The bullish sentiment shows no sign of weakness. The markets have broken yet another all-time high and have marched upwards.

We expect this sentiment to continue into the next week.

Both Nifty and Bank Nifty look bullish and have gone from strength to strength over the last week.

Nifty 50 |

Everytime an index or a stock breaks an All time high it is a sign of strength and an investor should always be long in such situations.

We believe that this bullishness will persist over the coming weeks.

Bank Nifty |

Having said this, the valuations are continually being stretched and we have advised our investors to reduce overall allocation to equity.

Nifty FMCG |

The index and this sector has bounced back with a lot of strength this week and has taken support from a very crucial levels of 39,900.

We foresee bullishness in this sector going forward.

Nifty IT |

The IT sector has begun to show signs of aging momentum and we would advise investors to show caution and let the correction play out before allocating funds to this sector.

We continue to remain bearish on both the Pharma & Auto sectors and are waiting for some momentum to believe that bullish sentiment has returned.

Nifty current month future closed with a premium of ~20 points to its spot. Next month's future is trading at a premium of around ~50 points.

We saw open interest addition of nearly 6.87 percent in Nifty and considering the price action it clearly hints strong selling during the week.

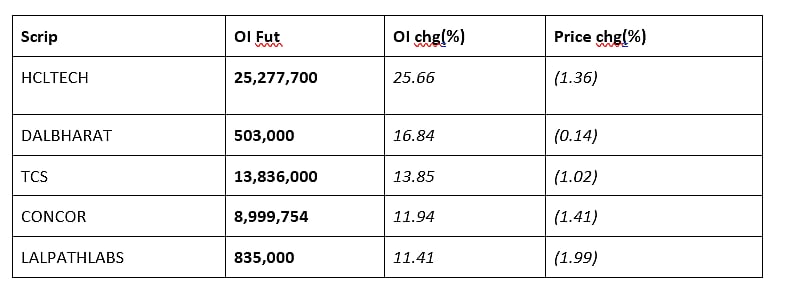

Long Formation |

Short Formation |

Top 5 recommendtions for the week

BEL

BEL is consolidating in range of 213 and 198 level since past four weeks. On weekly time frame it continued to form higher high and higher low pattern formation indicating strong uptrend. Above 214 level good upside momentum can be expected.

AARTIIND

Aarti Industries has been consolidating in a flag like pattern since the past few days and a break above 1132 can bring sustained momentum to this stock

HAVELLS

HAVELLS is trading near its all time high level. Breakout of previous swing high indicates can bring a good rally in the stock. Any sustainable move above 1490 level will present a good buying opportunity.

BAJAJFINSV

BAJAJFINSV is trading near its all-time high level. Breakout of previous swing high level will bring momentum in the stock. Any sustainable move above 18840 level will have a good buying opportunity.

HDFCAMC

HDFCAMC had taken the support from the previous support level indicating bullish momentum from this level can be expected. Above 2965 will be good opportunity to go long.

(Gaurav Udani is Founder & CEO of Thincredblu Securities. He tweets @Udanii)