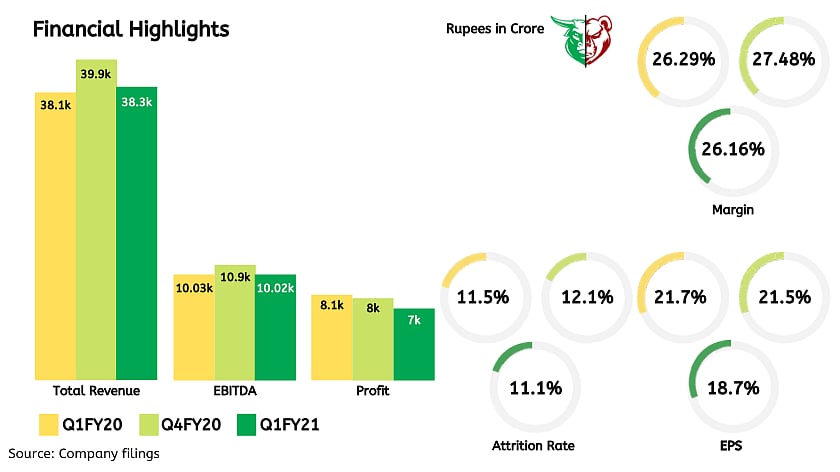

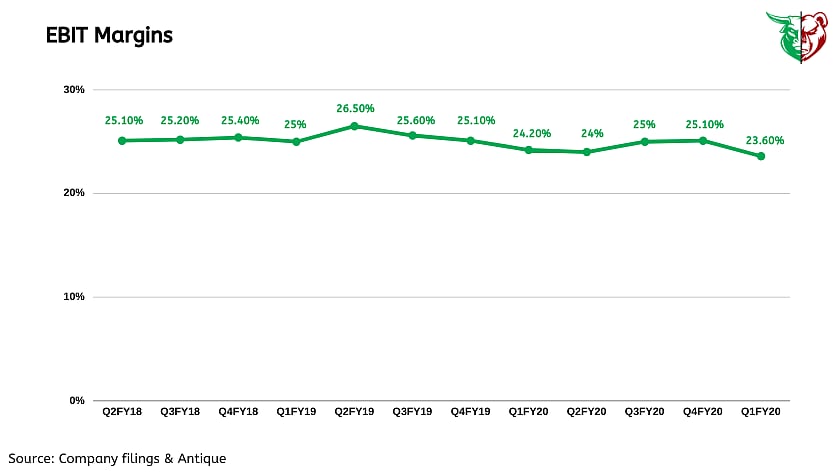

TCS reported a weak quarter, missing estimates in the first quarter of the Financial Year 2021. Revenue in constant currency terms fell ~7% since last quarter and 6.3% yearly. As a consequence, EBIT margins dropped by 150 bps despite the benefits from rupee depreciation. TCS also adopted overall cost rationalization measures like cutting General & Administrative and travel expenses.

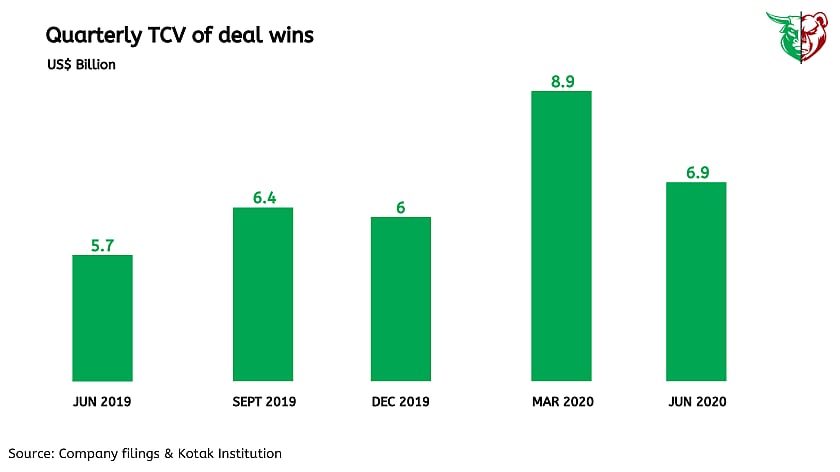

Strong deal wins

TCS’ deal wins at USD 6.9 bn were stronger than the historical average and grew 21% yearly. The first quarter deal wins were polarized, as it had a few large deals on top and some smaller deals; however, the deal pipeline has a good mix of large and small deals. Management sees strong demand for Cloud migration and opportunity for large scale hybrid and public cloud adoption. Transformation programs that were paused have started resuming. Many customers have fast-tracked some large transformation programs. Digital transformation and Cloud services pipeline is at the highest levels in the past many quarters.

The impact of pandemic is largely behind

During the conference call, the management highlighted that the impact of the pandemic played out broadly in line with the expectations and growth impact has bottomed out during the first quarter, and expect to see sequential growth from the next quarter onwards. Margins declined by 150bps sequentially led by a decline in revenues due to Pandemic; the company expects margins to improve gradually as growth picks up.

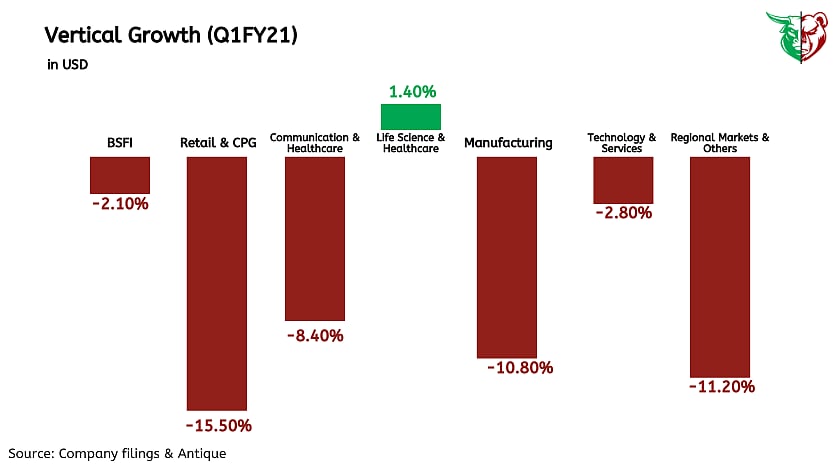

Broad-based weakness, with a decline in Communications too

USD revenue declined ~7% in constant currency terms yearly, with retail (-15.4%) and manufacturing (-10.7%) being key areas of weakness. BFSI (-2%) and Life Sciences (+1.4%) showed the expected resilience, but Communications (-8.3%) was surprisingly weak due to some media clients. Management sounded cautiously optimistic about a recovery in BFSI in the second half, especially in the US, and indicated some market share gains in European manufacturing. Pipeline related to digital infra/cloud migration deals remains strong in the first quarter.

From Management's desk

TCS indicated that the global economic growth outlook is uncertain. Swift response by governments and central banks will drive faster recovery compared to GFC. TCS indicated better traction in many clients shifting to digital business models. TCS indicated a good outlook for continental Europe and is cautiously optimistic about the US on specific verticals such as healthcare and banking. TCS believes the revenue impact of the pandemic has bottomed out in the first quarter. Strong client relationships and trends of clients depending more on technology for business needs will drive growth recovery.

Downward factor

Double-dip recession in a major market, the US, and a prolonged slowdown in Europe

Sharp cross-currency movements and weakness in the rupee

Pricing pressure

Lower margins

Issues relating to H-1B Visas

Teji or Mandi?

As India's largest and oldest IT services firm, our take is Teji for TCS as it is well-positioned to benefit from the growing demand for offshore IT services. Considering its greater experience than peers in implementing large, complex, and mission-critical projects, the company is a serious contender for large deals. A portfolio of turnkey services offerings, traction in emerging markets, ability to roll up, improving sales and marketing prowess, and willingness to take multiple big bets (different go-to-market models) are among the key drivers that should help TCS sustain its hi-growth trajectory in the long run. Also, the management intends to keep the payout ratio at 80-100% of the free cash generated.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research