fixed deposits

With Bajaj Finance offering an interest rate of up to 7.35% p.a., you don’t have to worry about negative returns. Whether you’re looking to invest toward a specific goal, build a retirement corpus, or combat inflation, this FD is a viable choice. Note that the FD rate offered will vary based on your investor profile and the tenor you choose. Investors below the age of 60 get up to 7.10% p.a., whereas senior citizen investors get an additional 0.25% p.a.

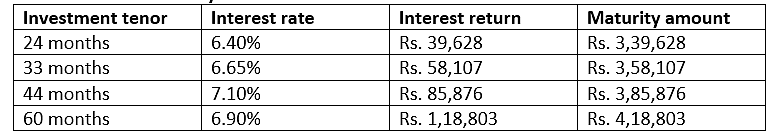

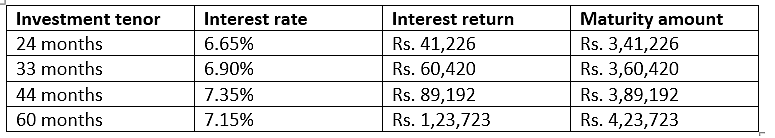

Refer to these tables to get a better idea of what you can expect to earn.

Consider a cumulative FD of Rs.3 lakh over varied tenors.

For investors below 60 years:

For senior citizens:

Disclaimer: The above values presented in both tables are indicative and computed using an FD calculator.

Achieve your short-term and long-term goals

Fulfilling specific aspirations such as sending your children for higher education or planning an extended overseas vacation will require a sizable amount of funds. You can build the necessary corpus efficiently by investing in a fixed deposit for such goals. It is an efficient way to achieve short-term and long-term goals, especially considering that Bajaj Finance allows you to avail a great FD rate across all tenor options.

Bajaj Finance offers tenor options ranging from 12 to 60 months, and you can invest flexibly as per your goals. What’s more, Bajaj Finance offers special FD rates on cumulative FDs for specific tenors. The FD rate can increase to 7.10% and 7.35% for non-senior and senior citizen investors, respectively, for 44 months. Use the Bajaj Finance FD Calculator to forecast earnings accurately and plan effectively. You get quick, error-free results, and this data is crucial to making the right investing decisions.

Start small and build a healthy corpus systematically

The minimum deposit to open a fixed deposit with Bajaj Finance is Rs. 25,000. So, you don’t have to build a large corpus and can start your investment right away. Bajaj Finance offers the Systematic Deposit Plan (SDP) facility for investors looking for more flexibility. Here, you can invest Rs. 5,000, or more, every month, and each contribution books a new FD.

You can either opt for a single or Monthly Maturity Scheme with the SDP. In a Monthly Maturity Scheme, interest payouts are made every month, and the tenor for each new FD booked will remain constant. Whereas with the Single Maturity Scheme, the interest earned is paid on a single date, at maturity, and the tenor for each new FD gets adjusted accordingly.

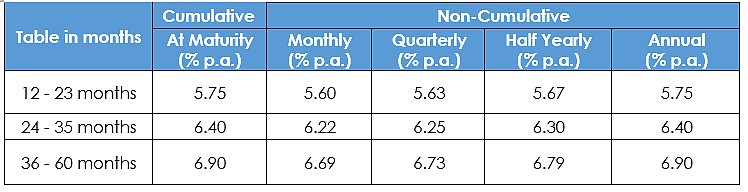

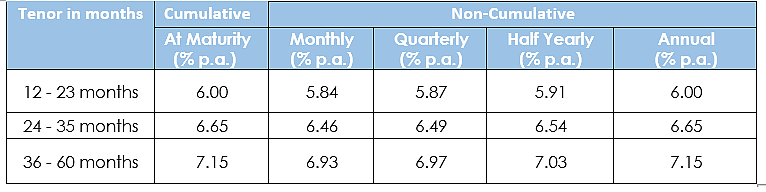

For all investments up to Rs. 5 crore, the FD interest rate offered by Bajaj Finance for various tenors is:

For customers below 60 years of age:

For senior citizens:

Invest freely with a secured fixed deposit

Fixed deposits, by nature, are one of the safest investment options. It is especially true for the Bajaj Finance FD as it has the highest credit ratings from leading agencies. It is rated FAAA/Stable and MAAA/Stable by CRISIL and ICRA, respectively. As such, you can invest freely without worrying about default or losses.

Combined with these features, the FD rate hike offered by Bajaj Finance makes this FD one of the best options in the market. To start your journey today, invest online in minutes by simply filling out a form and paying via net banking or UPI. Book your FD today and build your wealth steadily.