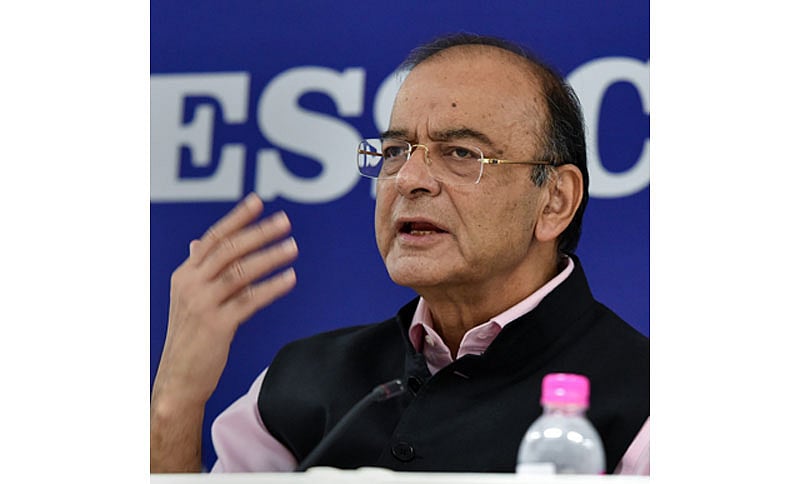

New Delhi : Finance Minister Arun Jaitley on Tuesday asked public sector banks (PSBs) to take “effective action” in cases of fraud and wilful loan defaults, as he exuded confidence of achieving sustained economic growth rate of 8 per cent.

The growing economy will also help banks grow in strength, he said at the annual review meeting of PSBs here. Conversely, as the lifeline of the economy, banks would need to build their strength to support the lending needs of a growing economy, he added, according to an official release.

“At the same time”, he exhorted the banks “to ensure all steps at their end to ensure clean lending and effective action in cases of fraud and wilful default, to justify the trust reposed in banks. Banks must strive to be seen always as institutions of clean and prudent lending”.

Banks have stepped up efforts as far as recovery of bad loans is concerned.

Jaitley said the formalisation of the economy through the Insolvency and Bankruptcy Code (IBC), GST, demonetisation and digital payments have enabled better assessment of financial capacity and risks, and coupled with inclusive growth through massive financial inclusion, has unlocked purchasing power which will drive India’s growth.

The finance minister said that “this should help India sustain a growth rate of around 8 per cent”.

The GDP growth has been estimated at 8.2 per cent in the first quarter of the financial year.

While noting the positive results from the IBC mechanism, Jaitley also flagged the need to assess and revisit the efficacy of the Debts Recovery Tribunal (DRT) mechanism, particularly in view of long lead times in disposal of cases.

Banks expect Rs 1.80L-cr bad loan recovery

NEW DELHI: Asserting that legacy issues are getting over, Finance Minister Arun Jaitley said bad loans in the banking system are on the decline and recoveries of NPAs have picked up. Banks recovered Rs 36,551 crore in the first quarter of 2018-19 and are expected to retrieve Rs 1.8 lakh crore in the whole year through the Insolvency and Bankruptcy Code and other means, a top finance ministry official said. During 2017-18, banks recovered Rs 74,562 crore. The finance minister noted that bad debts or NPAs in the banking system were on a decline. Last several years had been challenging for PSBs as a large amount of lending was held up in NPAs, he said.

But after the Insolvency and Bankruptcy Code (IBC) came into force, which calls for an auction of assets of loan defaulting entities, recoveries have picked up, he observed.

Recoveries are better, the lending ability of banks is much better and to top it all credit growth has significantly moved upwards, he said.

“Recoveries have picked up…it has not picked up not just because resolutions have taken place in the NCLT, they have also picked up because those debtors who fear that they are likely to cross the deadline are paying in anticipation of an IBC process being compelled on them.