During the ongoing Coronavirus pandemic, many suffered job losses, adverse business conditions, and falling of the economy. The economy as a whole is impacted, Jobs are vanishing day by day, daily expenses are increasing rapidly, saving is going down and businesses are getting closed. But at the same time, the stock market is reaching its new height. Stock prices are going up even though the economy of the whole world is falling.

The performance of India’s stock markets in recent weeks has proved, yet again, that there is little connection between what happens to the real economy and how investors bet on shares.

Hence today we will discuss why the stock market is booming as compared to low economic activity.

Supply and demand

Like other commodities, the price of a stock is decided by the supply and demand of the stock. If demand is high then the price would rise or vice-versa. Also, Any favourable news can move the stock price up and any negative news can become the reason for the falling of the price of such stock.

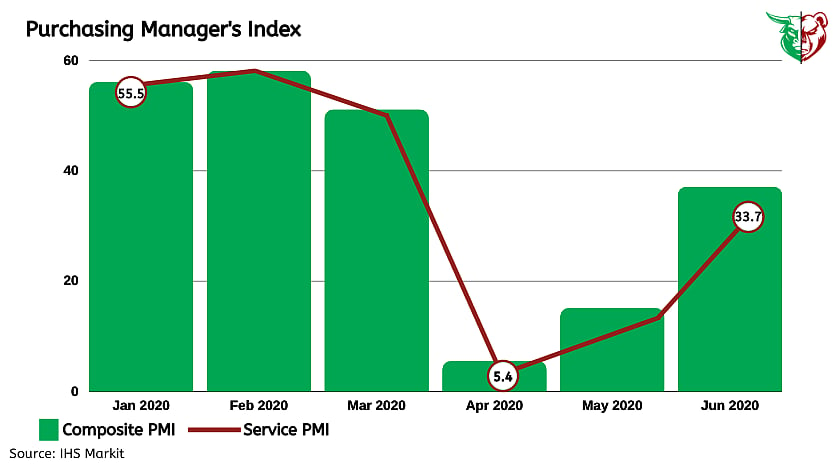

The recent data from IHS Markit reported that the Services PMI in June rose to 33.7 from 12.6 in May, indicating a pick-up from the previous month, although any reading below 50 on this survey-based index shows contraction. It stood at a record low of 5.4 in April. The PMI for manufacturing was better at 47.2 in June.

Market sentiments

If the majority of traders in the market made a particular perception regarding any company then its stock would behave based on market sentiments. For example, an investor may believe that it is a good time to invest in a company like say, Britannia Industries.

Because the demand for biscuits may go up, one buys shares of Britannia. In such cases, the share price of Britannia Industries can go up.

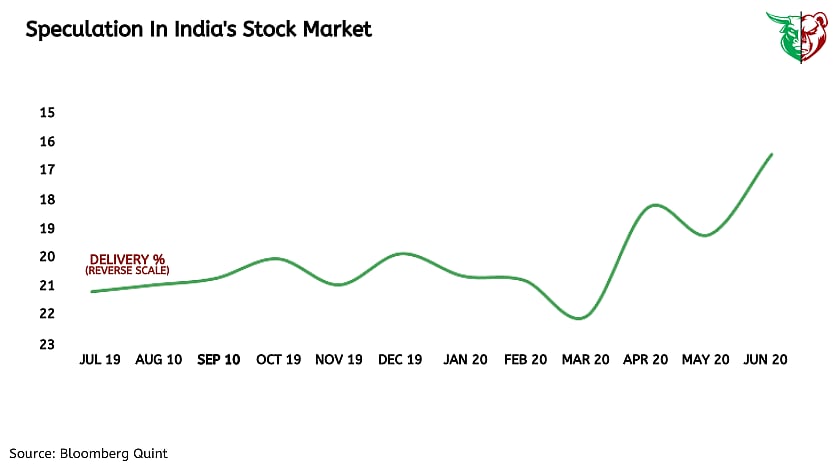

Therefore sometimes it is the speculation because of which the market bounces up.

Management Commentary

Management commentary plays an important role in the sustainability of any corporation in the long run and that's why it affects the price of the stock. In this current pandemic, if the management says that the company is witnessing demand, as usual, sales numbers are encouraging and does not see the coronavirus impacting the growth momentum than the stock price is bound to rise.

Another example is to imagine if Mukesh Ambani becomes the director in any listed company then the price of its stock would rise as a result of strong personnel in the management board.

Good Financial Performance

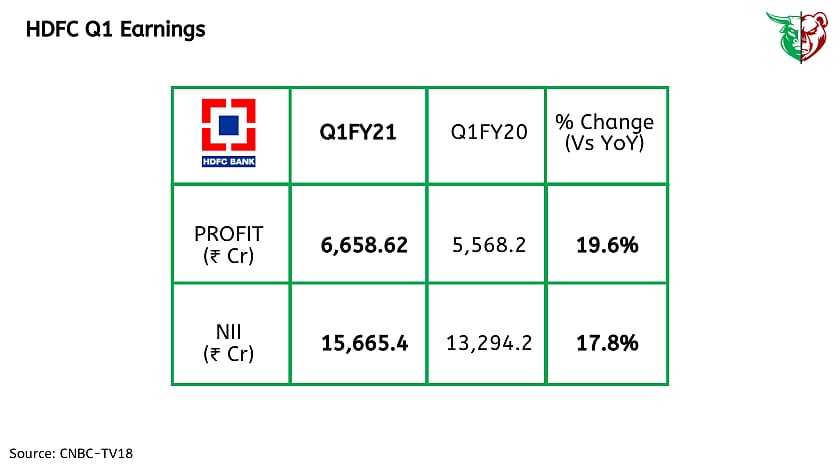

The financial performance of any listed company plays a crucial role in the movement of the stock price. If a company publishes profits then the price of such would rise and if it does not perform better and incurred losses then the price of such stock would fall.

For e.g look at HDFC Bank's Q1FY21 earnings. The stock price surged from Rs 1,098.45 to Rs 1,152.90 on the back of strong financial performance and management commentary which reflected a pickup in demand.

Economic Factors

Economic factors also play an important role in determining the price of the share. Economic factors include interest rate changes, financial outlook, and inflation.

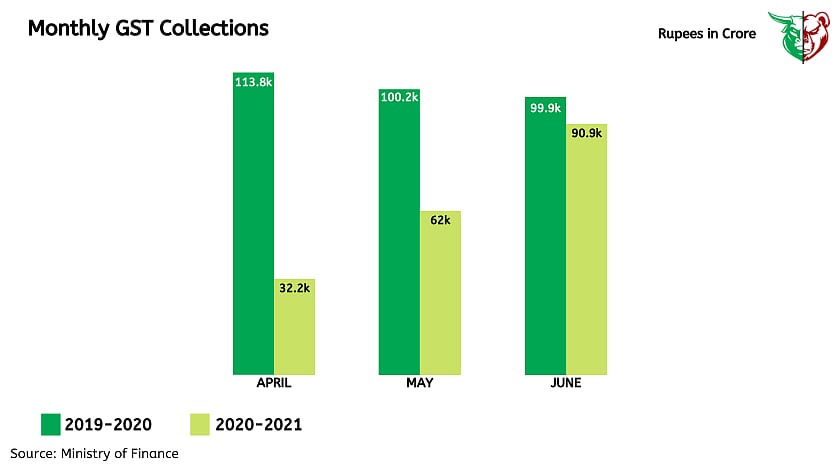

E.g. look at the recent June GST figures. June collections looked impressive, almost 46% higher than May, which in turn was 92% higher than April. Thus, the data shows that business is picking up which is a big positive and the Government would hope to continue with this trend.

Teji or Mandi?

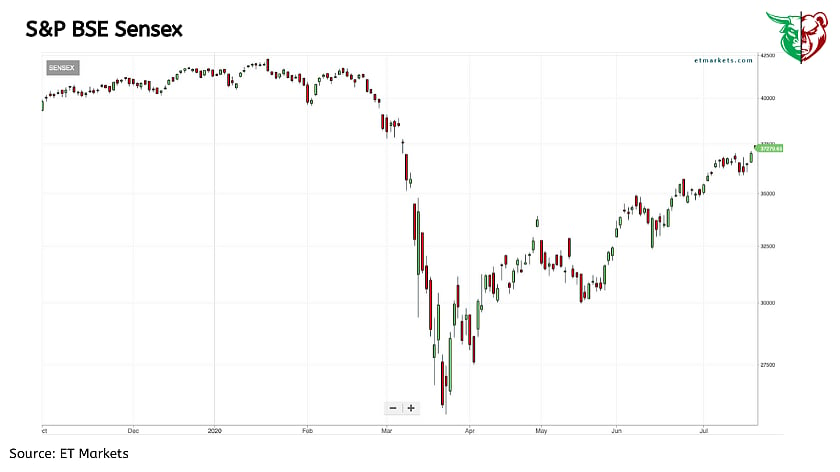

In the stock market, it is said that the market discounts everything. The stock market comes to know much before about the economic conditions of the country or the world at large and the same is reflected in the stock prices. The stock market already knew that the spread of coronavirus will be huge and will affect the economies so if you look the market started to fall from February which was a month before the nationwide lockdown which began on 24th March.

Thus our take is Teji as looking at the market scenario we believe that the normalcy will return soon and green shoots are visible in the economy in terms of increase in GST collections, Start of Q1FY21 earnings season with a bang with companies back with growth guidance, the pick up in the service and manufacturing data and strong inflows from Foreign Institutional Investors which reflects positive outlook.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research