Nifty made another bearish bar on October 29 and closed at 17,671, down by 185 points. Nifty has entered into a short-term bear trend. Any closing below 17,600 , can take Nifty to 17,450 and 17,300 levels.

Nifty50 |

Any form of new longs should be avoided in the current markets. Nifty has resistance in 19,850-18,000 range. Any pull back in Nifty towards its resistance can be used to book profits by traders.

Bank Nifty |

Nifty FMCG

The correction in the FMCG stocks continue this week as well, after a long time, we are now bearish on this sector too. The charts signify weakness across the board.

Nifty FMCG |

Nifty IT

The Index has just broken an important support at the 35500 level, further downside is expected over the coming weeks.

Nifty IT |

Derivative Outlook

Nifty current month future closed with a premium of ~60 points to its spot. Next month's future is trading at a premium of around ~100 points.

We saw open interest reduction of nearly 6% in Nifty and considering the price action it clearly hints strong selling during the week.

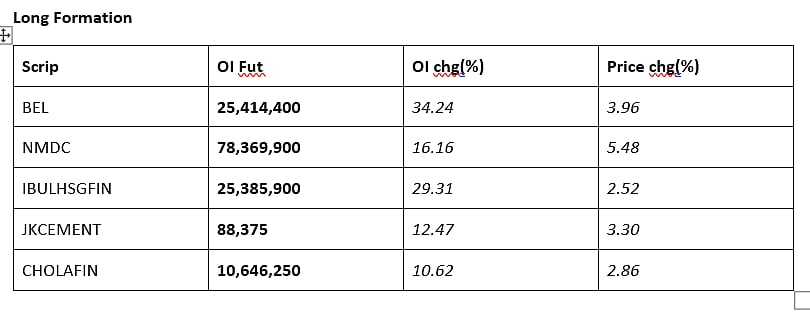

Long Formation |

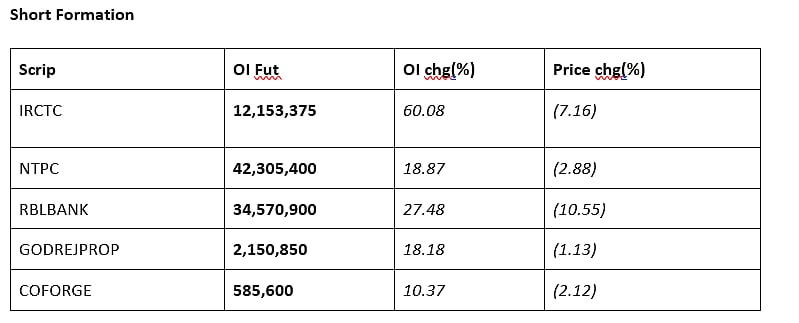

Short Formation |

Top 5 recommendations for the week

GUJGAS

GUJGASLTD is trading at its important support level. On a weekly timeframe it continued to form higher high higher low pattern formation indicating bullishness in the stock. In the daily time frame it formed a strong bullish candle at the support zone above 630 level. We can have a good buying opportunity.

BOSCHLTD

BOSCHLTD is trading near its 30 day moving average. It had also taken the support at previous resistance level which indicates strength in the stock. Above 17175 will be a good opportunity to go long.

RAMCOCEMENT

RAMCOCEM has given a breakout from a previous resistance zone. Above 1070 level we can have a good buying opportunity.

VOLTAS

VOLTAS is trading at its support level. It has taken support at the previous resistance level. Above 1223 will have a good upside momentum.

BATAINDIA

BATAINDIA is trading near its 30-day moving average and has taken support at the moving average which is a bullish signal. Above 2031 level will be a good opportunity to go long.

(Gaurav Udani is Founder & CEO of Thincredblu Securities. He tweets @Udanii)