Tata Motors shares are trading with limited gains, after the company announced that its board has approved the issuance of 2 lakh of Non-Convertible Debentures (NCDs). This would raise an estimated Rs 2,000 crore. This move comes ahead of the company demerger slated to happen later this year.

Tata Motors Board Approves NCDs

Recently, the company made it to the news, when it announced that its Jaguar Land Rover (JLR) arm aborted a plan to manufacture cars at a facility in Tamil Nadu. Despite the negative reactions, the company assured investors of the stability of the company.

In order to raise the required resources, the Tata Motors board authorised the issuing of rated, listed, unsecured, fixed coupon redeemable NCDs.

In addition, one of the largest carmakers in the country recently also announced a hike in the prices of its vehicles. This hike would come into picture starting April 2025. | Representative image

The issuance of these NCDs would come to pass in three tranches. At first, the 7.65 per cent Tata Motors 2027 - Tranche I. This would be followed by NCDs, 7.65 per cent Tata Motors 2028 -Tranche II NCDs, and 7.65 per cent Tata Motors 2028- Tranche III NCDs.

Price Cuts In April

In addition, one of the largest carmakers in the country recently also announced a hike in the prices of its vehicles. This hike would come into picture starting April 2025.

Tata Motors is set to revise prices for its passenger vehicles. This would also include electric models. In addition, it has also confirmed a 2 per cent increase for its commercial vehicles.

All these changes would come into effect in April.

Tata Motors Shares

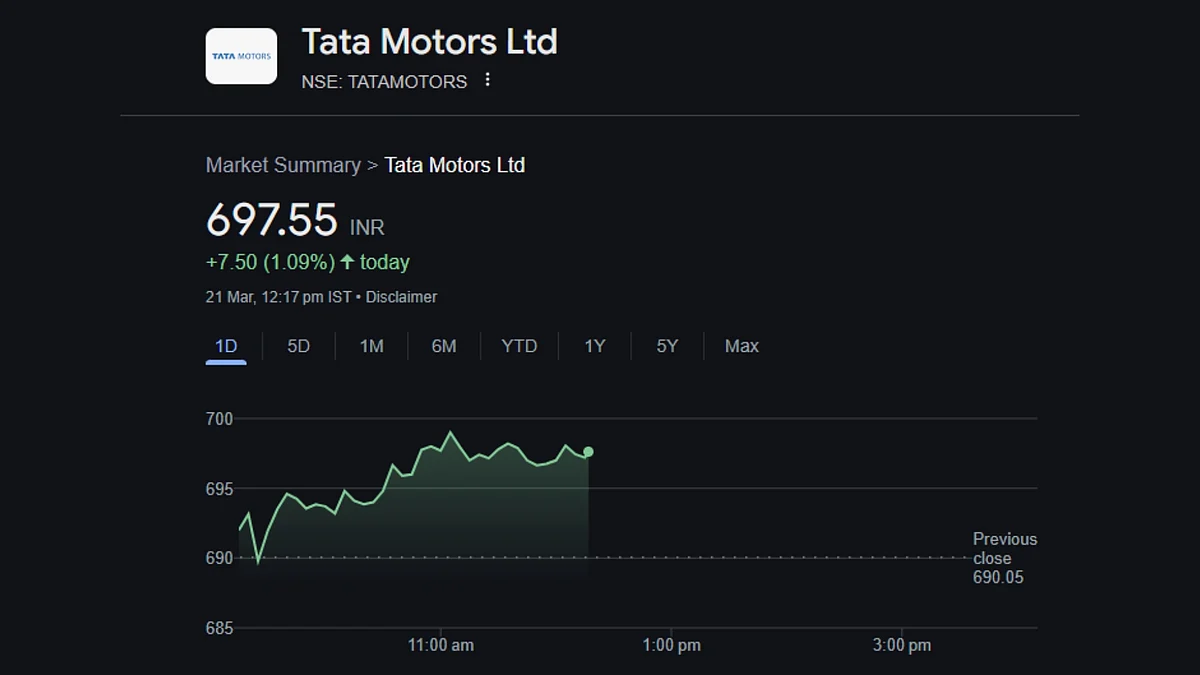

When it comes to the performance of the company stocks, the company shares started the day on a positive note, opening at Rs 693.00 per piece. Thereafter, the company shares only increased in value as the day went forward.

Tata Motors shares, at the time of writing, made gains of 1.09 per cent or Rs 7.50 per share. This took the overall value of the company shares to Rs 697.55 per piece.