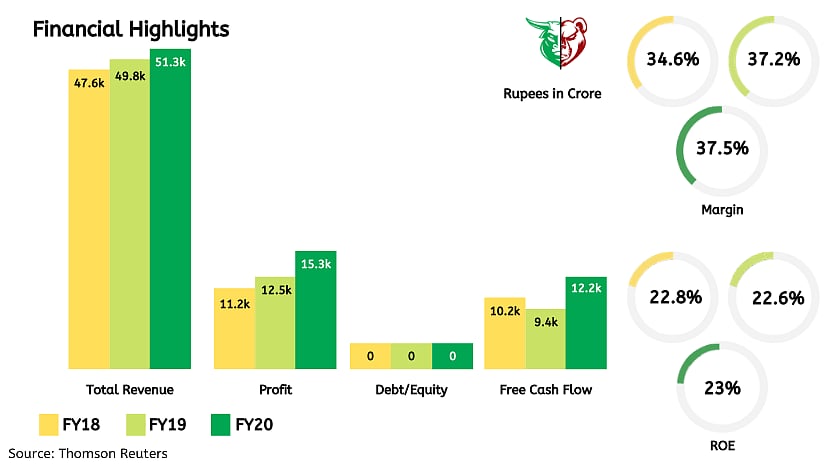

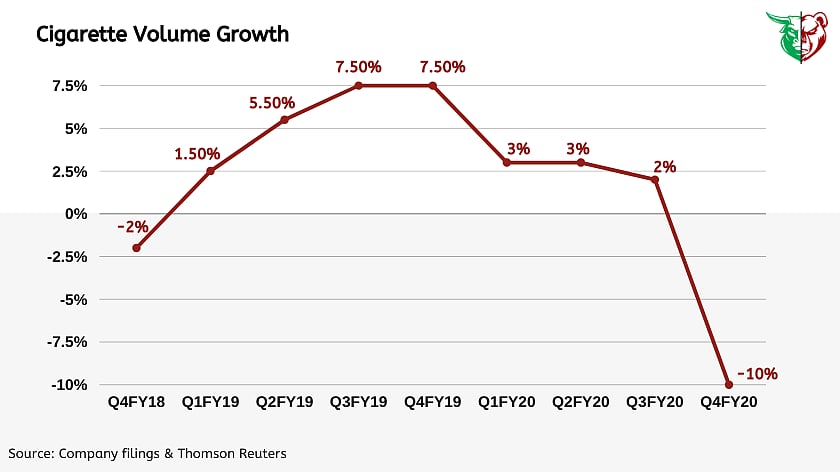

ITC’s last quarter of the Financial Year 2020 cigarette volume declined by ~10% was disappointing for the street. Whereas, 160bps margin expansion for Financial Year 2020 in FMCG business was a big positive. Although the first quarter of Financial Year 2021 is likely to show significant pressure due to washout in April across Cigarettes and Hotels business, we expect high growth in FMCG due to strong traction in Biscuits, Atta, Noodles, and personal hygiene products. Cigarette volume is likely to improve gradually while FMCG businesses is expected to performing well.

Teji Mandi

Cigarette volume declined primarily due to the lockdown

The cigarette division’s sales/EBIT declined 7%/12%, indicating a ~10% fall in volumes and loss in market share. January and February showed a marginal rise in cigarette volumes but were hit in the second half of March due to the lockdown. Sales resumed from the second week of May and recovery looks stronger than expected. Cigarette manufacturing plants are operating at 100% capacity now and sales and marketing operations are at 85%. ITC seems to be in a stronger position as compared to peers due to its better distribution network, which should drive share gains.

Teji Mandi

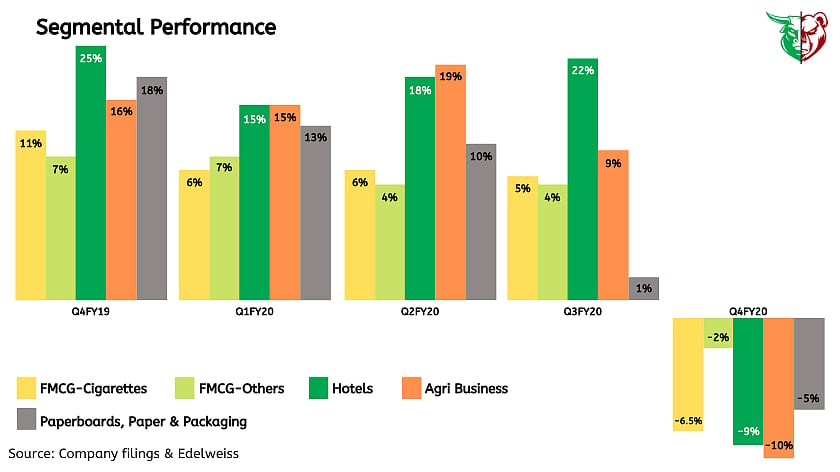

FMCG business resilient but other businesses reported subdued performance

FMCG business did relatively well considering the environment, registering a growth of 5% since last year on a comparable basis. Health & Hygiene along with the food portfolio should help ITC’s FMCG portfolio continue to do well in the first quarter of the Financial Year 2021 as well. The hotel business was severely impacted by COVID-19-led lockdowns, registering a revenue dip of 8.6% since last year. Considering the lockdown situation, we expect this business to continue to remain impacted. Agri and paper revenues were also impacted as well and were down 10% and 5% since last year. The education and stationery products business lost the peak month of March due to the closure of educational institutions.

Teji Mandi

Downward factor

Exposure to regulatory risk in the cigarette business

The slowdown in the macro-economic environment is a major threat to hotels' business.

Specified Undertaking of Unit Trust of India (SUUTI) stake sale to put pressure on ITC

Teji or Mandi?

ITC’s results were overall good with a fall in cigarette volume of ~10%. Cigarette volumes are back to pre-COVID levels towards the end of June, indicating that the recovery has been sharper than expected. This also puts to rest the fear that lockdown could induce behavioral change in smokers and they might decrease or quit smoking.

ITC’s FMCG business has shown good operating profitability in Financial Year 2019 onwards and we expect that trend to improve going ahead.

While the first quarter of the Financial Year 2021 will be hit due to the lockdown, our take is Teji due to the stronger recovery and share gains across cigarettes vertical and upside coming from the growing FMCG portfolio.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research