Nifty gave a strong bullish move this week and closed up by 3.7 percent near its lifetime high at 17,330.

The major sectors that contributed to the rally were Banking, IT ,FMGC , Pharma and Auto.

The following stocks in Nifty were the largest gainers: Shree Cements , Titan Company , Bharti Airtel , Asian Paints and Eicher Motors. Nifty is currently in its Impulse wave as per Elliott wave theory and will continue making new highs for a few weeks from here.

Nifty Outlook

Nifty made a new all-time high of 17,340 and gave a closing around the same level. September 4 was the second consecutive day when Nifty closed around its high indicating strength in Nifty. Nifty closed at 17,323- up 90 points. Nifty is now headed for 17,375 and 17,400 in the coming few trading sessions.17,200 and 17,280 will act as strong support levels for the Nifty. Traders can consider buying on every correction with strict stop loss as long as Nifty is trading above 17,150-levels. Correction can be used to buy with strict stop loss.

Nifty 50 |

Bank Nifty has broken out of its previous consolidation channel and we expect it to move to higher levels in the coming few trading sessions. It has a strong support in the 35,500 levels.

Nifty FMCG

The FMCG sector has been going from strength to strength over the past 2-3 weeks now. It shows how investors are flocking to this sector in times of stretched valuations and so much uncertainty.

Nifty FMCG |

Most companies in this sector have done very well and moreover, are grounded in great fundamentals. We expect the bullish trend to continue in this sector.

NIFTY IT

Just like the FMCG sector, IT has benefited greatly from the ongoing pandemic.

Nifty IT |

FMCG has proven to be a safe haven of sorts for investors. On the back of great fundamentals and clear-guided growth trajectories of companies, this sector is poised to do really well over the coming weeks.

NIFTY Pharma & Nifty Auto

Just like last week, we maintain a mildly bearish stance on both these indices as the charts look weak.

Derivative Outlook

Nifty current month future closed with a premium of 10 points to its spot. Next month's future is trading at a premium of 30 points.

We saw open interest addition of nearly 1.28 percent in Nifty and considering the price action. it clearly hints at strong buying during the week.

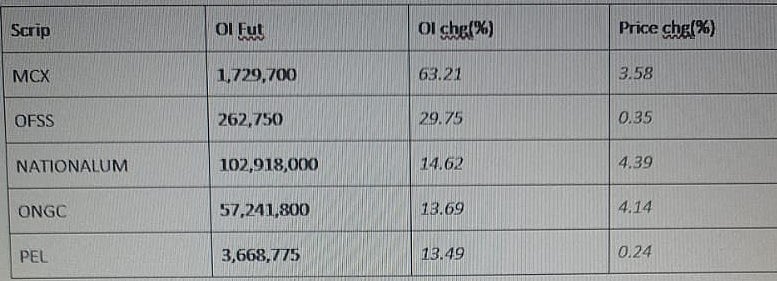

Long Formation

The following stocks saw OI build-up with a corresponding increase in price, suggesting a bullish sentiment.

Long Formation |

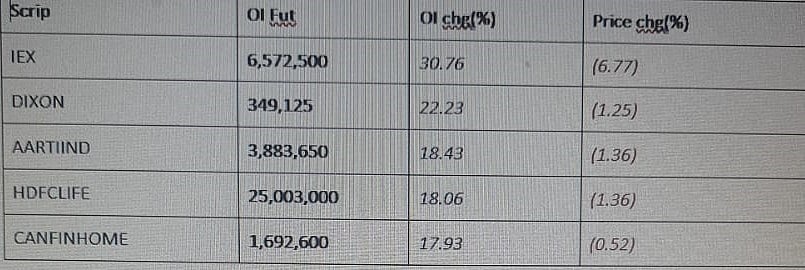

Short Formation:

The following stocks saw OI build up with a corresponding decrease in price, suggesting a bearish sentiment

Short formation |

Top 5 recommendations for the next week

Nestle India

Nestle Industries is in strong uptrend and trading near its previous resistance of 20,325 level. After pull-back it is trading near resistance level. Any sustainable move above 20,343 will bring good upside momentum in the stock.

PI Industries

PI Industries is trading in the range since past two trading sessions and also its at the support level of previous resistance. Above breakout range that is above 3.460 level good upside momentum can be expected.

Infosys

Infosys is trading near its 30 day moving average and formed bullish candle with long lower shadow which indicates bullishness in the stock. Above 1,712-level good opportunity to go long.

RECL LTD

RECL LTD is trading near its important resistance zone on the daily chart. Any sustainable move above 157 level will bring good upside momentum in the stock

Manappuram Finance

Manappuram Finance is trading in the consolidation zone after falling from 214 level to 160 level. Breakdown below 157 level again will see down side momentum.

(Gaurav Udani is Founder & CEO of Thincredblu Securities. He tweets @Udanii)