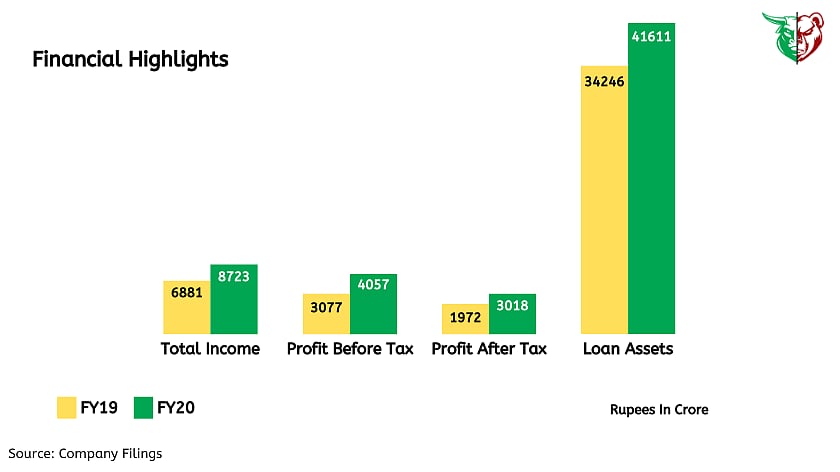

Muthoot Finance, the country's largest gold financing company in terms of loan portfolio reported robust growth in profitability (60% YoY) as well AUM (22% YoY) in the fourth quarter of the financial year 2020. The Net Interest Income (NII) grew by 30% YoY led by improvement in margins; while earnings before tax grew by 38% YoY led by lower provisions (down 76% YoY). Lower provision as asset quality improved as well as management expects no further requirement of provisions for COVID -19 due to the gold loan business model. Stage III loan assets declined by 38bps QoQ to 2.16%, however, NPA is never a cause of concern in the gold loan.

What the management has to say

The branch opening was important and by April end most of the branches got open and the functioning is back to normal. Initially, there was a rush of people to come to pay the loans and take back their gold but now in the last 3-4 weeks, more people are coming to take loans. So, the advances are going up and the losses suffered in April and May are expected to come to normal levels by July in terms of interest collection or loan growth.

The management said small MSMEs who need quick money have surged. They are coming in big numbers and taking loans to restart their business.

On Margins

The Net Interest Margins (NIMs) has declined by 115bps QoQ to 15.8% due to lower overdue interest collections during the quarter. Similarly, spreads have also declined to 14.7 % vs 15.4% QoQ. The management said that if the cost of borrowing comes down, it will be passed on to the customers as lending rates offered by Muthoot are reasonable compared to other NBFCs.

Focus on tonnage growth needs to follow rising gold prices

It has been observed in the past that during a phase of rising gold prices, gold loan acceleration is driven initially by higher gold prices, followed by tonnage growth, with a lag. There are 2 reasons –(1) benefits of expansion efforts of the gold loan companies that may drive meaningful volume growth over time and (2) retail behavior to increase gold monetization may see a lag.

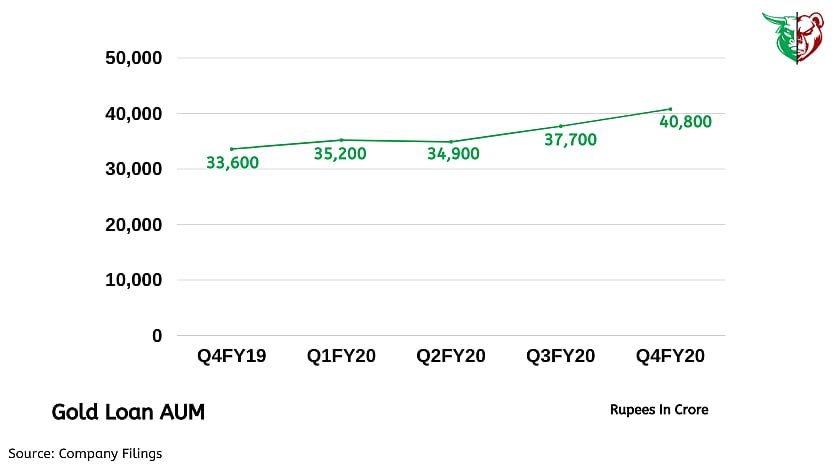

Rally in gold prices and relative liquidity easing drive strong growth in AUM

Muthoot reported a 22% YoY increase in gold loans in the last quarter of the financial year 2020, highest since the third quarter of the financial year 2013. This is driven by a sharp rise in gold prices. The average ticket size increased by 23% YoY in the financial year 2020.

Competition intensifies, but Muthoot tops the chart

Amid muted demand and rising stress in other retail and MSME segments, most banks and NBFCs have started to focus on gold loans. Catholic Syrian Bank, Bajaj Finance, Shriram City Union Finance, and other digital fintech players have ramped up focus on the gold loan segment. Muthoot with its extensive pan-India footprint, expertise, a high share of repeat customers, and strong brand visibility is well-placed to deliver strong growth over the next few years.

Performance of subsidiaries

Muthoot’s subsidiaries, engaged in microfinance, housing finance, and auto loans, contribute ~11% to overall AUM for Muthoot Finance. However, Asset quality is likely to deteriorate in MFI and affordable housing finance as the underlying customer segment is relatively more vulnerable to business disruptions due to Covid-19.

Teji or Mandi?

As COVID-19 has impacted the economy at large, near term risk for Muthoot includes a sudden dip in gold prices, increased competition from banks, and inability of branches to handle customers while long term risks constitute the inability to succeed into new lending products and forced conversion to the bank.

However, our take is Teji for Muthoot Finance because post 2018 IL&FS crisis, the availability of unsecured loans has become difficult due to tighter credit standards and ill health of many NBFCs. While this improves the competitive positioning of a healthy NBFC like Muthoot Finance, strength in gold prices improves the recall of gold loans.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://blog.tejimandi.com