New Delhi: Shares of Shriram Finance Ltd climbed nearly 4 per cent on Friday as Japan's Mitsubishi UFJ Financial Group Inc (MUFG) will acquire a 20 per cent minority stake in the non-banking lender for Rs 39,618 crore (around USD 4.4 billion). The stock edged higher by 3.74 per cent to settle at Rs 901.75 on the BSE. During the day, shares of the firm jumped 5.16 per cent to Rs 914.10 -- the 52-week high level.

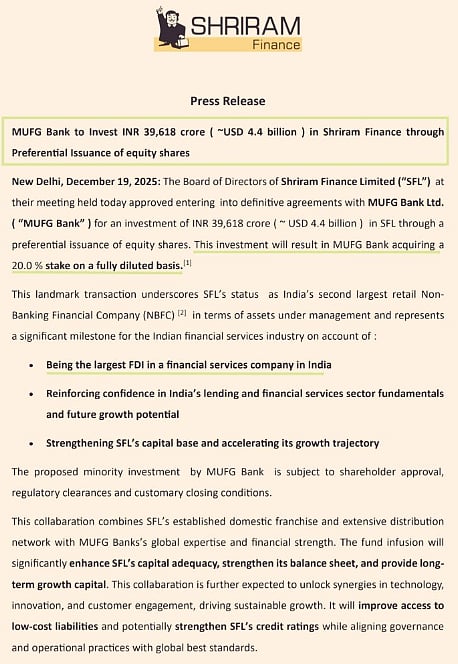

Press Release |

At the NSE, the stock went up by 3.70 per cent to Rs 901.70. The company's market valuation jumped Rs 6,154.63 crore to Rs 1,69,651.83 crore. Japan's Mitsubishi UFJ Financial Group Inc will acquire a 20 per cent minority stake in Shriram Finance Ltd for Rs 39,618 crore (around USD 4.4 billion), marking the largest cross-border investment in India's financial sector to date.

MUFG will pick up the minority stake through preferential equity shares, Shriram Finance said in a statement. The signing of definitive agreements with MUFG Bank reinforces confidence in India's lending and financial services sector fundamentals and future growth potential, the statement said, adding that it will also strengthen SFL's capital base and accelerate its growth trajectory.

The proposed investment by MUFG Bank is subject to shareholder approval, regulatory clearances and customary closing conditions, it said. "This collaboration combines SFL's established domestic franchise and extensive distribution network with MUFG Bank's global expertise and financial strength. The fund infusion will significantly enhance SFL's capital adequacy, strengthen its balance sheet, and provide long-term growth capital," it said.

This partnership is further expected to unlock synergies in technology, innovation, and customer engagement, driving sustainable growth, it said. The partnership will also improve access to low-cost liabilities and potentially strengthen SFL's credit ratings while aligning governance and operational practices with global best standards, it added.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.