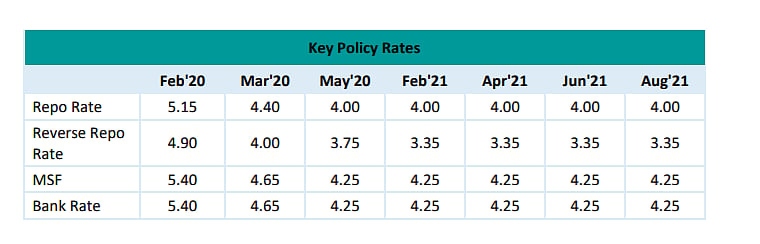

The RBI’s Monetary Policy Committee (MPC) presented its third bi-monthly monetary policy for 2021-22 today. On expected lines, the RBI has retained the policy rate (repo rate) at a record low of 4 percent and has maintained the accommodative monetary policy stance. This is the seventh meet at which the central bank has maintained status quo in policy i.e., from May’20.

The monetary policy decision of status quo on interest rates was unanimous by all the six MPC members. However, the vote on continuing with the accommodative policy stance was 5:1. The central bank’s focus on prioritizing growth prevailed in this policy too. So did its position that inflation was transitory and due to supply side disruptions.

The RBI has also indicated that it would continue to ensure that there is ample surplus liquidity in the banking system to enable lending and thereby stimulate demand in the economy.

Key Policy Rates | CARE

Even though there is no mention of normalization of policy support, as the vote on the monetary policy stance was not unanimous it signals that the accommodative policy stance may not prevail for too long.

RBI’s Outlook on Economic Growth and Inflation

Economic Growth

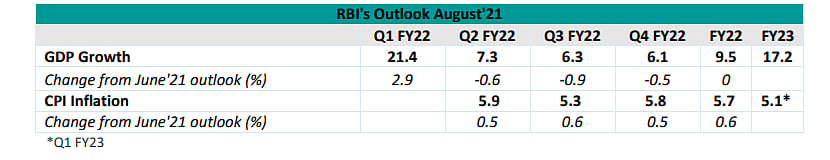

Even as it retained its outlook for the country’s economic growth at 9.5 percent for FY22, the central bank highlighted that recovery remain uneven across sectors and there is need for continued policy support to ensure durable growth. Demand conditions although improving continue to be weak and overcast by the pandemic.

The economic revival also faces downside risks from the elevated levels of global commodity prices and financial market volatility. However, the central bank is optimistic that the country will be able to tide over the third wave of the pandemic if it occurs.

In terms of quarterly growth, it has revised upwards the growth projections for Q1 FY22 from its earlier estimates of June’21 and lowered that for the remaining three quarters. The Q1FY22 growth has been raised by 2.9 percent to 21.4 percent and that of Q2 has been reduced by 0.6 percent to 7.3 percent. For Q3 and Q4 FY22 the growth outlook has been revised lower by 0.9 percent to 0.5 percent respectively. This signals that the central bank expects rural demand to be resilient while urban demand is likely to lag and would become durable with a pick-up in the pace of vaccination.

Economic recovery would be supported by buoyant exports, anticipated higher government expenditure and recent policy measures of the government. Investment demand would however not see an immediate improvement.

The RBI economic growth outlook for FY22 is higher than CARE’s forecast of a growth of 8.8 to 9 percent

Inflation

Even as the RBI holds on to its view that the current inflationary pressures are driven by supply shocks which are likely to be transitory in nature, it has revised upwards the retail inflation outlook for FY22 from its earlier forecast of June’21. Inflation for FY22 now reads as 5.7 percent, 0.6 percent higher than the earlier forecast. The estimates for all the three quarter i.e., Q2 to Q4 FY22 have been raised by an average 0.5 percent.

The RBI expects food price pressures to soften with the progress in monsoons and the supply side intervention by the government in case of edible oil and pulses. Further, even as input prices are rising across manufacturing and services sectors, the weak demand and efforts towards cost cutting are seen as tempering the pass-through to output prices.

The RBI opines that a reduction in indirect taxes of transport fuels by the centre and state government could lower cost pressure.

RBI's Outlook August'21 | CARE Ratings

The central bank has reiterated that although it remains mindful of anchoring inflation, a preemptive policy decision would kill the nascent recovery.

Assessment and Implication of the RBI policy announcements

The upward revision in the inflation targets point towards the strengthening of inflationary pressures. This could pose a challenge for the continuation for the accommodative policy stance given that resistance to the same has already emerged in the MPC. However, the view taken by the RBI is that this inflation is transient and caused by the supply side rather than the demand side which is still only in the recovery phase.

The bond buying under the GSAP and likelihood of more market operations would help assuage bond market concerns over demand-supply dynamic, albeit to a limit extent. Yields would continue to be pressured given inflationary worries. The RBI however is expected to be able to manage the proposed government borrowings for the year. A question here is that while there is a lot of liquidity in the system demand appears to be limited. Also, banks are less willing to lend today given the underlying conditions.

The enhanced quantum of VRRR auction that is proposed to be conducted, although done with the view of managing liquidity is unlikely to impact system liquidity as the underlying aim of the RBI in the prevailing pandemic emergency situation is to ensure liquidity surplus in the system. The RBI has said that this should be interpreted in any way as the withdrawal of the liquidity from the system as was done the first time last year when they were announced.

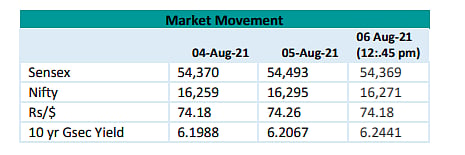

Market reaction to RBI policy

The benchmark equity indices and bonds declined after the monetary policy announcement while the domestic currency however strengthened against the dollar.

Market Movement | CARE Ratings

While concerns over inflation and the ability of the RBI to maintain its accommodative policy stance can be attributed to the decline in equities and bonds.

CARE Ratings Views

The monetary policy continues to be growth centric, despite the underlying upside risks to inflation. Diverging view on inflation could strengthen within the MPC members in coming policies and this could have implication on sustainability of the accommodative policy stance.

The important thing is when would the MPC interpret inflation as being permanent and not transient. That said, the accommodative policy stance is likely to prevail at-least in this calendar year. As such, we do not foresee a change in policy rates in the 2021.

Even with surplus liquidity and the open market operations, the bond market sentiments may not see an immediate improvement. Bond yield would continue to be at elevated levels. We expect the benchmark 10-year GSec to rule around 6.20 percent-6.30 percent for the next 1-2 months. It does not likely to move below 6.20 percent as government borrowing programme as also the GST compensation pressures continue to raise concerns.

(Madan Sabnavis is Chief Economist, CARE Ratings)