Key Highlights:

- Reliance Infra and Power stocks hit 5 percent lower circuits for two straight days.

- ED raided 35+ locations linked to Anil Ambani’s RAAGA Group.

- Both companies denied links to entities under investigation.

Mumbai: On July 25, shares of Reliance Infrastructure and Reliance Power hit their respective 5 percent lower circuits for the second day in a row. This sharp fall came after the Enforcement Directorate (ED) raided over 35 locations linked to Anil Ambani’s Reliance Group, also referred to as RAAGA companies.

The raids were part of an ongoing probe into a Rs 3,000 crore Yes Bank loan fraud, in which funds are suspected to have been misused or siphoned off unlawfully.

Stock Crash Details

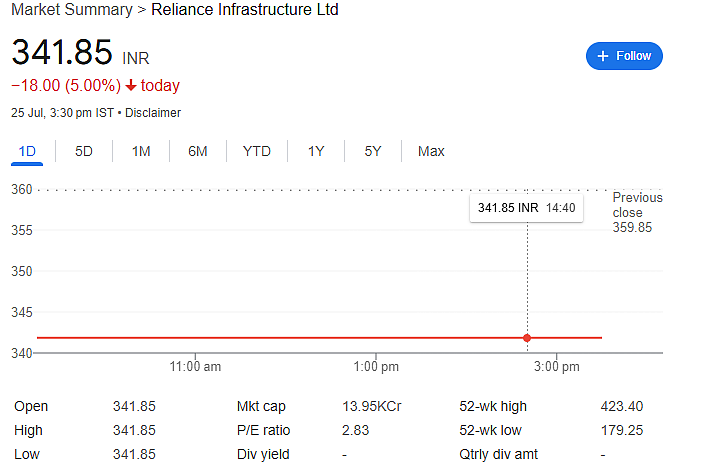

Reliance Infrastructure stock, which traded at Rs 384 on July 23, fell sharply over the next two sessions:

July 24: Fell 5 percent to Rs 360.05, hitting the lower circuit

July 25: Dropped another 5 percent to Rs 341.85, again locked in the lower circuit

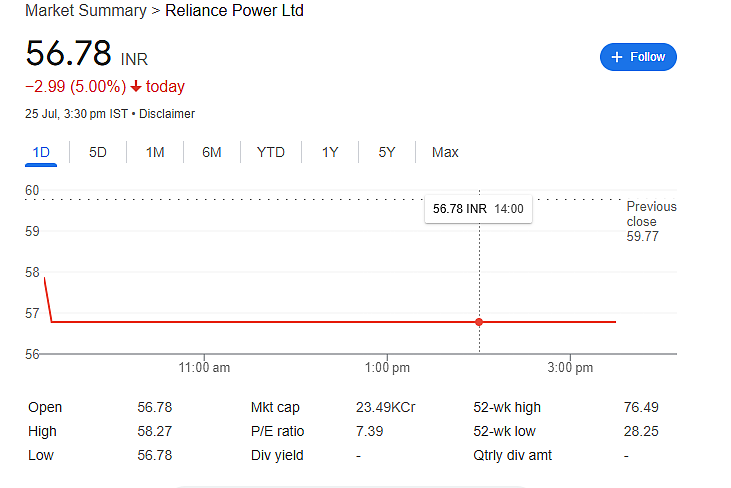

Meanwhile, Reliance Power shares fell 7.41 percent over the same period. On Friday, it hit the 5 percent lower circuit, closing at Rs 56.72.

Company Clarifies Position

Both Reliance Power and Reliance Infrastructure issued public statements to clarify their position. They said the ED action does not involve them directly, but instead relates to Reliance Communications and Reliance Home Finance — companies that are no longer part of the group.

Despite the clarification, investors remained cautious, leading to continued selling pressure in the stock market.

Serious Allegations in ED Probe

According to sources, the ED’s preliminary investigation suggests that there was a planned scheme to divert public funds. It includes charges of:

- Bribery of bank officials, including promoters of Yes Bank

- Backdated loan documents and missing due diligence

- Violations in Yes Bank’s internal loan approval process

The alleged loan diversions took place between 2017 and 2019, and public institutions, banks, and investors were reportedly cheated in the process.

The situation remains under investigation, but the market reaction shows clear investor concern, especially regarding governance and transparency within companies previously linked to the Anil Ambani-led group.

(With IANS Inputs)