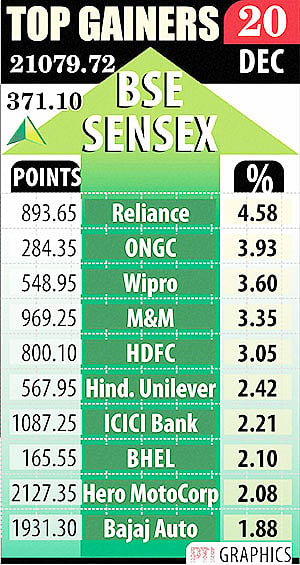

MUMBAI : A sudden spurt in the last hour of trade saw shares of Reliance Industries Ltd, apart from lifting the benchmark indices, ending as the top gainer on the National Stock Exchange’s 50-share Nifty.

The stock ended at its highest level since Nov 6, at 895.15 rupees, up 41.10 rupees or 4.8% from Thursday’s close. Dealers attributed the surge in the stock price to short covering. Data showed that open interest in the December contract of the company declined 18.6% to 9.44 mln shares.

“Buy Reliance Industries January futures in the range of 865-870 rupees and sell Reliance Industries January 860 Call at rupees 31-33,” ICICIdirect.com has recommended. The brokerage suggests exiting this strategy if the stock closes below 805 rupees in the spot market.

Analysts believe the government’s decision to raise gas prices while insisting that Reliance Industries provide a bank guarantee until the reasons for the shortfall in gas production at the KG-D6 block are identified, is a positive for the share.

Apart from RIL, gains in other index heavyweights like Oil & Natural Gas Corp, DLF, Hindustan Unilever, Tata Consultancy Services, and Infosys boosted the rally. GAIL India, Bharat Petroleum Corp, Oil India, Cairn India, and Hindustan Petroleum Corp ended up 0.9-4.5%.

Talk that iGate Corp may acquire promoters’ 46% stake in Mastek at 195-210 rupees per share, lifted the stock. Mastek ended up 16.7% at 157.05 rupees amid strong volumes.

Foreign institutional investors’ activity is likely to be muted ahead of Christmas on Wednesday and the holiday season abroad.

The rupee recouped all intraday losses and ended slightly higher against the US currency on the back of heavy dollar sales by foreign banks and tracking the sharp rise in local share indices, dealers said.

The rupee ended at 62.03 to a dollar against Thursday’s close of 62.12. -Cogencis