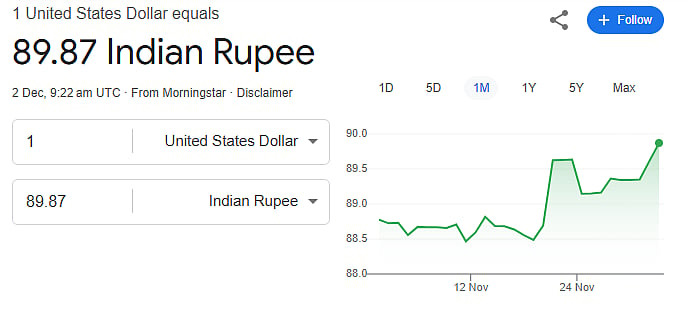

Mumbai: The Indian rupee fell sharply to 90.02 against the US dollar on Tuesday, December 2, marking its all-time lowest level. The local currency has lost around 5 percent against the dollar in 2025, making it one of the worst-performing Asian currencies this year. Market experts point to multiple economic pressures weighing heavily on the rupee.

Widening Trade Deficit Adds Pressure

India’s merchandise trade deficit reached a record high of USD 41.68 billion in October, up from USD 32.15 billion in September. Exports fell nearly 12 percent to USD 34.38 billion, while imports surged 17 percent to USD 76.06 billion, largely driven by gold and silver purchases. The rising gap between imports and exports has boosted demand for dollars, putting the rupee under significant pressure.

Delay in India-US Trade Deal

The absence of a formal trade agreement between India and the US has further weighed on the rupee. High tariffs imposed by the US have slowed trade activity, hurt manufacturing, and reduced exports. Exports to the US fell nearly 9 percent due to punitive 50 percent duties, and India’s manufacturing growth cooled to a nine-month low in November, according to an HSBC survey. Analysts say a deal could have eased some pressure on the currency.

Persistent Foreign Outflows

Foreign portfolio investors (FPIs) have been selling Indian shares consistently. So far in 2025, FPIs have offloaded shares worth ₹1,47,164 crore (USD 16.78 billion). These outflows reduce dollar inflows into the country, weakening the rupee further and compounding the impact of trade and economic challenges.

The combination of a widening trade gap, delayed trade negotiations, and relentless foreign selling continues to drive the rupee toward historic lows, raising concerns for policymakers and investors alike.

Disclaimer: This article is intended solely for informational purposes. The Free Press Journal recommends that readers should not treat it as financial advice and should consult professional advisors before making any investment decisions.