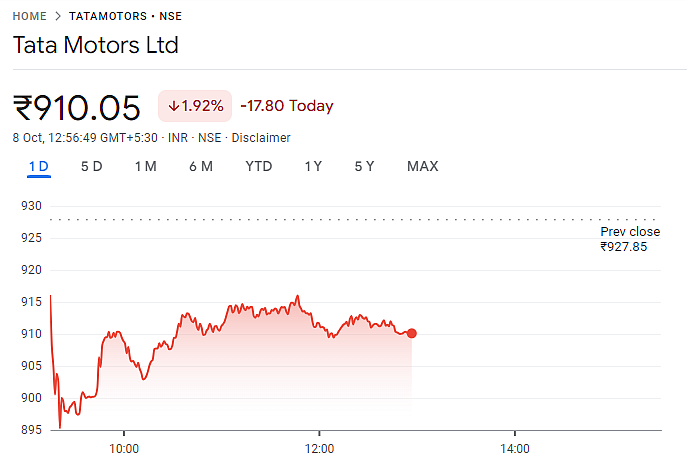

The shares of Tata Motors on Tuesday (October 8), fell 3 per cent in the morning trade. The decline in the share price of the company was in response to the significant drop in Jaguar Land Rover’s (JLR) wholesale sales during the second quarter of the financial year 2024-25 (Q2 FY25).

Apart from this, this also marks the second consecutive session of losses for the company, as supply constraints hit production and sales.

Stock Price Movement and Decline

The shares of the company today opened at Rs 918.10 on the BSE, slipping more than 1 per cent compared to the previous close of Rs 928.10.

The stock further tumbled to Rs 893.90, a 3 per cent decline within a few hours of trading. By 9:20 am, the stock was trading around Rs 903 on the NSE.

As of 12:56 pm IST, the company's shares were trading at Rs 910.05 apiece, down by 1.91 per cent.

Share performance |

Jaguar Land Rover's Wholesale Sales Drop 10 per cent

On Monday (October 7), the company announced that that JLR wholesales for Q2 FY25 stood at 87,303 units, marking a 10 per cent year-on-year (YoY) decline.

Similarly, its production segment also got affected with only 86,000 units produced, down 7 per cent YoY.

Representational Image

The company in the exchange filing added that this decline is due to the disruptions in the supply of high-grade aluminium, which is one of the major material for manufacturing, impacting not just JLR but several other original equipment manufacturers (OEMs).

Adding to the woes, around 6,500 vehicles, particularly in the UK and Europe, were placed on temporary hold to allow for additional quality control checks, further affecting the sales numbers.

Retail Sales Also Take a Hit

JLR’s retail sales, which include the Chery Jaguar Land Rover China JV, also declined 3 per cent YoY, totaling 103,108 units for the quarter.