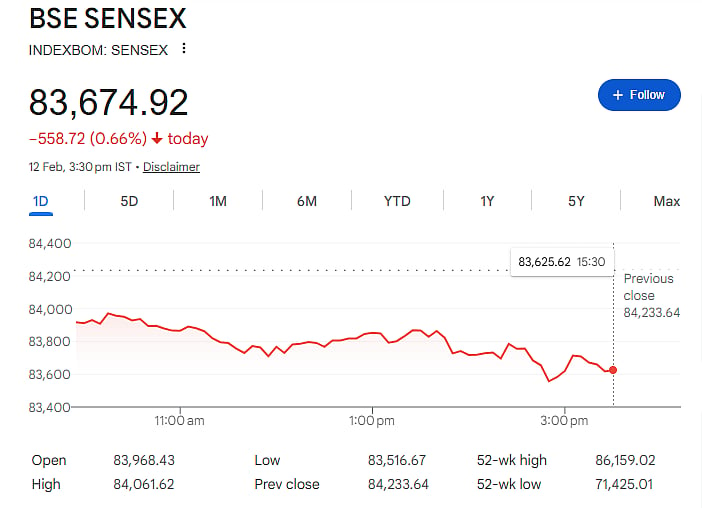

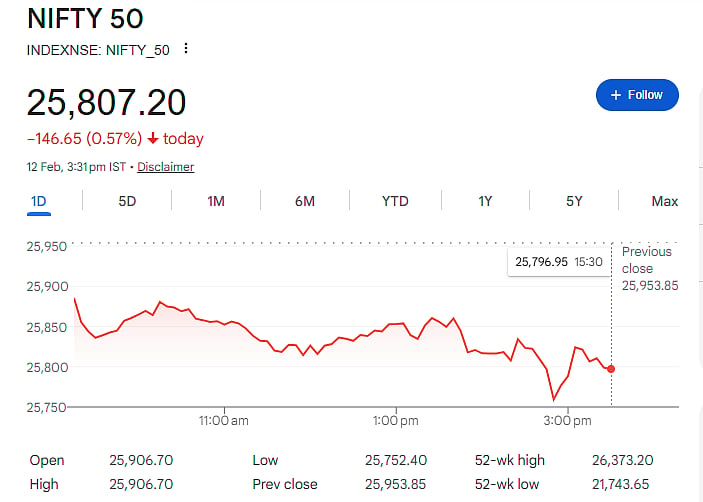

Mumbai: Indian stock markets ended lower as selling pressure increased across sectors. The Sensex closed around 83,675, while the Nifty fell to around 25,807. The fall reflected weak investor confidence during the trading session as global and sector-specific concerns weighed on market sentiment.

IT Selloff Becomes Biggest Trigger

The biggest reason for the fall was heavy selling in IT stocks. The Nifty IT index dropped nearly 4 percent. Major companies like Infosys, TCS, HCL Tech and Wipro fell 4–5 percent.

The selloff came after global worries about Artificial Intelligence tools. A US AI startup launched tools that can automate legal and office work. Investors fear such tools could reduce demand for traditional IT services.

Strong US Jobs Data Adds Pressure

Stronger US jobs data reduced hopes of early interest rate cuts by the US Federal Reserve. Higher interest rates are usually negative for stock markets, especially technology stocks.

Market data suggests chances of rate cuts are getting delayed, which is making investors nervous globally.

Weak Earnings Also Impact Sentiment

FMCG major HUL shares fell about 5 percent after reporting weak profit numbers. The company reported a 30 percent fall in profit, even though revenue saw slight growth. Lower margins also worried investors.

Profit Booking And Technical Factors

Markets also saw profit booking after recent gains. Experts say if Nifty stays below 25,800, it may see short-term consolidation. If it moves above 26,000, positive momentum may return.

Geopolitical Tensions Add To Worries

Global tensions in the Middle East also impacted sentiment. Rising tensions between the US and Iran increased global risk concerns, leading investors to reduce risk exposure.