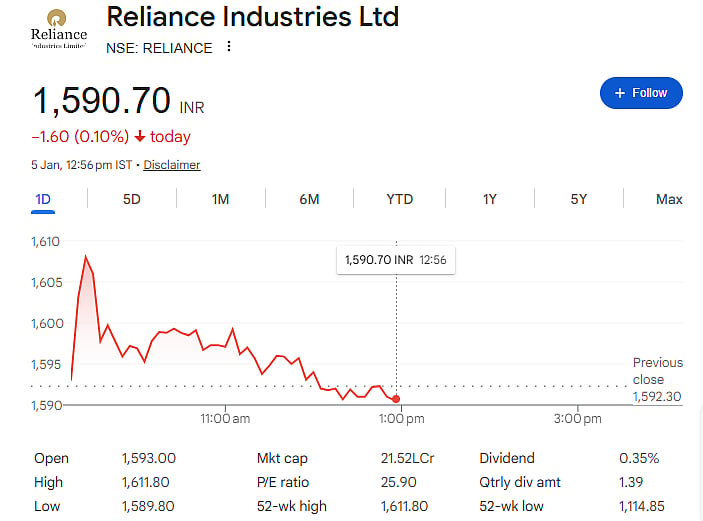

Mumbai: Shares of Reliance Industries, India’s most valuable company, surged for the fourth consecutive session on Monday, January 5, reaching a record high of Rs 1,611.80 on the National Stock Exchange. In intraday trading, the stock rose as much as 1.22 percent, marking a 4.67 percent gain over the last four sessions. With this surge, the company’s market capitalization climbed to Rs 21.62 lakh crore, increasing by Rs 83,000 crore over the same period.

Buying Interest Driven by Clarifications on Gas Field Claims

Investor confidence was boosted after Reliance Industries clarified a recent report claiming the government had alleged USD 30 billion in underproduction claims against Reliance and BP. The company stated that the actual claim related to the KG D6 Block is only USD 247 million, which has been consistently disclosed in its audited financial statements. This clarification reassured investors about the company’s legal and financial standing.

Potential Benefits from Venezuelan Oil

Global investment bank Jefferies noted that Reliance Industries, along with ONGC, could benefit from a US takeover of Venezuelan oil. Lifting of US sanctions may allow Reliance to purchase discounted Venezuelan crude, historically about 20 percent of its daily requirement from PDVSA, at USD 5-8 per barrel below Brent. This could improve the company’s gross refining margins (GRMs), while ONGC may receive USD 500 million in unpaid dividends, creating further positive sentiment among investors.

Jio IPO Anticipation

Reliance Jio Platforms, the telecom and digital arm of Reliance, is preparing for one of India’s largest IPOs. With formal filings expected once new IPO regulations come into effect, the IPO is scheduled for the first half of 2026, as shared by Chairman Mukesh Ambani. Bloomberg estimates Jio’s valuation could reach USD 170 billion, surpassing Bharti Airtel’s USD 140 billion, increasing market excitement.

Strong Q2 Earnings Performance

Reliance reported a consolidated net profit of Rs 18,165 crore in Q2, up 10 percent from the previous year. Revenue from operations grew 10 percent to Rs 2,58,898 crore. The company’s EBITDA rose 18 percent to Rs 45,885 crore, with the operating profit margin expanding by 120 basis points to 18 percent, reflecting strong operational performance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a qualified financial advisor before making investment decisions.