We are finally seeing some signs of exhaustion with front line stocks like Dmart, IRCTC correcting significantly, We would advise investors to remain cautious in this over stretched markets.

The broad indices also corrected over this week and these are early signs that the market needs to take a breather before resuming its upward trajectory.

Nifty & Bank Nifty

Both Nifty & Bank Nifty look bearish to us and this week has shown significant weakness in both the indices.

Such corrections are part and parcel of the markets and as investors we should be waiting patiently for opportunities to deploy capital.

Nifty 50 |

Bank Nifty |

Nifty FMCG

This week FMCG stocks have corrected considerably having said this, as the broader markets correct, FMCG index provides the cushion for capital to be parked while waiting for the correction to play out.

We expect this sector to consolidate over the coming weeks.

Nifty FMCG |

Nifty IT

The IT sector has shown a double top on the daily chart and we expect the sector to correct and consolidate in the coming few weeks.

Nifty IT |

Derivative Outlook

Nifty current month future closed with a premium of 24 points to its spot. Next month's future is trading at a premium of around 50 points.

We saw open interest reduction of nearly 3 percent in Nifty and considering the price action it clearly hints strong selling during the week.

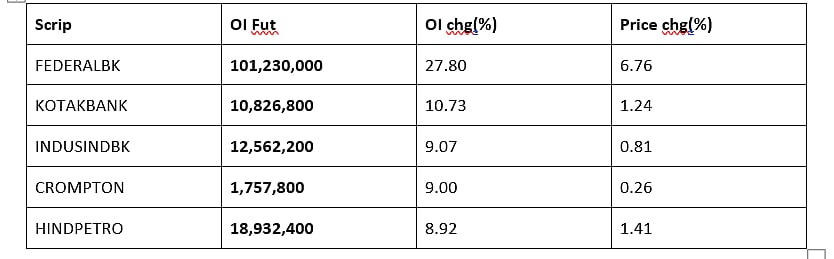

Long Formation

Long Formation |

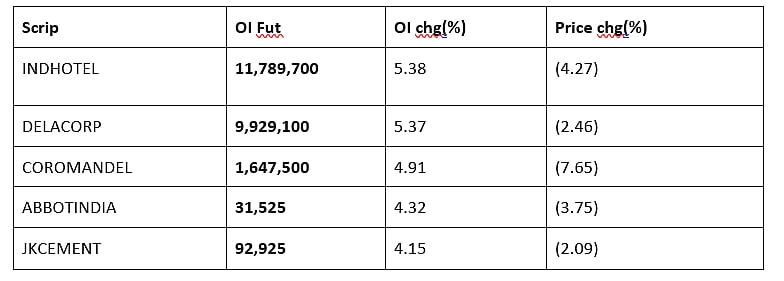

Short Formation

Short Formation |

Top 5 Recommendations for the week

AUROBINDO PHARMA

AUROPHARMA has formed channel pattern on daily charts. Earlier downtrend in stock indicating bearishness. Breakdown below 689 level will have a good shorting opportunity.

CANARA BANK

CANBK is forming higher high & higher low pattern formation on daily timeframe indicating uptrend in the stock. Again breakout of previous swing high might continue the bullish momentum. Above 205 will be a good opportunity to go long.

GUJGAS LTD

GUJGASLTD is trading near its important support level of 605. Price has tested this support level multiple time. Below 605 level there are chances of bearish momentum. Any sustainable move below 605 level will have a good shorting opportunity.

NESTLE INDIA

NESTLEIND is trading near its previous swing low. It is also resisted from the 30 day moving average. Breakdown of 18830 level will confirm downtrend in the stock. Any sustainable move below 18830 level will have a good shorting opportunity.

GLENMARK

GLENMARK is trading between price range of 540 and 490 since past five week. As the trend in the stock is bearish there are higher probability of breakdown. Below 488 level there are good shorting opportunity.

(Gaurav Udani is Founder & CEO of Thincredblu Securities. He tweets @Udanii)