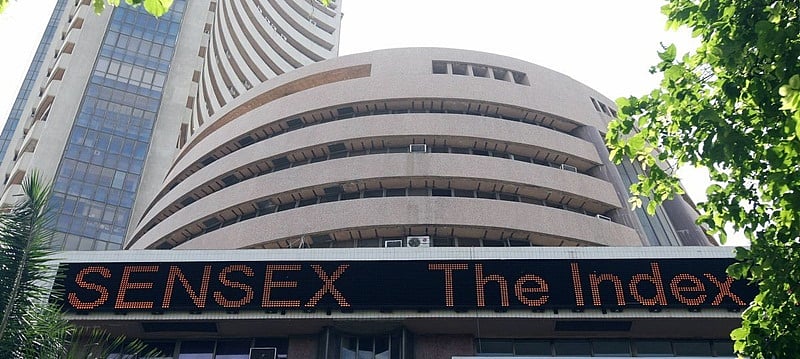

Mumbai : Indian equities continued their bull run for the second straight session today, helping both benchmarks Sensex and Nifty hit new closing highs of 38,278 and 11,552, respectively on hectic buying mainly in capital goods, metal and auto shares amid positive leads from global markets.

Investor sentiments remained upbeat tracking global developments as the US, China geared up for trade talks due this week. Besides, falling crude prices in global markets and the rupee rebounding from its historic low of 70.40 against the dollar to 69.60 (intra-day) also supported the key indices.

The 30-share Sensex scaled a fresh all-time high (intra-day) of 38,340.69, breaching its previous record of 38,076.23, reached on August 9. Finally, it settled at a new closing peak of 38,278.75, surging 330.87 points, or 0.87 per cent, its biggest single session gain since August 3 when it had rallied 391 points. The Sensex bettered the previous record closing of 38,024.37, reached on August 9.

The BSE benchmark had risen by 284.32 points in the previous session on Friday.

While, the broader 50-share NSE Nifty also maintained its bull run and went past the 11,500-mark for the first time to touch a new peak of 11,565.30 (intra-day) before settling higher by 81 points, or 0.71 per cent, at a new peak of 11,551.75, beating its previous record closing of 11,470.75, logged in the previous session on August 17. It also broke the previous intra-day record of 11,495.20 hit on August 9.

“Markets hit new record high and gained over half a per cent, thanks to supportive global markets and favourable local cues. Though the buying interest was witnessed across the board, however, two of index majors Reliance and L&T contributed more than half to the index rise. Both the major economy, the US and China, have agreed to talk and resolve trade war issue and markets across the globe including ours gave thumbs up to this development,” Jayant Manglik, President, Religare Broking, said.

Talking about domestic cues, he said that earnings season went off well on local front which subsided worry related to currency depreciation to some extent.

Pumping of fresh funds by foreign portfolio investors (FPIs) also supported the rally that lifted both key indices to new highs. Domestic institutional investors (DIIs) bought shares worth a net of Rs 151.89 crore, while foreign portfolio investors (FPIs) bought shares worth a net of Rs 147.31 crore on Friday, provisional data showed.

New Delhi: BSE will delist as many as 17 companies from Tuesday as trading in their shares has remained suspended for over six months. The exchange has been delisting for the past few months those firms in which trading has remained suspended for a long period.

In a circular, BSE on Monday said, “17 companies that have remained suspended for more than 6 months would be delisted from the platform of the exchange, with effect from August 21, 2018 pursuant to order of the delisting committee”.