Trends on SGX Nifty indicate a negative opening for the index in India with a 58-points loss. The Nifty futures were trading at 17,324 on the Singaporean Exchange around 7:30 AM.

"Nifty is expected to open negative at 17,330 , down by 30 points from September 8th closing. Today is the weekly expiry and we may get to see some volatility. Nifty has support at 17,300 and 17,250. Nifty has been consolidating since the last few days, any breakout above the highs may take Nifty to 17,480 and 17,520 levels," said Gaurav Udani, CEO & Founder, ThincRedBlu Securities.

Indian markets could open mildly lower in line with largely negative Asian markets today and negative US markets on Wednesday, said Deepak Jasani, Head-Retail Research, HDFC Securities.

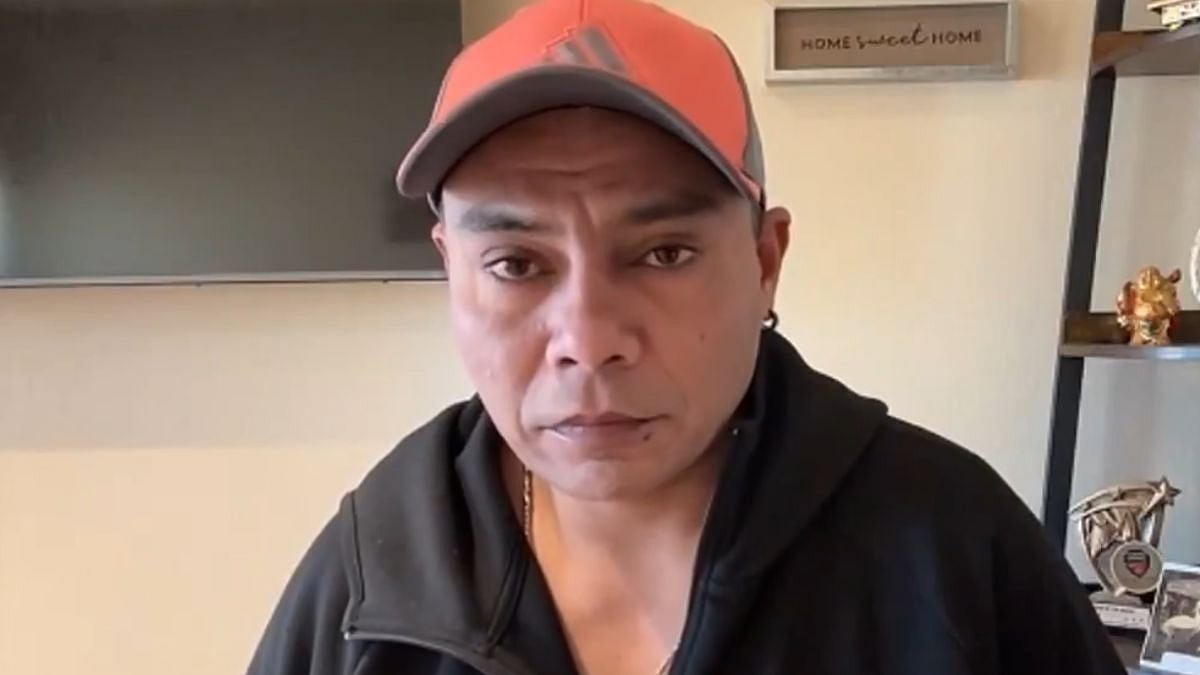

Mohit Nigam, Head - PMS, Hem Securities said, "Benchmark Indices are expected to open on a subdued note as suggested by trends on SGX Nifty. US and European stock indices closed lower yesterday as investors continue to fret over a slowdown in the recovery from the pandemic. Asian market declined early today after a dip seen in the global market. Investors await more indications that economic reopening can overcome challenges posed by the delta variant. Overall Indian indices look on a positive territory with regular foreign capital inflows, strong domestic data. On the technical front, 17450 may act as immediate resistance for Nifty 50 followed by 17,500 while 17,100 remains a crucial support for Nifty 50."

Wall Street ends lower

Wall Street ended lower on Wednesday, spooked by worries that the Delta coronavirus variant could blunt the economy’s recovery and on uncertainty about when the US Federal Reserve may pull back its accommodative policies.

The Dow Jones Industrial Average fell 0.2 percent to end at 35,031.07 points, while the S&P 500 lost 0.13 percent to 4,514.07. The Nasdaq Composite dropped 0.57 percent to 15,286.64.

On September 8, Nifty recovered smartly from the mid-day selloff to close almost flat. At close the Nifty closed 0.03 percent or 6 points higher at 17,368.

Nifty made a lower low compared to the previous two sessions but closed flat to mildly higher. This means sell-offs are being bought into. Also advance decline ratio improved to much above 1:1 denoting some return of confidence by the participants. 17254-17437 could be the trading band for the Nifty over the next few sessions.

Asia shares fall in early trade

Shares in Asia-Pacific fell in Thursday morning trade as investors reacted to the release of China’s August inflation data. China’s consumer price index rose 0.8 percent year-on-year in August, compared to expectations for a 1 percent increase in a Reuters poll.

Nikkei 225 in Japan dipped 0.41 percent while the Topix index fell 0.39 percent. South Korea’s Kospi declined 0.82 percent.

Brazil's real currency and stocks sank more than 2 percent on Wednesday on heightening political tensions ahead of elections next year,

Several Federal Reserve policymakers on Wednesday signaled that the US central bank remains on track to trimming its massive asset purchases this year, despite the slowdown in jobs growth seen in August and the impact of the recent COVID-19 resurgence.

The Fed has promised to keep purchasing Treasury securities and mortgage-backed securities at the current pace of $120 billion a month until there is “substantial further progress” toward their goals for inflation and maximum employment.

US job openings raced to a new record high in July, suggesting that last month's sharp slowdown in hiring was due to employers being unable to find workers rather than weak demand for labor.

Job openings, a measure of labor demand, jumped 749,000 to 10.9 million on the last day of July, the highest level since the series began in December 2000, the Labor Department said in its monthly Job Openings and Labor Turnover Survey, or JOLTS report, on Wednesday. Hiring was little changed at 6.7 million.

Oil prices up more than 1%

Oil prices jumped on Wednesday and settled up more than 1% as U.S. Gulf of Mexico producers made slow progress in restoring output after Hurricane Ida. Brent settled up 91 cents, or 1.3% percent, at $72.60 and U.S. West Texas Intermediate (WTI) crude settled up 95 cents, or 1.4 percent, to $69.30 a barrel.

India economic growth strong: S&P

India is expected to post strong economic growth in the coming quarters, even as inflation, led by food prices, is likely to remain elevated, S&P Global Ratings said on Wednesday.

The economy is expected to clock 9.5 percent growth in the current fiscal year, followed by 7 percent expansion in the next year, it said, adding high nominal GDP growth would be important for ensuring fiscal consolidation going forward.

"Given India’s weak fiscal settings and high stock of debt around 90 percent of GDP, the nominal GDP growth is going to be very important to prevent any further erosion of fiscal settings in the country and to enable some degree of fiscal consolidation going forward,” S&P Global Ratings Director (Sovereign) Andrew Wood said.

Govt appoints intermediaries for LIC IPO

The central government on September 8, appointed intermediaries-Kotak Mahindra Capital Company, Goldman Sachs India Securities, JP Morgan India, ICICI Securities, and others for listing and partial disinvestment its equity shareholding in Life Insurance Corporation of India(LIC) via initial public offering.

LIC has appointed Kotak Mahindra Capital Company, Goldman Sachs India Securities, JP Morgan India, ICICI Securities, JM Financial, Citigroup Global Markets India, Nomura Financial Advisory and Securities (India), Axis

Capital, DSP Merrill Lynch, and SBI Capital Markets as book running lead managers, says a circular on DIPAM website.

RBI frees UCO Bank from lending curbs

The Reserve Bank of India has freed UCO Bank from its prompt corrective action framework, intended to help weak banks revive. In a statement, the regulator said that as per UCO Bank’s FY21 results, the lender is no longer in breach of the PCA parameters.

India likely to be part of global bond index

India is likely to be added to the global bond indexes by the first quarter of 2022, which would lure $40 billion of inflows to the country’s debt market in the next two years, according to Morgan Stanley.

Three stocks under F&O ban

Three stocks – Indiabulls Housing Finance, IRCTC and NALCO – are under the F&O ban today.